Content

- Depreciation And Amortization

- Adjusting Entries

- What Are The Types Of Adjusting Journal Entries?

- What Is An Adjusting Journal Entry?

- Free Accounting Courses

- How Adjusting Entries Are Made

- Example Of An Adjusting Journal Entry

Generally, one-half of FICA is withheld from employees; the other half comes from your coffers as an expense of the business. The amounts are a little different in 2012 because of the payroll tax break. The primary distinction between cash and accrual accounting is in the timing of when expenses and revenues are recognized.

- The depreciation expense shows up on your profit and loss statement each month, showing how much of the truck’s value has been used that month.

- They didn’t receive these wages until Jan. 1, because you pay your employees on the 1st and 15th of each month.

- To deal with the mismatches between cash and transactions, deferred or accrued accounts are created to record the cash payments or actual transactions.

- They are sometimes called Balance Day adjustments because they are made on balance day.

- Also determines that revenues and expenses must be recorded in the period when they are actually incurred.

- An accrued revenue is the revenue that has been earned , while the cash has neither been received nor recorded.

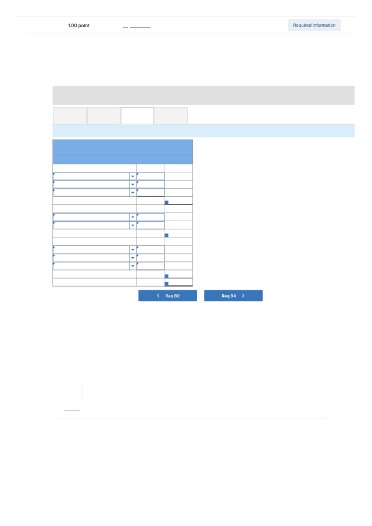

The entries are made in accordance with the matching principle to match expenses to the related revenue in the same accounting period. The adjustments made in journal entries are carried over to the general ledger that flows through to the financial statements. Adjusting entries are done at the end of a cycle in accounting in order to update financial accounts. Study the definition, examples, and types of accounts adjusted such as prepaid and accrued expenses, and unearned and accrued revenues. An adjusting journal entry is an entry in a company’s general ledger that occurs at the end of an accounting period to record any unrecognized income or expenses for the period. When a transaction is started in one accounting period and ended in a later period, an adjusting journal entry is required to properly account for the transaction. An accountant records unpaid salaries as a liability and an expense because the company has incurred an expense.

Depreciation And Amortization

Also determines that revenues and expenses must be recorded in the period when they are actually incurred. Keep in mind, this calculation and entry will not match what your accountant calculates for depreciation for tax purposes. But this entry will let you see your true expenses for management purposes. The Vehicles account is a fixed asset account on your balance sheet. We post the purchase in this manner because you don’t fully deplete the usefulness of the truck when you purchase it. At the end of the following year, then, your Insurance Expense account on your profit and loss statement will show $1,200, and your Prepaid Expenses account on your balance sheet will be at $0. Again, this type of adjustment is not common in small-business accounting, but it can give you a lot of clarity about your true costs per accounting period.Instead, it is used up over time, and this use is recorded as a depreciation or amortization expense. If so, you probably need to make an adjusting entry in your general journal to properly account for the sale. You may need to have your accountant help you with this type of transaction. If a long‐term note payable of $10,000 carries an annual interest rate of 12%, then $1,200 in interest expense accrues each year. At the close of each month, therefore, the company makes an adjusting entry to increase interest expense for $100 and to increase interest payable for $100.

