Content

- What Is A Bad Debt?

- What Is Slander In Business?

- Importance Of Honesty In Accounting

- Failure To Balance Bank Accounts Regularly

- Common Clues Of Financial Statement Manipulation

- Ethics Company Training

When you receive a payment, you need to tie it to a revenue account and invoice. When you pay a bill, you need to reconcile it to an expense account and tie it to a receipt. You would have set up the expense and revenue accounts in your chart of accounts. When you are getting your fresh setup, what you need to create in the accounting system is a chart of accounts. Your chart of accounts is the structure of your business’ accounts where you can book transactions to the proper accounts. To complete proper bookkeeping, you need accounting software to setup and document all transactions.

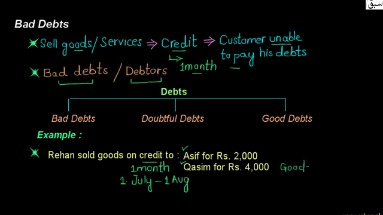

What Is A Bad Debt?

It allows you to set strategic goals, make data-driven decisions to move toward your goals, and to ultimately achieve your goals so that you can start setting new ones. A robust back office is one that allows you to get timely, accurate financials, have confidence in your numbers, and keeps your cash flow moving smoothly. Having an optimized accounting system and an efficient back office is essential to operating a successful business. It should be a source for actionable insights to help you make data-driven decisions. As your business grows, you inevitably have more fires to put out and issues to deal with. One of the worst is when you have cash flow or other financial problems.

What Is Slander In Business?

Filing your taxes late can result in a hefty fine and scrutiny from the IRS. Business owners can often put off their tax preparation too late because they are busy running their day-to-day operations. This can result in gather up receipts and documents at the last minute and throwing it into a box. Save yourself time and trouble during tax time by keeping your records up-to-date all year long.He also directs the Credo team in establishing the strategies for the growth of the firm and continually raising the bar on its standards of exceeding clients’ expectations. Unfortunately, if you don’t set the precedent for payments, people aren’t going to pay in a timely manner.

Importance Of Honesty In Accounting

As a CPA myself, I think it’s horrible when others in my profession act in a way that throws doubt, suspicion, and mistrust on an accountant’s title. If you’ve read these 7 signs of a bad accountant and noticed many similarities to your existing accountant, it’s time to change accountants.

Is it OK to change accountants?

While many businesses prefer to stick with long-time accountants, changes in your business’ management or structure can mean it’s time to change accountants. As your business grows, your accountant must continue to provide updates and advice that help you maintain and improve your company’s financial health.The first step in getting on the right track is to stop and start over. That might not sound like the easiest fix, but your accounting system has to be built on a strong foundation, just like a house built on rock instead of sand. You need a new system with a clean slate and to start rebuilding the transactions. All these accounting software can automate most of the manual tasks to save time, but what’s the use of a software that doesn’t meet all your business requirements? Hence, you should first list all your business needs before selecting software.

Failure To Balance Bank Accounts Regularly

When neglecting to address these challenges, your company’s workplace culture will undoubtedly suffer. Without a strong back office, you’ll be wading through inaccuracies, receiving outdated reports, and you won’t be able to rely on the data. Here are 10 warning signs your back office will keep you stressed and your business stagnate.. Get in touch today with our team of CPAs and tax experts for a no-obligation consultation. An accountant who stole more than $109, 000 from a church in Wakefield, Nebraska.To make this easier to understand, we can compare what the governments are doing with a couple’s personal finances. In this situation, we would help this company unpack this one account and segment it into three, which is the industry standard for freight. Emerging growth companies that have expanding operations with multiple distributors will have even more contracts to reassess, unwind, and rebook.

- The company’s CEO, Bernie Ebbers, was sentenced to 25 years in prison for fraud, conspiracy, and filing false documents.

- Below is how accounting practices can impact your financial well-being.

- You’re looking backward, playing catch-up and never have a true sense of where you stand financially.

- We often see marketing and sales costs merged into one account — but, like freight, that leads to business costs.

- Yashu Varshney is a Digital Marketeer and Content Writer at ACE Cloud Hosting.

This gave the impression that the company had $50 billion more in cash and $50 billion less in toxic assets. Start your plan Easily write a business plan, secure funding, and gain insights. You’ll experience a learning curve, but once you have a routine in place, you’ll be able to work through the necessary accounting measures with ease, Smith says. Of course, you can always hire an accountant on a part-time or full-time basis to help as well. Every cent of income your business brings in should be deposited into your business bank account, Smith says.

