Content

- Bad Debt:

- How To Calculate Goods Sold In A Retail Business

- Company

- The Direct Write Off Method Of Accounting For Uncollectible Accounts

- What Is A Bad Debt Expense?

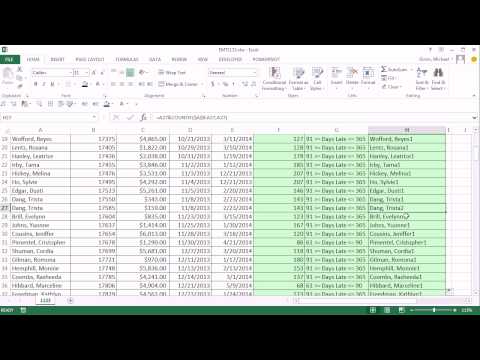

The estimated percentages are then multiplied by the total amount of receivables in that date range and added together to determine the amount of bad debt expense. The table below shows how a company would use the accounts receivable aging method to estimate bad debts.

- GoCardless is authorised by the Financial Conduct Authority under the Payment Services Regulations 2017, registration number , for the provision of payment services.

- Revenue and capital expenditures are expenses ingrained in the daily operation of a business.

- We use this estimate to record Bad Debt Expense and to setup a reserve account called Allowance for Doubtful Accounts based on previous experience with past due accounts.

- If the customer is able to pay a partial amount of the balance (say $5,000), it will debit cash of $5,000, debit bad debt expense of $5,000, and credit accounts receivable of $10,000.

- Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

- Bad Debts Expense is reported in the income statement as an operating expense.

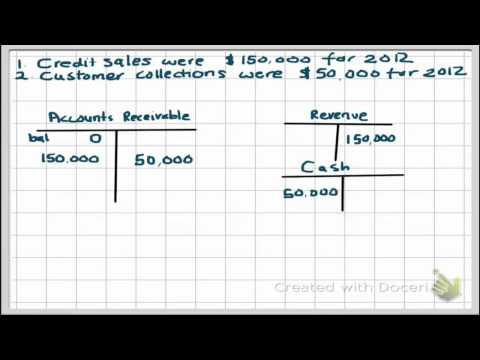

Bad debt is an expense that a business incurs once the repayment of credit previously extended to a customer is estimated to be uncollectible. Coca-Cola has several assets that are listed on its balance sheet. Let’s look at what is reported on Coca-Cola’s Form 10-K regarding its accounts receivable.

Bad Debt:

Sales resulting from the use of Visa and MasterCard are considered cash sales by the retailer. When credit is tight, companies may not be able to borrow money in the usual credit markets. Pursue problem accounts with phone calls, letters, and legal action if necessary. Interest Revenue is shown under “Other Revenues and Gains” in the nonoperating section of the income statement. When the maturity date is stated in days, the time factor is frequently the number of days divided by 360.Describe the entries to record the disposition of notes receivable. The provision for credit losses is an estimation of potential losses that a company might experience due to credit risk. Bad debt expense is an unfortunate cost of doing business with customers on credit, as there is always a default risk inherent to extending credit. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes.The direct write-off method records the exact amount of uncollectible accounts as they are specifically identified. In the direct write off method example above, what happens if the client does end up paying later on? Accounts Receivable would be debited, and the Bad Debt Expense account would be reduced. Revenue and capital expenditures are expenses ingrained in the daily operation of a business.

How To Calculate Goods Sold In A Retail Business

Therefore, the business would credit accounts receivable of $10,000 and debit bad debt expense of $10,000. If the customer is able to pay a partial amount of the balance (say $5,000), it will debit cash of $5,000, debit bad debt expense of $5,000, and credit accounts receivable of $10,000. The direct write off method of accounting for bad debts allows businesses to reconcile these amounts in financial statements. If the bad debt is accounted for in a different year, it will be recorded against revenue which is completely unrelated to the expense. This will mean that the total revenue will be incorrect in both the accounting years, the year of posting the invoice as well as the year of accounting for uncollectible accounts. This goes against the standards set by GAAP; hence, GAAP doesn’t approve of this method and asks accountants to follow the allowance method for reporting uncollectible accounts or bad debts.

When the direct write-off method is used to recognize uncollectible accounts expense An Allowance for doubtful accounts is not required?

Under the direct write off method there is no contra asset account such as Allowance for Doubtful Accounts. This means that the balance sheet is reporting the full amount of accounts receivable and therefore implying that the full amount will be converted to cash.This allowance can accumulate across accounting periods and may be adjusted based on the balance in the account. The customer tries avoiding his calls and comes up with different excuses. After a while, the designer realizes that the customer will not be paying ever.Because customers do not always keep their promises to pay, companies must provide for these uncollectible accounts in their records. The direct write-off method recognizes bad accounts as an expense at the point when judged to be uncollectible and is the required method for federal income tax purposes. The allowance method provides in advance for uncollectible accounts think of as setting aside money in a reserve account. The allowance method represents the accrual basis of accounting and is the accepted method to record uncollectible accounts for financial accounting purposes.

