Content

- Examples Of Variable Costs For Manufacturing

- Applications Of Variable And Fixed Costs

- Software Features

- Chapter 5: Cost Behavior And Cost

- Managerial Accounting

- How Do You Determine Variable Vs Fixed Costs For A Product?

As an example, the electricity cost for your business will likely remain consistent if you run a service business. It might not be fun, but calculating your fixed costs on a regular basis will benefit your business in the long run. Having a finger on the pulse of your business metrics will be crucial to happily serving your customers for years to come. Talus Pay POS Everything from basic payment processing to inventory management and customer management—even for multiple locations. PAX A920 Terminal Customer-facing terminals that are easy to use, EMV-ready, and chock-full of convenient functionality. SwipeSimple Card Reader Mobile card readers that make fast, secure transactions a reality even when your business is on the go.Those are all fixed costs because the cost does not change from month to month. You’ll need to pay for the rent of your garage, utility bills to keep the lights on, and employee salaries. The more oil changes you’re able to do, the less your average fixed costs will be. These costs are likely attributed to your food truck monthly payment, auto insurance, legal permits, and vehicle fuel. No matter how many tacos you sell every month, you’ll still be required to pay $1,000.

Examples Of Variable Costs For Manufacturing

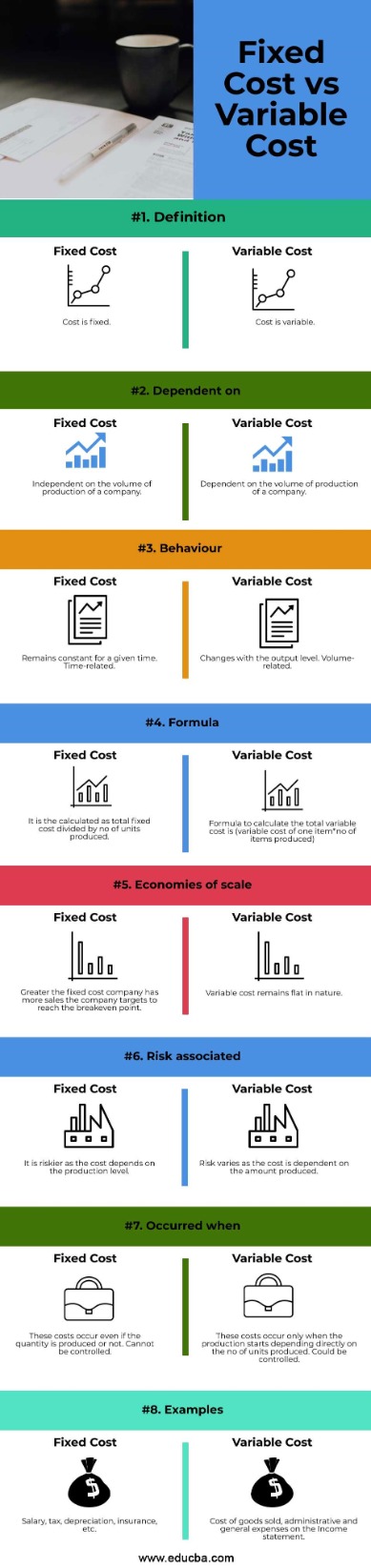

In business planning and management accounting, usage of the terms fixed costs, variable costs and others will often differ from usage in economics, and may depend on the context. Some cost accounting practices such as activity-based costing will allocate fixed costs to business activities for profitability measures. This can simplify decision-making, but can be confusing and controversial. Under full costing fixed costs will be included in both the cost of goods sold and in the operating expenses.

Applications Of Variable And Fixed Costs

Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. We’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month.In accounting, all costs are either fixed costs or variablecosts. That means accountants allocate fixed costs to units of production. Then they are recorded in inventory accounts, such as cost of goods sold.

Software Features

Each taco costs $3 to make when you consider what you spend on taco meat, shells, and vegetables. There will be some expenses you’ll have more control over, like variable costs.

What are 4 examples of fixed costs?

Common examples of fixed costs include rental lease or mortgage payments, salaries, insurance, property taxes, interest expenses, depreciation, and potentially some utilities.For example, ABC has a lease of $10,000 a month on its production facility and it produces 1,000 mugs per month. As such, it may spread the fixed cost of the lease at $10 per mug. If it produces 10,000 mugs a month, the fixed cost of the lease goes down, to the tune of $1 per mug. While property tax and rent can fluctuate from year to year, they tend to remain the same for at least a year. Salaries include only those paid on a salaried basis and do not include hourly employees whose hours may change due to production demand. Your income statement should serve as a blueprint for finding ways to make your business more profitable. By understanding the total cost , you can look for ways to bring down your total costs.

