Content

- As A Business Owner, It’s Important To Know What Your Profit Margins Are And Track Them At All Times

- Analyzing Financial Statements

- Free Accounting Courses

- What Is The Formula For Operating Margin?

- Analysis

- Read More About Profit And Loss Metrics:

- Do You Want A High Or Low Profit Margin?

The operating margin is a useful tool for determining how profitable the operations of a company are, but not necessarily how profitable the company is as a whole. Gross profit results from subtracting a company’s cost of goods from its gross revenue. Below gross profit on an income statement, you’ll find the firm’s operating expenses. These include compensation-related expenses, sales and marketing costs, and miscellaneous office expenses like utilities and office supplies. One of the best ways to evaluate a company’s operational efficiency is to determine the company’s operating margin over time. Rising operating margins show a company that is managing its costs and increasing its profits. Margins above the industry average or the overall market indicate financial efficiency and stability.Probably the most common way to determine the successfulness of a company is to look at the net profits of the business. Companies are collections of projects and markets, individual areas can be judged on how successful they are at adding to the corporate net profit. Not all projects are of equal size, however, and one way to adjust for size is to divide the profit by sales revenue. The resulting ratio is return on sales , the percentage of sales revenue that gets ‘returned’ to the company as net profits after all the related costs of the activity are deducted. Profit margin is expressed as a percentage and it measures how much of every dollar in sale that a business keeps from its earnings. Profit margin represents the company’s net income when it’s divided by the net sales or revenue.

As A Business Owner, It’s Important To Know What Your Profit Margins Are And Track Them At All Times

Using EBIT instead of operating income means that the ratio considers all income earned by the company, not just income from operating activity. Your operating margin can be an indicator of how well your company is being run, and many investors and lenders will ask to see it if you are seeking financing or funding. Understanding it can help you determine how to increase profitability and stability by lower operating expenses. The operating income shows, in terms of dollars, what remains for the owners after deducting all of the expenses related to producing the pizzas and operating the business. Profits margins also tell business owners whether their company needs to change its approach or not to doing business. A high profit margin is one that outperforms the average determined for its industry. Operating Profit Margin is the income left after removing cost of goods sold and operating expenses.Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

Is 40 gross profit margin good?

Full-service restaurants have gross profit margins in the range of 35 to 40 percent. … This includes determining a good gross profit margin for their industry that is sufficient to cover general and administrative expenses and leave a reasonable net profit.However, investors are looking for companies that perform better than their competitors and have staying power. Volume is also critical; a company that sells 100 units a year probably needs a much larger operating margin than a company that sells 10,000 units a year. The capital structures, levels of competition and scale efficiencies are different from industry to industry. It is not particularly useful to compare the operating margin of a car parts manufacturer to a clothing retailer.

Analyzing Financial Statements

Revenue refers only to the positive cash flow directly attributable to primary operations. Since the particular economics of each industry is different, comparing operating margins should only be done between competitors. The margin for each company should also be reviewed over time to understand longer-term trends in business management. The best uses of the operating margin, at least for investors, center around competitive and historical context. ROS is an indicator of profitability and is often used to compare the profitability of companies and industries of differing sizes.Since revenues and expenses are considered ‘operating’ in most companies, this is a good way to measure a company’s profitability. While in a bubble, your operating profit margin ratio is useful for providing insight into your business’s financial health only. A business that is capable of generating operating profit rather than operating at a loss is a positive sign for potential investors and existing creditors. This means that the company’s operating margin creates value for shareholders and continuous loan servicing for lenders. The higher the margin that a company has, the less financial risk it has – as compared to having a lower ratio, indicating a lower profit margin.Operating income is the profit of a business after all operating expenses are deducted from sales receipts or revenue. It represents how much a company is making from its core operations, not including other income sources not directly related to its main business activities. It differs from net income in that it does not include the expenses of taxes and interest.

- ROE is also the product of return on assets and financial leverage.

- Profit margin measures the amount of profit a company earns from its sales and is calculated by dividing profit by sales.

- Then plus those two numbers into the formula above to get your operating margin.

- Businesses need to make money to keep afloat, and monitoring your profit margins helps you know the health of your business and tells you if your company can grow.

- ROA was developed by DuPont to show how effectively assets are being used.

- Thus, a higher proportion of debt in the firm’s capital structure leads to higher ROE.

Here’s what you need to know about profit margins, according to the business owners and finance experts we spoke with. Businesses need to make money to keep afloat, and monitoring your profit margins helps you know the health of your business and tells you if your company can grow. BEP, like all profitability ratios, does not provide a complete picture of which company is better or more attractive to investors.