Company

On the other hand, researching your past receivable history may also show you that the majority of accounts that reach 120 days old are not paid. From that research, you would likely choose to write off accounts when they reach 120 days old. Find the bad debt point in the receivables history and then use that as a measurement to pinpoint uncollectible accounts. Bad debt expenses are generally classified as a sales and general administrative expense and are found on the income statement. Recognizing bad debts leads to an offsetting reduction to accounts receivable on the balance sheet—though businesses retain the right to collect funds should the circumstances change.This journal entry template will help you construct properly formatted journal entries and provide a guideline for what a general ledger should look like. Similar to its name, the allowance for doubtful accounts reports a prediction of receivables that are “doubtful” to be paid. The Coca-Cola Company , like other U.S. publicly-held companies, files its financial statements in an annual filing called a Form 10-K with the Securities & Exchange Commission . Let’s try and make accounts receivable more relevant or understandable using an actual company.The ratio used to assess the liquidity of the receivables is the receivables turnover ratio. Ask potential customers for references from banks and suppliers and check the references. The payee may be specifically identified by name or may be designated simply as the bearer of the note. The entry made in writing off the account is reversed to reinstate the customer’s account. Cash realizable value in the balance sheet, therefore, remains the same. Receivables are claims that are expected to be collected in cash. The term receivablesrefers to amounts due from individuals and companies.

The Direct Write Off Method Of Accounting For Uncollectible Accounts

Under the direct write off method, when a small business determines an invoice is uncollectible they can debit the Bad Debts Expense account and credit Accounts Receivable immediately. This eliminates the revenue recorded as well as the outstanding balance owed to the business in the books. However, the direct write off method allows losses to be recorded in different periods from the original invoice dates. This means that reported losses could appear on the income statement against unrelated revenue, which distorts the balance sheet. It will report more revenue than might have actually been generated. Under the direct write off method there is no contra asset account such asAllowance for Doubtful Accounts. This means that the balance sheet is reporting the full amount of accounts receivable and therefore implying that the full amount will be converted to cash.Uncollectable accounts from customer defaults must be recorded on the balance sheet of a business. In contrast to the direct write-off method, the allowance method is only an estimation of money that won’t be collected and is based on the entire accounts receivable account. The amount of money written off with the allowance method is estimated through the accounts receivable aging method or the percentage of sales method. An example of an allowance method journal entry can be found below. Companies that extend credit to their customers report bad debts as an allowance for doubtful accounts on the balance sheet, which is also known as a provision for credit losses. Is the amount the company expects to collect from accounts receivable.

What Is A Bad Debt Expense?

The direct write-off method involves writing off a bad debt expense directly against the corresponding receivable account. Therefore, under the direct write-off method, a specific dollar amount from a customer account will be written off as a bad debt expense. What happens when a customer doesn’t pay for products or services? The business is left out of pocket with “bad debt” to balance in the books. The direct write off method offers a way to deal with this for accounting purposes, but it comes with some pros and cons. Account adjustments are entries out of internal transactions within a business, which are entered into the general journal at the end of an accounting period.

What Are Two Methods Used To Adjust Accounts Receivable?

Short-term receivables are reported in the current asset section of the balance sheet below short-term investments. The credit balance in the allowance account will absorb the specific write-offs when they occur. Cash realizable value is the net amount of cash expected to be received; it excludes amounts that the company estimates it will not collect. When a specific account is determined to be uncollectible, the loss is charged to Bad Debt Expense. Merchandisers record accounts receivable at the point of sale of merchandise on account. Nontrade receivables including interest receivable, loans to company officers, advances to employees, and income taxes refundable.A note receivable is a written agreement between a borrower and lender specifying when a given payment will be made. Explore how these agreements are made on promissory notes while examining interest rates and maturity dates. Under the direct write-off method of accounting for the uncollectible… In the direct write off method, a small business owner can debit the Bad Debts Expense account and credit Accounts Receivable. Determine a required payment period and communicate that policy to customers. Both the gross amount of receivables and the allowance for doubtful accounts should be reported.If there is no hope of collection, the face value of the note should be written off. No interest revenue is reported when the note is accepted because the revenue recognition principle does not recognize revenue until earned. The note receivable is recorded at its face value, the value shown on the face of the note. In a promissory note, the party making the promise to pay is called the maker.The allowance method asks businesses to estimate their amount of bad debt, which isn’t an accurate enough way to calculate a deduction for the IRS. Like accounts receivable, notes receivable can be readily sold to another party. Occasionally the allowance account will have a debit balance prior to adjustment because write-offs during the year have exceededprevious provisions for bad debts. After the accounts are arranged by age, the expected bad debt losses are determined by applying percentages, based on past experience, to the totals of each category.This distortion goes against GAAP principles as the balance sheet will report more revenue than was generated. This is why GAAP doesn’t allow the direct write off method for financial reporting.

Reason Why The Direct Write Off Method Is Not Preferred

The estimated bad debts represent the existing customer claims expected to become uncollectible in the future. In “real life,” companies must estimate the amount of expected uncollectible accounts if they use the allowance method. The allowance method is required for financial reporting purposes when bad debts are material. The percentage of sales method simply takes the total sales for the period and multiplies that number by a percentage. Once again, the percentage is an estimate based on the company’s previous ability to collect receivables. Bad debt expense is the way businesses account for a receivable account that will not be paid. Bad debt arises when a customer either cannot pay because of financial difficulties or chooses not to pay due to a disagreement over the product or service they were sold.It makes the company look more profitable than it really is, at least for a short period of time. See the definition of web browser, the history of web browsers, how a browser works, and examples of different types of web browsers. Bad debt expense recognition is delayed under the direct write-off method, while the recognition is immediate under the allowance method. This results in higher initial profits under the direct write-off method.Notice how we do not use bad debts expense in a write-off under the allowance method. But, the write off method allows revenue to be expensed whenever a business decides an invoice won’t be paid. This makes a company appear more profitable, at least in the short term, than it really is. A concentration of credit risk is a threat of nonpayment from a single customer or class of customers that could adversely affect the financial health of the company. The notes receivable allowance account is Allowance for Doubtful accounts. Under the allowance method, every bad debt write-off is debited to the allowance account and not to Bad Debt Expense. No attempt is made to show accounts receivable in the balance sheet at the amount actually expected to be received.