Content

- Bookkeeping

- What Is The Difference Between Bookkeeping And Accounting

- Differences:

- Bottom Line Vs Top Line: Whats The Difference For Small Business Owners?

- Forensic Accounting Analysis Vs Audit

- Want More Helpful Articles About Running A Business?

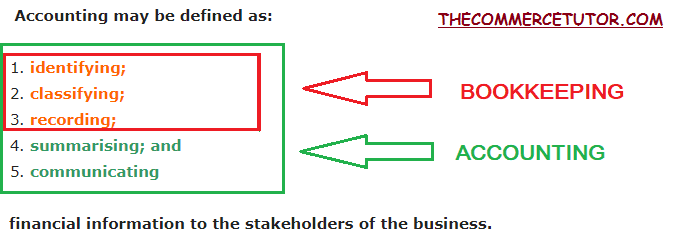

- The Distinctions Between Accounting And Bookkeeping

Below, we’ll dive in to explain what debits and credits mean in accounting. Despite the overlaps in roles and responsibilities, accounting and bookkeeping are two distinct functions. We hope that our post helped to provide clarification on the similarities and differences. The bottom line may also come down to the available money for expenditure. Some small entrepreneurs do their bookkeeping and will only require an accountant when tax accounting or intricate financial processes require the expertise of a tax accountant or CPA.

How many hours do bookkeepers work?

Bookkeepers typically keep regular business hours, working from 9 a.m. to 5 p.m. or similar hours from Monday to Friday. Weekend and public holiday work is limited, although bookkeepers may need to work extended hours during busy periods, such as leading up to tax season or at the end of the fiscal year.Therefore between bookkeepers vs. accountants, the limitations of the bookkeeper’s skills analysis and interpretation of financial data are the main difference in professions. An accountant is in charge of assessing and interpreting the financial data of a company, and for reporting on it. An accountant has a higher skill set than a bookkeeper, whose primary responsibility is handling the actual recording of the company’s financial transactions. A lot of people ask, “What is the difference between bookkeeping and accounting?

Bookkeeping

This makes it easier to quickly record and access all payables and receivables. Daily monetary transactions are what keep many businesses moving, and it’s essential to record these exchanges closely. Without procedures in place to track transactions , a business is left guessing where its money is coming from and going to. As a small business owner, having a good grasp of your business financials is key-even if you’ve hired an accountant. Unlike bookkeepers, there are a range of different professional certifications that accountants may acquire. Examples include the AAT, ACA, ACCA and CIMA accountancy qualifications.

- Bookkeeping is the foundation of the accounting process that produces the data used by accountants for financial analysis and preparation of reports.

- During the accounting process, it’s easier to access the book of all the financial records to make financial reports and statements.

- Bookkeeping and accounting may appear to be the same profession to an untrained eye.

- Dummies has always stood for taking on complex concepts and making them easy to understand.

- Recording financial transactions is the first part of and the foundation of the accounting process.

- To work in accounting, you must have at least a bachelor’s degree to become an accountant or, for a higher level of expertise, you can become a certified public accountant.

You can also look at the American Institute of Certified Public Accountants to find CPAs that have skills in certain areas, such as employee benefits or personal finance. There is a difference between an accountant and a certified public accountant .

What Is The Difference Between Bookkeeping And Accounting

It’s not cost-effective to hire an expensive accountant to handle what a bookkeeper can comfortably do at a much less price. For example, an accountant can generate reports on the company’s current financial condition, which in turn can guide the owner or executive to make informed business decisions going forward.

Do I need a bookkeeper or accountant?

In A Nutshell If you are a sole trader and your business is not VAT registered, a bookkeeper will be the most cost effective service for you. They will also provide some good, basic tax advice. If you run a limited company, get an accountant to prepare your annual accounts and corporation tax returns.Although both can prepare your tax returns, a CPA is more knowledgeable about tax codes and can represent you before the IRS if you’re audited. AIPB certification requires bookkeepers to have at least two years of full-time work experience and pass a national exam. To maintain the credential, bookkeepers are required to engage in continuing education. Bookkeepers aren’t required to be certified to handle the books for their customers or employer, but licensing is available.

Differences:

This is a simple record-keeping system; however, since accounts cannot be reconciled, the potential for fraud is high. Accountants will often elect to take the Uniform CPA Examination to receive their credentials as a Certified Public Accountant . Most state boards require accountants to acquire 2 years’ worth of work experience before they are eligible to sit for the exam. After obtaining their certification, CPAs will need to stay up to date with current laws and practices by periodically participating in continuing education courses, and renewing their license. Accounting positions generally require a bachelor’s degree in accounting or a related field, like internal auditing. Some small companies may not have an official bookkeeper, so an accountant will also take on the responsibilities of a bookkeeper too. Or the bookkeeping duties may be assigned to an accountant with less work experience.

