Content

- Board Of Governors Of The Federal Reserve System

- What Is Credit Risk Analysis?

- Recommended Credit Risk Management Solutions From Sas

- Credit Risk Definition

- Compare By Credit Needed

- Best Practices In Credit Risk Management

- Recourse Loans Vs Non

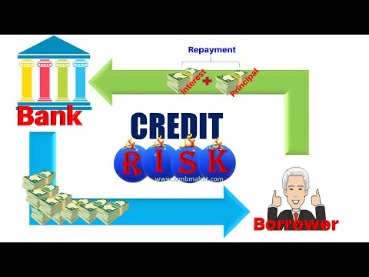

- Understanding Credit Risk

The dealership weighs this with the fact that Andrew is putting a deposit of $5,000 down on the vehicle. If it’s an individual asking for a loan, then the lender may ask for a letter of employment. This would be written by the HR department of the borrower’s company – outlining how long the individual has worked there, and the salary he makes. According to Experian, a credit score of 700 or above is considered good, 800 or above is considered excellent. If you have any problems with your access or would like to request an individual access account please contact our customer service team.

Board Of Governors Of The Federal Reserve System

Better credit risk management also presents an opportunity to greatly improve overall performance and secure a competitive advantage. Risk-based pricing – Lenders may charge a higher interest rate to borrowers who are more likely to default, a practice called risk-based pricing. Lenders consider factors relating to the loan such as loan purpose, credit rating, and loan-to-value ratio and estimates the effect on yield . While banks strive for an integrated understanding of their risk profiles, much information is often scattered among business units. Without a thorough risk assessment, banks have no way of knowing if capital reserves accurately reflect risks or if loan loss reserves adequately cover potential short-term credit losses. Vulnerable banks are targets for close scrutiny by regulators and investors, as well as debilitating losses. The first step in effective credit risk management is to gain a complete understanding of a bank’s overall credit risk by viewing risk at the individual, customer and portfolio levels.Sovereign credit risk is the risk of a government being unwilling or unable to meet its loan obligations, or reneging on loans it guarantees. Many countries have faced sovereign risk in the late-2000s global recession. The existence of such risk means that creditors should take a two-stage decision process when deciding to lend to a firm based in a foreign country. Firstly one should consider the sovereign risk quality of the country and then consider the firm’s credit quality. Bond credit-rating agencies, such as Moody’s Investors Services and Fitch Ratings, evaluate the credit risks of thousands of corporate bond issuers and municipalities on an ongoing basis. Moody’s Analytics delivers award-winning credit models and expert advisory services to provide you with best-in-class credit risk modeling solutions.When lenders offer mortgages, credit cards, or other types of loans, there is a risk that the borrower may not repay the loan. Similarly, if a company offers credit to a customer, there is a risk that the customer may not pay their invoices. Credit risk also describes the risk that a bond issuer may fail to make payment when requested or that an insurance company will be unable to pay a claim. After conducting an analysis of the specific borrower’s risk, the credit risk management group assigns a credit rating to the borrower. Generally, firms accept a scale of ratings ranging from AAA to BB and an additional default rating of D.

What Is Credit Risk Analysis?

If the financial statements and credit history are good, but the loan is significant, the lending institution might ask for something as collateral. Collateral is something of value the borrower will give to the lender, if the loan is defaulted on. An expensive car could be considered collateral, but keep in mind it will depreciate quickly and the bank may not accept it. For companies, credit risk represents the risk that a company may not be able to make payments on its outstanding debt.

- Credit risk is most simply defined as the potential that a bank borrower or counterparty will fail to meet its obligations in accordance with agreed terms.

- Deposit insurance – Governments may establish deposit insurance to guarantee bank deposits in the event of insolvency and to encourage consumers to hold their savings in the banking system instead of in cash.

- Credit risk is distinct from counterparty credit risk , which is the risk of a financial counterparty defaulting before it has completed a trade.

- Tightening – Lenders can reduce credit risk by reducing the amount of credit extended, either in total or to certain borrowers.

Borrowers considered to be a low credit risk are charged lower interest rates. Lenders, investors, and other counterparties consult ratings agencies to asses the credit risk of doing business with companies. Credit risk is the possibility of a loss resulting from a borrower’s failure to repay a loan or meet contractual obligations. Traditionally, it refers to the risk that a lender may not receive the owed principal and interest, which results in an interruption of cash flows and increased costs for collection. Excess cash flows may be written to provide additional cover for credit risk. When a lender faces heightened credit risk, it can be mitigated via a higher coupon rate, which provides for greater cash flows.