Adjusting Entries

Allowances reduce the sale price when defective goods are retained by the buyer. Having a basic understanding of fundamental accounting terms is a good idea for everyone. In this lesson, we’ll learn some of the terminology and concepts used in basic accounting.An adjusting journal entry involves an income statement account along with a balance sheet account . It typically relates to the balance sheet accounts for accumulated depreciation, allowance for doubtful accounts, accrued expenses, accrued income, prepaid expenses,deferred revenue, and unearned revenue.One of the important steps in the accounting cycle when preparing financial statements is the adjusted trial balance. Discover more about the definition of the adjusted trial balance, including its preparation and the trial balance worksheet, and an example of this step in practice. In accounting, unearned revenue is the revenue received by a company before the actual delivery of goods or services. Explore the definitions of the unearned revenue received and the unearned revenue earned, their examples, and their journal entries. Adjusting journal entries are used to reconcile transactions that have not yet closed, but which straddle accounting periods.Accrued interest refers to the interest that has been incurred on a loan or other financial obligation but has not yet been paid out.Be sure to write off this account in youraccounts receivable ledger, so that it agrees with yourgeneral ledger. A classified balance sheet or a Statement of Financial Position, contains information on the financial position of a business.

What Are The Types Of Adjusting Journal Entries?

The recording of the payment of employee salaries usually involves a debit to an expense account and a credit to Cash. Unless a company pays salaries on the last day of the accounting period for a pay period ending on that date, it must make an adjusting entry to record any salaries incurred but not yet paid. Adjusting entries usually involve one or more balance sheet accounts and one or more accounts from your profit and loss statement. In other words, when you make an adjusting entry to your books, you are adjusting your income or expenses and either what your company owns or what it owes .

What Is An Adjusting Journal Entry?

The entry for bad debt expense can also be classified as an estimate. If each entry above had been posted as of Dec. 31, your December expenses would have been increased by $19,950.

Free Accounting Courses

Generally, adjusting journal entries are made for accruals and deferrals, as well as estimates. Sometimes, they are also used to correct accounting mistakes or adjust the estimates that were made previously. Typically, you — or your bookkeeper — will enter income and expenses as they are recognized in your business.

How Adjusting Entries Are Made

Because you know your inventory amount has decreased by $3,750, you will adjust your actual inventory number instead of posting to the reserve account. Now, when you record your payroll for Jan. 1, your Wages and Salaries expense won’t be overstated.For tax purposes, your tax preparer might fully expense the purchase of a fixed asset when you purchase it. However, for management purposes, you don’t fully use the asset at the time of purchase.These can be either payments or expenses whereby the payment does not occur at the same time as delivery. The purpose of adjusting entries is to convert cash transactions into the accrual accounting method. Accrual accounting is based on the revenue recognition principle that seeks to recognize revenue in the period in which it was earned, rather than the period in which cash is received. Adjusting journal entries are recorded in a company’s general ledger at the end of an accounting period to abide by the matching and revenue recognition principles.

Why Are Adjusting Journal Entries Important?

This is common at the end of the year when we are doing work but have not recorded the revenue yet. This would also apply to interest earned on notes receivable even if the interest is not due until the next year. In contrast to accruals, deferrals are also known as prepayments for which cash payments are made prior to the actual consumption or sale of goods and services. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site.We need to do an adjusting entry to record the salary earned by employees from December 28 – December 31 of this year. December 28 and 29 are weekend days and employees do not work those days. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. An accrued expense is the expense that has been incurred before the cash payment has been made. Examples include utility bills, salaries, and taxes, which are usually charged in a later period after they have been incurred.This means it shows up under your Vehicle asset account on your balance sheet as a negative number. This has the net effect of reducing the value of your assets on your balance sheet while still reflecting the purchase value of the vehicle. If you have adjusting entries that need to be made to your financial statements before closing your books for the year, does that mean your books aren’t as accurate as you thought? This article will take a close look at adjusting entries for accounting purposes, how they are made, what they affect and how to minimize their impact on your financial statements. Accruals are revenues and expenses that have not been received or paid, respectively, and have not yet been recorded through a standard accounting transaction. For instance, an accrued expense may be rent that is paid at the end of the month, even though a firm is able to occupy the space at the beginning of the month that has not yet been paid. When the cash is paid, an adjusting entry is made to remove the account payable that was recorded together with the accrued expense previously.