Content

- How To Determine Manufacturing Overhead

- What Figures Do You Use To Find Direct Labor When It Is Missing From A Formula?

- How To Calculate The Total Manufacturing Cost In Accounting

- Calculating Manufacturing Overhead

- Manufacturing Overhead Definition

- 3 Assigning Manufacturing Overhead Costs To Jobs

Unfortunately, general manufacturing costs don’t reflect the true cost of producing goods. Using the general manufacturing costs exclusively gives you an incorrect and incomplete view of your business. Chan Company received a bill totaling $3,700 for machine parts used in maintaining factory equipment.In a standard cost system, accountants apply the manufacturing overhead to the goods produced using a standard overhead rate. They set the rate prior to the start of the period by dividing the budgeted manufacturing overhead cost by a standard level of output or activity. Recall from Figure 10.1 “Standard Costs at Jerry’s Ice Cream” that the variable overhead standard rate for Jerry’s is $5 per direct labor hour and the standard direct labor hours is 0.10 per unit. Review this figure carefully before moving on to the next section where these calculations are explained in detail. It is often difficult to assess precisely the amount of overhead costs that should be attributed to each production process. Costs must thus be estimated based on an overhead rate for each cost driver or activity. It is important to include indirect costs that are based on this overhead rate in order to price a product or service appropriately.Note that the manufacturing overhead account has a credit balance when overhead is overapplied because more costs were applied to jobs than were actually incurred. Occurs when actual overhead costs are higher than overhead applied to jobs .

How To Determine Manufacturing Overhead

Is the difference between the number of direct labor hours actually worked and what should have been worked based on the standards. Let’s assume a company has overhead expenses that total $20 million for the period.

Is CEO salary a period cost?

In managerial and cost accounting, period costs refer to costs that are not tied to or related to the production of inventory. Examples include selling, general and administrative (SG&A) expenses, marketing expenses, CEO salary, and rent expense relating to a corporate office.The finance head is referring to indirect overhead cost, which shall be incurred irrespective of whether the product is manufactured or not. Indirect CostIndirect cost is the cost that cannot be directly attributed to the production.The following break-up of the cost of sales is provided.Based on the given information, calculate the manufacturing overhead of Samsung for the year 2018. Manufacturing overhead is an essential part of running a manufacturing unit.

What Figures Do You Use To Find Direct Labor When It Is Missing From A Formula?

Use the above-given data for the calculation of manufacturing overhead. This amount will also be recorded on the job cost sheet for Job 153. A clearing account is used to hold financial data temporarily and is closed out at the end of the period before preparing financial statements. An account used to hold financial data temporarily until it is closed out at the end of the period. Adam Hayes is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.Normal costing averages these costs out over the course of a year. This means that 37% of the company’s revenue goes towards covering the company’s manufacturing overheads. A higher overhead rate can indicate a company’s production process is lagging and inefficient. Calculating manufacturing overhead is simpler than you might think.Based on available information, you are required to estimate the cost which the finance head is expecting.

How To Calculate The Total Manufacturing Cost In Accounting

In an industry that is highly automated and thus has relatively little direct labor cost, it may make more sense to allocate manufacturing overhead in proportion to machine hours per unit of production. It takes more than raw materials and shop workers to manufacture products. Factories need power, supplies and employees whose functions are essential to the operation even though they aren’t part of the manufacturing process itself. Generally accepted accounting principles require that you properly account for manufacturing overhead.Direct costs include direct labor, direct materials, manufacturing supplies, and wages tied to production. Overhead expenses are generally fixed costs, meaning they’re incurred whether or not a factory produces a single item or a retail store sells a single product. Fixed costs would include building or office space rent, utilities, insurance, supplies, maintenance, and repair.

Calculating Manufacturing Overhead

Manufacturing overhead is also known as factory overhead, production overhead, and factory burden. Janet Berry-Johnson is a CPA with 10 years of experience in public accounting and writes about income taxes and small business accounting. The income statement and balance sheet must have COGS and inventory value. Therefore, the manufacturing overhead of the company for the year stood at $97 million. The allocation of costs is necessary to establish realistic figures for the cost of each unit manufactured. DepreciationDepreciation is a method of accounting for the costs of any physical or tangible asset over the course of its useful life.

How do you calculate budgeted manufacturing overhead rate?

To do this, take your monthly overhead costs and divide it by your company’s monthly sales. Then multiply it by 100. For example, if your company has $100,000 in monthly manufacturing overhead and $600,000 in monthly sales, the overhead percentage would be about 17%.Let us take the example of a company and look at its various cost fields and then calculate the manufacturing overhead. These costs must be included in the stock valuation of finished goods and work in progress. Both COGS and the inventory value must be reported on the income statement and the balance sheet. On office building as it is not incurred indirectly for the production unit. You are required to calculate manufacturing overhead based on the above information. Which is incurred solely for the production unit, and those have to be considered while calculating the manufacturing overhead. Variable overhead is the indirect cost of operating a business, which fluctuates with manufacturing activity.

