Content

- Variable Cost Vs Fixed Cost

- What Is The Difference Between Costs And Expenses?

- Understanding Variable Costs

- Improve Your Year End Closing By Avoiding These 5 Accounting Myths

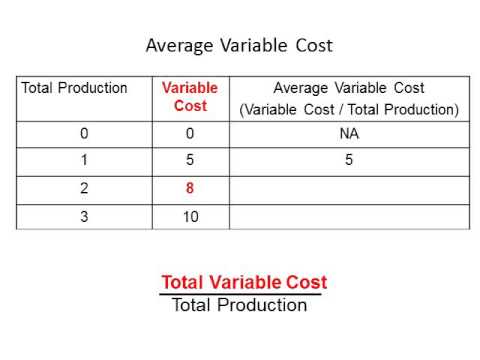

- Variable Cost Formula

When the bakery does not bake any cake, its variable costs drop to zero. Unlike fixed expenses, you can control variable costs to allow for more profits. Variable costs are expenses that change directly and proportionally to the changes in business activity level or volume. For example, the rent of a building is a fixed cost that a small business owner negotiates with the landlord based the square footage needed for its operations. If the owner rents 10,000 square feet of space at $40 a square foot for ten years, the rent will be $40,000 per month for the next ten years, regardless of the profits or losses. Companies may have what is called semi-variable costs, which are a mixture of both variable and fixed costs.

- A variable cost is a corporate expense that changes in proportion to how much a company produces or sells.

- Cost-volume-profit analysis looks at the impact that varying levels of sales and product costs have on operating profit.

- Total variable costs increase proportionately as volume increases, while variable costs per unit remain unchanged.

- Direct labor may not be a variable cost if labor is not added to or subtracted from the production process as production volumes change.

- A good way of determining what your fixed costs are is to think about the costs your business would incur if you had to temporarily close.

You can calculate the variable cost for a product by dividing the total variable expenses by the number of units for sale. To determine the fixed cost per unit, divide the total fixed cost by the number of units for sale. Fixed costs are generally easier to plan, manage, and budget for than variable costs. However, as a business owner, it is crucial to monitor and understand how both fixed and variable costs impact your business as they determine the price level of your goods and services. Knowing the difference between expenses and revenue is the key to understanding the profitability of your business. As a small business owner, it is vital to track and understand how the various costs change with the changes in the volume and output levels. The breakdown of these expenses determines the price level of the services and assists in many other aspects of the overall business strategy.

Variable Cost Vs Fixed Cost

Variable costs can increase or decrease based on the output of the business. Your company has expended resources to acquire an asset that it has not yet consumed. For example, if you buy a van to use in your business, you depreciate it over time. When it is depreciated to zero dollars, it is fully expensed. A business incurs a shipping cost only when it sells and ships out a product.This distinction is crucial in forecasting the earnings generated by various changes in unit sales and thus the financial impact of proposed marketing campaigns. In a survey of nearly 200 senior marketing managers, 60 percent responded that they found the “variable and fixed costs” metric very useful. In other words, they are costs that vary depending on the volume of activity.Since they stay the same throughout the financial year, fixed costs are easier to budget. They are also less controllable than variable costs because they’re not related to operations or volume. Fixed costs are predetermined expenses that remain the same throughout a specific period. These overhead costs do not vary with output or how the business is performing. To determine your fixed costs, consider the expenses you would incur if you temporarily closed your business. You would still continue to pay for rent, insurance and other overhead expenses. Rising variable costs are not always bad news for your business.

What Is The Difference Between Costs And Expenses?

Operating leverage is a cost-accounting formula that measures the degree to which a firm can increase operating income by increasing revenue. Variable overhead is the indirect cost of operating a business, which fluctuates with manufacturing activity. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. This would mean that the company might need to cut jobs or buy in less of the materials that they use to make their products. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money.

Understanding Variable Costs

If a business grows, so will its expenses such as utility bills for electricity, gas, or water. An understanding of the fixed and variable expenses can be used to identify economies of scale. This cost advantage is established in the fact that as output increases, fixed costs are spread over a larger number of output items.