Common Clues Of Financial Statement Manipulation

After all, retaining a bad accountant is much too expensive for your business. When you’re interviewing applicants for your company’s accountant position, you’re sure to hear at least one of these or something similar. Now, any worthwhile accountant will be able to confidently explain why they are the best person for the job, but you should be wary of exaggerated promises or guarantees. Just like you wouldn’t trust a doctor who prescribes you without seeing or examining you, you shouldn’t trust an accountant who makes claims without reviewing your financial statements. A good accountant will make you tax-efficient the legal way, which is better for your business in the long run.

Can a bookkeeper do taxes?

A bookkeeper may be able to prepare some of the tax forms required by IRS, such as 1099s for your contractors. Even though the bookkeepers do not prepare tax returns, having books up-to-date can bring significant savings.It could signal that your staff is delivering decreased service or that the staff you do have is overworked and getting burned out. Poor ethics can also inflict damages on the business’ reputation and trustworthiness of its stakeholders, such as customers and business partners. The absence of trust ensures that the business finds it difficult to conduct business with others. This damage to a business’ reputation is particularly devastating to accounting firms who rely heavily on that reputation to remain in business. Arthur Andersen LLP effectively perished as a business because of its poor conduct in the Enron scandal. Poor ethics amongst a business’ accountants means that those persons are more willing to break the rules to benefit either themselves or their business illegally. For example, an unethical accountant granted too much control and too little oversight from superiors can embezzle from the business and conceal the evidence.The GASB sets the standards for state and local government accounting and is currently reviewing general fund accounting. There are many aspects of a business that a business owner has to be mindful.

Top Accounting Scandals

On top of that, you have more balance sheet items and accounts in play. Naturally, the process is more complex, so companies are more likely to make recurring mistakes — such as crediting the wrong account (i.e., an error of principle). Bad accounting can lead to slow or misguided decisions, money leakages, the inability to adapt quickly, and a lack of reliable historical performance.Yes, you can retroactively clean up past accounting mistakes and inaccuracies — but it’s costly from multiple perspectives. When your bookkeeping is a mess, you don’t have the ability to see margins or understand what part of the business is performing well. This lack of insight puts you at a huge disadvantage because you aren’t able to make informed decisions with hiring, marketing or anything else to build the business. Without smart policies and sound processes that enable adequate separation of powers/duties and proper checks and balances, your small business risks enormous loss due to internal fraud schemes. With an inefficient back office, there’s no way to know whether you’re providing clients with accurate up-front estimates followed up by accurate invoices. You also won’t know if you’re collecting payment on time, or if you’re even charging the right price for your services. You should be able to rely on key performance indicators that are most important to your business.The Federal Home Loan Mortgage Corporation, also known as Freddie Mac, is a US federally-backed mortgage financing giant based out of Fairfax County, Virginia. In 2003, it was discovered that Freddie Mac had misstated over $5 billion in earnings. COO David Glenn, CEO Leland Brendsel, former CFO Vaughn Clarke, and former Senior Vice Presidents Robert Dean and Nazir Dossani had intentionally overstated earnings in the company’s books. The scandal came to light due to an SEC investigation into Freddie Mac’s accounting practices. Glenn, Clarke, and Brendsel were all fired and the company was fined $125 million. Email the director of GASB to have the general fund accounted for properly using full accrual accounting. Encourage GASB to not approve the current exposure drafts, which call for a continuation of the current bad accounting practices.

Ethics Company Training

A big bath is not necessarily illegal because it can be done effectively within the boundaries of current accounting rules; however, it is seen as unethical. When a customer misrepresents itself in obtaining a sale on credit, and has no intent of ever paying the seller. The scandal resulted in shareholders losing over $74 billion as Enron’s share price collapsed from around $90 to under $1 within a year.Bad government budgeting and accounting practices make it impossible for you to knowledgeably participate in government. It is impossible for you to effectively advocate for tax and spending policies in your cities and states, because your governments are providing you with misleading financial information. Accurate and efficient accounting is required for the survival of any company. It doesn’t matter how small or large your business is, if your accounting is not being adequately attended to, you’re on the path to financial disaster. Make sure you invest the proper amount of time and resources into your company’s accounting. If it is not completed correctly, it can lead to substantial threats to you and your company’s livelihood. Below is how accounting practices can impact your financial well-being.

Dont Forget To Reconcile Your Bank Account

The role of an accountant is critical to your success as a business owner. An effective accountant helps you stay on top of tax codes, maintain regulatory compliance with the IRS and local tax authorities, and otherwise manage your business’ accounting duties. Saving money is always a good thing – unless it’s done dishonestly.