Bottom Line Vs Top Line: Whats The Difference For Small Business Owners?

Bookkeepers do not require a license but can choose to obtain a certification. The required certifications or licenses usually depend on where the individual, or the individual’s employer, is located. Staying on top of your finances is a key part of being a successful small business owner. As such, it’s important that your financial data is current and accurate so that you have the tools you need to make sound business decisions and ensure healthy cash flow. What’s important to know, though, is that some tasks bookkeepers and accountants do can vary between businesses. Especially in the case of smaller businesses, bookkeepers might do some basic accounting duties as there’s sometimes a bit of an overlap.Accountants analyze financial transactions in financial statements and business reports following accounting principles, standards and requirements. Accountants analyze and interpret financial data to report the financial condition and performance of the business to company leaders to help them make informed business decisions.We’ll demonstrate how you can save money while improving your efficiency and accuracy when you outsource your back office services to TEAM LUXA. Most people would be hard-pressed to describe the difference between an accountant and a bookkeeper. See productivity soar and kick time-wasting technology to the curb with our range of cloud solutions, created for accounting firms. Flatworld Solutions offers a gamut of services for small, medium & large organizations. Needs so they are free to pursue growth with a trusted financial partner by their side. Bookkeepers can assist accountants by preparing the correct documents and establishing the best systems in order for the accountant to have everything they need to be successful.

Forensic Accounting Analysis Vs Audit

Both the American Institute of Professional Bookkeepers and the National Association of Certified Public Bookkeepers offer accreditation and licensing to bookkeepers. This person allows everyone else to focus specifically on their own tasks to maintain growth while making sure that nothing is falling through the cracks financially. Accountants, on the other hand, are mainly responsible for generally overseeing accounts and producing financial statements and tax returns that are in compliance with the law. This blog will outline the difference between bookkeeping and accounting in more detail so you can easily tell them apart. In order to track transactions consistently and accurately, a bookkeeper will use a tool called a ledger.

Want More Helpful Articles About Running A Business?

James has written extensively for Bizfluent, SmallBusiness.Chron.com, and Work.Chron.com. He previously had his own firm that specialized in financing exports from the United States to clients in Central and South America. James received a Bachelor of Mechanical Engineering from the Georgia Institute of Technology and an MBA in finance from the Columbia University Graduate School of Business. If you have any kind of accounting and bookkeeping requirements, feel free to write to us or talk to one of our representatives and we will get back to you within 24 hours. Bureau of Labor Statistics, the median salary for an accountant in 2019 was $71,550 per year or $34.40 per hour.They use one of two major record-keeping systems, which we will discuss in further detail later on. An accountant typically has a degree and relevant work experience, however, there is no formal certification process for becoming an accountant.” The concise answer is that bookkeeping involves the recording of data and financial information while accounting involves analyzing, classifying and interpreting this data. Because of accounting’s analytical and complex nature, accountants require more formal education and training than bookkeepers. The business world is fast-changing, while regulations that keep enterprises afloat such as licensing and taxation require exceptional financial accounting services. Transparent and trustworthy financial statements are mandatory for most dealings that involve partners or financing institutions.The goals for accountant’s is to help businesses with tax and compliance duties whilst providing strategic advice to save money and time, allowing the business to focus on it’s core activities. Accounting is the process of recording, interpreting, analysing and reporting of financial information. They both help the company maintain its finances and help in making better financial decisions. The accounting report has a record of the financial transactions that take place over a decided accounting period. The management even approaches higher authorities if the reports spot the financial transactions to be more different than the normally expected transactions.Accounting is the process of keeping financials for a company by recording, summarizing, analyzing, consulting, and reporting. Accounting tasks are usually performed by a certified professional accountant . Most recently she was a senior contributor at Forbes covering the intersection of money and technology before joining business.com. Donna has carved out a name for herself in the finance and small business markets, writing hundreds of business articles offering advice, insightful analysis, and groundbreaking coverage. Her areas of focus at business.com include business loans, accounting, and retirement benefits. Bookkeeping, in the traditional sense, has been around as long as there has been commerce – since around 2600 B.C.By outsourcing your requirements to us, you can save about 50% of your costs and concentrate more on your core competencies. For example, some small business owners do their own bookkeeping on software their accountant recommends or uses, providing it to the accountant on a weekly, monthly, or quarterly basis for action. Other small businesses employ a bookkeeper or have a small accounting department with data entry clerks reporting to the bookkeeper. This allows small business owners to have a better understanding of the profitability and cash flow. Accounting converts information from the ledger into financial statements that indicate the financial health of the company, and how it is progressing on.