Chapter 5: Cost Behavior And Cost

When you operate a small business, you have two types of costs – fixed costs and variable costs. The most common examples of fixed costs include lease and rent payments, utilities, insurance, certain salaries, and interest payments. Fixed cost are considered an entry barrier for new entrepreneurs.Take your total cost of production and subtract your variable costs multiplied by the number of units you produced. Fixed costs are not permanently fixed; they will change over time, but are fixed, by contractual obligation, in relation to the quantity of production for the relevant period. For example, a company may have unexpected and unpredictable expenses unrelated to production, such as warehouse costs and the like that are fixed only over the time period of the lease.Also known as “indirect costs” or “overhead costs,” fixed costs are the critical expenses that keep your business afloat. These expenses can’t be changed in the short-term, so if you’re looking for ways to make your business more profitable quickly, you should look elsewhere. It’s always a good idea to be aware of all of the different types of expenses you have within your business. Both fixed cost and variable costs play a crucial part in the health and growth of your business.

Managerial Accounting

Using the example of our ceramics studio, say you are thinking of pricing the pots at $90. Since the variable cost per unit is $50 and fixed costs are $15,000, the breakeven point would be at pot 375. Because of this, the ability to differentiate between the two types of costs is vital.For example, you might find that you can get clay from another supplier for less, bringing down your cost per unit to $45. Under those circumstances, your total costs would drop, as well. Above that amount, they cost you more, depending on how much revenue you earn. For example, a business rents a building for a fixed cost of $50,000 per month for five years. The rent will stay the same every month, regardless of the business’s profit or losses. That same principle is also applied to utilities, which can be considered a fixed cost in many cases.

- Breakeven analysis shows the relationship between the price of the product you sell, the volume of the product you sell, and your costs.

- Some cost accounting practices such as activity-based costing will allocate fixed costs to business activities for profitability measures.

- Talus Pay Advantage Our cash discount program passes the cost of acceptance, in most cases 3.99%, back to customers who choose to pay with a credit or debit card.

- Using the example of our ceramics studio, say you are thinking of pricing the pots at $90.

- A variable cost is an expense that changes in proportion to production or sales volume.

- That means accountants allocate fixed costs to units of production.

- For some businesses, overhead may make up 90% of monthly expenses, and variable 10%.

Appointment Scheduling 10to8 10to8 is a cloud-based appointment scheduling software that simplifies and automates the process of scheduling, managing, and following up with appointments. Merchants Accept payments from anywhere—at your brick-and-mortar store, on your website, or even from a mobile phone or tablet. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice.CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle. Your variable unit costs are $1 which includes paper coffee cups, coffee beans, and milk for spinning up lattes. Break-even analysis allows you to make many decisions like how to price your products, whether to look for lower-cost ways to produce them, or whether new product ideas are worth introducing. Breakeven analysis shows the relationship between the price of the product you sell, the volume of the product you sell, and your costs. Your company has expended resources to acquire an asset that it has not yet consumed. For example, if you buy a van to use in your business, you depreciate it over time.

Variable Costs Aka Variable Expenses

Since most businesses will have certain fixed costs regardless of whether there is any business activity, they are easier to budget for as they stay the same throughout the financial year. In accounting, a distinction is often made between the variablevsfixed costs definition. In comparison, fixed costs remain constant regardless of activity or production volume. If the cost structure is comprised mostly of variable costs , managers need to turn a profit on every sale, and so are less inclined to accept low-priced offers from customers. These businesses can easily cover their small amounts of fixed costs. This difference is a key part of understanding the financial characteristics of a business.Understanding the difference between fixed and variable costs can help a business owner identify economies of scale, which occur when a business makes cost reductions as it increases its level of production. By achieving economies of scale, a business can spread out fixed costs over a larger number of products or services and decrease variable costs in the process, resulting in significant cost advantages. In accounting and economics, fixed costs, also known as indirect costs or overhead costs, are business expenses that are not dependent on the level of goods or services produced by the business. They tend to be recurring, such as interest or rents being paid per month.In recent years, fixed costs gradually exceed variable costs for many companies. Firstly, automatic production increases the cost of investment equipment, including the depreciation and maintenance of old equipment. Secondly, labor costs are often considered as long-term costs. It is difficult to adjust human resources according to the actual work needs in short term.In manufacturing, the total cost of direct labor, raw materials, and facility upkeep will take the biggest bite out of your revenue. Whether it’s the office Christmas party or a week in Acapulco with your top clients, any event you have to plan will come with fixed and variable costs. Reducing certain fixed costs to improve your cash flow is possible, but may require decisions like moving to a less expensive workplace or reducing the number of employees. Other fixed costs, like depreciation, on the other hand, won’t improve your cash flow but may improve your balance sheet. A change in your fixed or variable costs affects your net income. Keep in mind that fixed costs may not be consistent in the long run. In the example above, the rent will stay the same until the business no longer occupies the space, or when the agreement comes to an end and the owner decides to increase the rent for the next rental period.