Free Accounting Courses

However, margins below the industry average might indicate potential financial vulnerability to an economic downturn or financial distress if a trend develops. As you can see, Christie’s operating income is $360,000 (Net sales – all operating expenses). This means that 64 cents on every dollar of sales is used to pay for variable costs. Only 36 cents remains to cover all non-operating expenses or fixed costs. If your gross profit margin and operating profit margin are healthy but your net profit margin shows issues with the bottom line, you have nonessential operating costs and overhead to cut. If the problem shows up at the level of the operating profit margin, your operating costs are more than you can cover at the price you’re charging for goods or services.

What Is The Formula For Operating Margin?

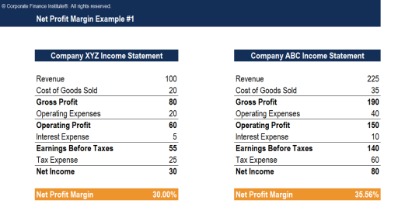

We’ll dive further into how to use these gross margin ratios to determine net income and total revenue in the next section. The three main profit margin metrics are gross profit margin(total revenue minus cost of goods sold ), operating profit margin , and net profit margin .Although It is a good starting point for analyzing many companies, there are items like interest and taxes that are not included in operating income. Therefore, the operating margin is an imperfect measurement a company’s profitability. Just like you keep tabs on accounting documents like your income statement or balance sheet, it’s a good idea to keep an eye on your net profit, cash flow, and operating profit margin. Once you have calculated your COGS, SG&A, and any other operating expenses, subtract these numbers from your total revenue to get your operating income. Then plus those two numbers into the formula above to get your operating margin.Again, these guidelines vary widely by industry and company size, and can be impacted by a variety of other factors. This may either be attributed to efficient control of operating costs or other factors that influence revenue build-ups such as higher pricing, better marketing, and increases in customer demand. This ratio is important to both creditors and investors because it helps show how strong and profitable a company’s operations are.

Analysis

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Chris B. Murphy is an editor and financial writer with more than 15 years of experience covering banking and the financial markets. Fundamental analysis is a method of measuring a stock’s intrinsic value. Analysts who follow this method seek out companies priced below their real worth. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace.Market momentum is a measure of overall market sentiment that can support buying and selling with and against market trends. The revenue number used in the calculation is just the total, top-line revenue or net sales for the year. Best Business Loans for 2021 Here are the best business loans and financing options… Business News Daily was founded in 2010 as a resource for small business owners at all stages of their entrepreneurial journey. Our site is focused exclusively on giving small business advice, tutorials and insider insights.

Read More About Profit And Loss Metrics:

For example, the average operating profit margin for the S&P 500 was 9.35% for the first quarter of 2021. Operating margin can be considered total revenue from product sales less all costs before adjustment for taxes, dividends to shareholders, and interest on debt. The operating margin formula is calculated by dividing the operating income by the net sales during a period.It is important to stress that when calculating profit margins, operating profit margins and net profit margins are considered to be the most important numbers, as they take expenses into account. While gross profit margins will give a general idea of a company’s profitability, it should not be relied upon when making business decisions. Operating profit margins vary significantly across different industries and sectors. For example, average operating margins in the retail clothing industry run lower than the average operating profit margins in the telecommunications sector. Large, chain retailers can function with lower margins due to their massive sales volumes. Conversely, small, independent businesses need higher margins to cover costs and still make a profit.

Accounting Topics

Net income or net profit is determined by subtracting the company’s expenses from its total revenue. Breaking ROE into parts allows us to understand how and why it changes over time. For example, if the net margin increases, every sale brings in more money, resulting in a higher overall ROE. Similarly, if the asset turnover increases, the firm generates more sales for every unit of assets owned, again resulting in a higher overall ROE. Finally, increasing financial leverage means that the firm uses more debt financing relative to equity financing.

Bep Ratio

A company with a high ROE does a good job of turning the capital invested in it into profit, and a company with a low ROE does a bad job. However, like many of the other ratios, there is no standard way to define a good ROE or a bad ROE. Higher ratios are better, but what counts as “good” varies by company, industry, and economic environment. The advantage of using EBIT, and thus BEP, is that it allows for more accurate comparisons of companies. BEP disregards different tax situations and degrees of financial leverage while still providing an idea of how good a company is at using its assets to generate income.