Is rent a variable cost?

Variable costs may include labor, commissions, and raw materials. … Fixed costs may include lease and rental payments, insurance, and interest payments.Depreciation – the gradual deduction of an asset’s decline in value. A physical asset is gradually expensed over time down to a value of $0. Therefore, for Amy to break even, she would need to sell at least 340 cakes a month.

Improve Your Year End Closing By Avoiding These 5 Accounting Myths

A distress price is when a company chooses to mark down the price of an item or service instead of discontinuing the product in question altogether. Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial. Sage Intacct Advanced financial management platform for professionals with a growing business.If the owner decides to move to a bigger facility or pay more, the business expense would obviously go up. In most organizations, the bulk of all expenses are fixed costs, and represent the overhead that an organization must incur to operate on a daily basis. While variable costs are a part of anything business related, some common examples include sales commissions, labor costs, and the costs of raw materials. In marketing, it is necessary to know how costs divide between variable and fixed.

Variable Cost Formula

While fixed costs may change over time, it is not because of changes in output. Instead, alterations in contractual agreements or changes in rents can affect the rate of payment for fixed costs. In another example, let’s say a business has a fixed cost of $7,500 to rent a machine it uses to produce shoes. If the business does not produce any shoes for the month, it still has to pay $7,500 for the cost of renting the machine. Similarly, if the business produces 10,000 mugs, the cost of renting the machine stays the same. Keep in mind that fixed costs may not be consistent in the long run.

How To Calculate Total Variable Costs

The fixed costs are always shown as the vertical intercept of the total cost curve; that is, they are the costs incurred when output is zero so there are no variable costs. You can see from the graph that once production starts, total costs and variable costs rise.These costs are also the primary ingredients to various costing methods employed by businesses including job order costing, activity-based costing and process costing. Unlike variable costs, a company’s fixed costs do not vary with the volume of production. Fixed costs remain the same regardless of whether goods or services are produced or not. Examples of fixed costs are rent, employee salaries, insurance, and office supplies. A company must still pay its rent for the space it occupies to run its business operations irrespective of the volume of products manufactured and sold. If a business increased production or decreased production, rent will stay exactly the same. Although fixed costs can change over a period of time, the change will not be related to production, and as such, fixed costs are viewed as long-term costs.Fluctuations in sales and production levels can affect variable costs if factors such as sales commissions are included in per-unit production costs. Meanwhile, fixed costs must still be paid even if production slows down significantly. A variable cost of this product would be the direct material, i.e., cloth, and the direct labor. The facility and equipment are fixed costs, incurred regardless of whether even one shirt is made.Businesses can have semi-variable costs, which include a combination of fixed and variable costs. An example of a semi-variable cost is a vehicle rental that is billed at a base rate plus a per-mile charge.

See For Yourself How Easy Our Accounting Software Is To Use!

The most purely variable cost of all, these are the raw materials that go into a product. The variable cost ratio is a calculation of the costs of increasing production in comparison to the greater revenues that will result. Patriot’s online small business accounting software uses a simple cash-in, cash-out system. You classify an expense by whether it is affected by a change in sales.

Variable Costs Example

If the company produces 500 units, its variable cost will be $1,000. However, if the company does not produce any units, it will not have any variable costs for producing the mugs. Similarly, if the company produces 1000 units, the cost will rise to $2,000. When production or sales increase, variable costs increase; when production or sales decrease, variable costs decrease. This month, variable costs double, but the revenue only increases by 10%. Because the variable costs increase faster than revenue, you lose money.Some fixed costs are incurred at the discretion of a company’s management, such as advertising and promotional expense, while others are not. It is important to remember that all non-discretionary fixed costs will be incurred even if production or sales volume falls to zero. For example, a company may pay a sales person a monthly salary plus a percentage commission for every unit sold above a certain level . The relationship between the quantity of output being produced and the cost of producing that output is shown graphically in the figure.