Content

- Invoicing Tips From Other Small Businesses

- Cons Of Due Upon Receipt

- The Best Invoice Payment Terms To Avoid Unpaid Invoices

- Consider A Late Fee

- Tip #2: Know Your Clientele

- How To Create A New Client Questionnaire

And if costs are going over budget, you can let your client know, instead of sending them an expensive surprise at the end of the month. Now you know how to manage client expectations, let’s look at the two main terms of payment most freelancers use. In other words, you should let clients know a deadline for payment, and you can expect to be paid by your deadline. Clients who pay promptly are showing respect for your work and your professional relationship.

- And in most cases, choosing the right invoice wording is the best type of encouragement.

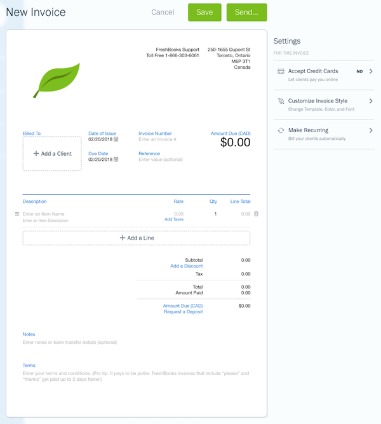

- Once you make the switch, you will wonder how you ever lived without it.

- Finally, you need to submit the work as per your client’s specifications, but this will also delay you in receiving your payment.

- Due upon receipt payment term should be accompanied with other invoice payment terms.

Requesting payment in a normal email, regardless of how formal your language, can inadvertently send the message that your client’s due balance isn’t a pressing manner. You can add any additional information, such as an upcoming seasonal deal, your referral program, or a request for reviews or helpful feedback. This is the very last thing they’ll see before paying, and is a great way to make them feel good about choosing your business. Payment Due.Stockwell will deliver to Client invoices monthly.

Invoicing Tips From Other Small Businesses

Keep these things in mind when you are choosing which invoices should include the term. In other words, the success of your business may depend on the invoice payment terms that you create when sending out invoices.You’ll be surprised how quickly your clients pay their invoices when all it takes is a simple click. Using a professional invoice template can sometimes feel intimidating or unnecessary, especially if you run a fairly casual gig. But with the help of invoicing software, like invoicely, creating these documents can be just as easy as drafting an email. You complete a project, send out the invoice, and get back nothing but silence. Maybe your invoice is sitting forgotten in your client’s inbox. Or, perhaps, they’ve chosen to skip out on paying you for your work.It will help in efficient and clear communication with the customers eliminating confusion arising from the financial terminologies. You may have made your first invoices in a standard software package like Microsoft Word. Maybe you even had to search the internet for tips on how to make an invoice. Get all of our productive tips for freelancers and small businesses. Typically, Net D invoices are due within 10, 15 or 30 days. Don’t be intimidated by the terms — “Net” is just invoice-speak for “days”.

Cons Of Due Upon Receipt

Job Toolkit makes creating, winning, tracking, and getting paid for jobs fast and easy. Payment Due.Whenever this Agreement provides for billing, the agency receiving the bill has an obligation to pay. Once bills are received by the reimbursing agency, payment will be made in accordance with that agency’s payment processes outlined in the operating plan. So although asking for immediate payment may seem like a good idea, it’s better to specify a particular number of days, to focus your clients’ minds on a fixed deadline.

The Best Invoice Payment Terms To Avoid Unpaid Invoices

For example, if the invoice was dated June 10 and you used one of the most used payment terms, Net 30, then the payment would be expected before July 9. These are the payments terms that you and the buyer have agreed on. Terms such as cost, amount, delivery, payment method, and when the payment is expected or due. If you are unsure of the client’s behavior, it is always wise to discuss about your payment terms beforehand. It is actually vital to inform your client beforehand about your expectation on immediate payment after the invoice sent as it prevents negative impact and disputes. Some clients also prefer to make payments after reviewing the work delivered.This is a friendly reminder that the payment was due on December 31, 2018. With a flat rate, your client would pay the same fee whether they pay a day or a week after the due date. But with the latter method, you could charge an extra fee for each day that the payment is late. Opposite of early payment incentives, you can also include late fees in your contract terms. Some clients will delay payment regardless of when the invoice is due. By carefully choosing what you do or do not include in a invoice, you can subtly encourage clients to pay their due balance on receipt.Let’s say a firm sends out a big batch of widgets to a customer, and then mails out an invoice. According to our records, we haven’t received payment for invoice #1035, which is overdue by one week. Again, if you have any questions, don’t hesitate to get in touch. This is a reminder that payment for invoice #1035 is due today (total $1,475). If you have any questions, please don’t hesitate to contact us. Or Payable on Receipt, this payment method requires immediate payment when the services are rendered. This simply means payment is due at the time services are rendered.

Consider A Late Fee

If you want to use different terms, and you can justify to your clients why those terms are fair, then go for it. This Creative Invoice, is just one of the hundreds of professional invoice templates available from GraphicRiver.1.A term such as “Net 30” requires the client or customer to make a payment within 30 days. However, if they make a payment within ten days, they’ll receive a 2% discount. For example, you could sweeten the incentive by offering a 5% discount if the invoice is paid within a week. Payment in advance, PIA for short, is simply a payment that is made ahead of schedule. It’s not uncommon for business owners to require advance payments for their products or services.

Tip #2: Know Your Clientele

Yes, this invoicing term looks so beneficial but it comes with no guarantee. It doesn’t assure you that your client will pay within the next business day.

How do I respond to a payment confirmation email?

Thank you for the recent payment you have made to us for the sum of @PaymentAmount@. I hereby acknowledge receipt of payment which has been set against the following invoices. If I can be of any further assistance, please do not hesitate to contact me.Fortunately, it’s easy to solve this problem before it occurs. After all, it’s a lot easier to ignore a wordy email than a clear and concise bill. This might sound like the work of skillful manipulation, but it’s a lot easier than you probably think.

Here Are 5 Tips For Writing Effective Invoice Payment Terms

The reason for which is obvious; either the invoice hasn’t been sent on time or it lacks professionalism. This is why we are here to help you understand due upon receipt meaning and a perfect method for invoice payment terms. First, the risk of penalty for late payment will help kick procrastinating clients into gear. Second, charging a late fee will help offset the inconvenience you might face from delayed payments. Some freelancers and business owners choose to offer financial incentives for immediate payment. Typically, this means taking a small percentage off your client’s total if they pay their bill shortly after receipt.There are few downsides to it, but mostly it benefits freelancers and business owners who need the money right away. You can get the benefit of due on receipt with our online invoice maker app. Our online invoicing software helps you integrate direct payment links in the invoice.Instead, we suggest you use the word “days” instead of “Net”, which establishes much clearer payment expectations from the get-go. This form of payment is more unusual in the service industry unless you also sell products. For example, if you own an HVAC repair or window washing company, you’ll most likely send an invoice after the service is completed. Being a small business owner often means you’re short on time, but it’s worth making the effort to get your invoicing set up properly. Having a streamlined invoicing process can drastically reduce the amount of time you spend collecting your hard-earned money. You needn’t feel bad about giving shorter invoice payment terms. Close to 75% of invoices ask for payment within 2 weeks, so expectations are changing.