Recommended Credit Risk Management Solutions From Sas

Generally, the ratings of all borrowers in a particular industry are also reviewed upon the occurrence of any significant event impacting the industry. Every proposal for a facility is reviewed by the appropriate industry specialists in the credit risk management group before being submitted for approval to the appropriate approval authority. Generally, the approval process for non-fund facilities is similar to that of fund-based facilities. Some companies have established departments solely responsible for assessing the credit risks of their current and potential customers. Technology has afforded businesses the ability to quickly analyze data used to assess a customer’s risk profile. Consumers posing higher credit risks usually end up paying higher interest rates on loans.Off-balance sheet items include letters of credit unfunded loan commitments, and lines of credit. Other products, activities, and services that expose a bank to credit risk are credit derivatives, foreign exchange, and cash management services. The banking representative goes online to access Andrew’s credit report, which he can do quickly on his computer. The credit report shows that Andrew typically pays his credit cards and other bills when they are due. There will be other considerations for the bank, but as a starting point, this solid credit rating score puts Andrew in a good position to get the loan. Credit risk is a measure of a borrower’s ability to repay a loan and the interest charged on that loan. Most lenders employ their models to rank potential and existing customers according to risk, and then apply appropriate strategies.The external factors are the state of the economy, wide swings in commodity/equity prices, foreign exchange rates and interest rates, trade restrictions, economic sanctions, Government policies, etc. This paper points out the measurement, hedging and monitoring of the credit risk.

How do I know my EAD?

The EAD is obtained by adding the risk already drawn on the operation to a percentage of undrawn risk. This percentage is calculated using the CCF. It is defined as the percentage of the undrawn balance that is expected to be used before default occurs. Thus the EAD is estimated by calculating this conversion factor.The Journal of Credit Risk publishes research on credit risk theory and practice. Deposit insurance – Governments may establish deposit insurance to guarantee bank deposits in the event of insolvency and to encourage consumers to hold their savings in the banking system instead of in cash. A company is unable to repay asset-secured fixed or floating charge debt. Is to ensure that it understands, measures, and monitors the various risks that arise and that the organization adheres strictly to the policies and procedures established to address these risks. Firms have a structured credit approval process which includes a well-established procedure for comprehensive credit appraisal. Someone who is risk averse has the characteristic or trait of preferring avoiding loss over making a gain. A financial guarantee is a non-cancellable promise backed by a third party to guarantee investors that principal and interest payments will be made.

Credit Risk Definition

To comply with the more stringent regulatory requirements and absorb the higher capital costs for credit risk, many banks are overhauling their approaches to credit risk. But banks who view this as strictly a compliance exercise are being short-sighted.A credit analyst is a financial professional who assesses the creditworthiness of individuals, companies, or securities. For example, a risk-averse investor may opt to buy an AAA-rated municipal bond.

Compare By Credit Needed

Shortly thereafter, home prices dropped dramatically and interest rates rose. The banks were on the hook for defaulted mortgages for homes they could not resell. Every time a bank supplies credit, or gives a loan, it is putting itself at risk. The bank must weigh the possibility of profits versus the risk of defaults.

What are the 3 types of risks?

Risk and Types of Risks: Widely, risks can be classified into three types: Business Risk, Non-Business Risk, and Financial Risk.Enroll and advance your career with our certification programs and courses. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace.

Why Did My Credit Score Drop After Paying Off Debt?

Late payments can cause significant damage to your credit score, and they stay on your credit report for seven years. It’s possible to give your creditworthiness a facelift by reviewing your credit report for any mistakes, paying down credit card debt, making all payments on time and cutting expenses wherever possible. Tightening – Lenders can reduce credit risk by reducing the amount of credit extended, either in total or to certain borrowers. For example, a distributor selling its products to a troubled retailer may attempt to lessen credit risk by reducing payment terms from net 30 to net 15. If there is a higher level of perceived credit risk, investors and lenders usually demand a higher rate of interest for their capital. He goes to a local bank in the hopes of getting a loan to get his small business off the ground.

Best Practices In Credit Risk Management

When dealing with a business, the bank may want to see some of a company’s financial statements. For instance, they could ask for previous tax returns for the business, the income statement or the cash flow statement. Credit risk is distinct from counterparty credit risk , which is the risk of a financial counterparty defaulting before it has completed a trade. Conversely, if gross margins are small, credit risk becomes a substantial issue. Repay the loan in full, at the lender’s request, in certain events such as changes in the borrower’s debt-to-equity ratio or interest coverage ratio.The balance sheet is one of the three fundamental financial statements. The financial statements are key to both financial modeling and accounting. Often, borrowers who are considered to be a low credit risk are offered better rates of interest. Many credit card issuers offer their customers free credit scores, and some even provide them to non-customers.This does not refer to just your visa statement, but your mortgage payments, your hydro bill, your car lease. Anything you owe money on, must be paid when the money is due.

Understanding Credit Risk

Consequently, it is also one of the greatest sources of risk, making effective portfolio management a key factor in bank safety and soundness. Sometimes not having enough credit can reflect on one’s credit history. This is not a license to spend, you just want to show you can juggle multiple credit lines. If you’re only making the minimum payment on a number of bills, then that is going to affect your credit score too. Let’s say Andrew is not starting a new business but simply wants to get a new vehicle. He does not need to go to the bank for the loan as most dealerships will deal with the bank for their customers. Let’s use an example of how a credit report can help a bank decide whether to give a loan or not.