Manufacturing Overhead Definition

Fixed overhead costs don’t change based on the volume of production. These include rental expenses (office/factory space), monthly or yearly repairs, and other consistent or “fixed” expenses that mostly remain the same. For example, you have to continue paying the same amount for renting office or factory space even if your company decides to lower production for this quarter. Determine the total of the allocation base generated in the current period by reviewing the maintenance and payroll records of the factory. The payroll records, for example, will show 2,000 direct labor hours during the current period. To allocate manufacturing overhead costs, an overhead rate is calculated and applied.

- Instead, overhead applied represents a portion of estimated overhead costs that is assigned to a particular job.

- During 2018, the company reported a gross profit of $120 million on a total sales of $300 million.

- In an industry that is highly automated and thus has relatively little direct labor cost, it may make more sense to allocate manufacturing overhead in proportion to machine hours per unit of production.

- Whatever allocation method used should be employed on a consistent basis from period to period.

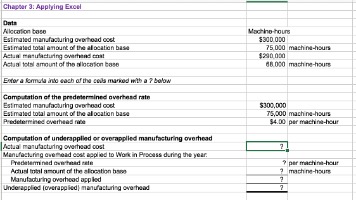

- This is calculated by dividing the estimated manufacturing overhead costs by the allocation base, or estimated volume of production in terms of labor hours, labor cost, machine hours, or materials.

- This is why they’re considered indirect costs and part of your organization’s overhead.

None of these expenses is directly tied to the actual manufacturing process. However, it would be impossible for the business to manufacture its products to a high standard without these. This is why they’re considered indirect costs and part of your organization’s overhead. Manufacturing overhead costs are the indirect expenses required to keep a company operational.

Formula To Calculate Manufacturing Overhead Cost

Knowing the separate rates for variable and fixed overhead is useful for decision making. The variable overhead rate is $ 2 per machine hour ($ 40,000 variable OH/20,000 hours), and the fixed overhead rate is $ 3 per hour ($ 60,000/20,000 hours). If the expected volume had been 18,000 machine-hours, the standard overhead rate would have been $ 5.33 ($96,000/18,000 hours). If the standard volume had been 22,000 machine-hours, the standard overhead rate would have been $ 4.73 ($104,000/22,000 hours). Again, this analysis is appropriate assuming direct labor hours truly drives the use of variable overhead activities.Instead, overhead applied represents a portion of estimated overhead costs that is assigned to a particular job. GAAP standards call for manufacturing overhead to be added to the cost of materials and direct labor to determine the value of inventory and the cost of goods sold. Overhead must be included in the inventory valuation of work in progress as well as finished goods. Both inventory value and cost of goods sold must be reported on the firm’s balance sheet and income statement. For reporting on financial statements, it’s not necessary to precisely determine the manufacturing overhead assigned to each unit of production as long as the overall totals are accurate.When this is done in a precise and logical manner, it will give the manufacturer the true cost of manufacturing each item. Managers use a flexible budget to isolate overhead variances and to set the standard overhead rate. Flexible budgets show the budgeted amount of manufacturing overhead for various levels of output. Direct costsare costs directly tied to a product or service that a company produces. Cost objects can include goods, services, departments, or projects.Manufacturing overhead does not include any of the selling or administrative functions of a business. Thus, the costs of such items as corporate salaries, audit and legal fees, and bad debts are not included in manufacturing overhead. The departmental overhead rate is defined as an expense rate for every department in a factory production process. Manufacturing overhead is considered the extra cost of manufacturing a good that isn’t included in direct labor or material costs. Review the payroll and maintenance records to find the total allocation base generated in the previous accounting period. There’s a fairly simple calculation you can use to determine your business’s manufacturing overhead rate.The difference between actual costs for variable overhead and budgeted costs based on the standards. The overhead rate can also be expressed in terms of the number of hours. Let’s say a company has overhead expenses totaling $500,000 for one month. During that same month, the company logs 30,000 machine hours to produce their goods. Some of them are permanent, while others may vary with an increase and decrease in production. For calculating manufacturing overhead costs, you need to add all the indirect industrial costs brought about while manufacturing an item.The commonly used allocation bases in manufacturing are direct machine hours and direct labor hours. Chan Company estimates that annual manufacturing overhead costs will be $500,000. Chan allocates overhead to jobs based on machine hours, and it expects that 100,000 machine hours will be required for the year. When this journal entry is recorded, we also record overhead applied on the appropriate job cost sheet, just as we did with direct materials and direct labor. Figure 2.6 “Overhead Applied for Custom Furniture Company’s Job 50” shows the manufacturing overhead applied based on the six hours worked by Tim Wallace. Notice that total manufacturing costs as of May 4 for job 50 are summarized at the bottom of the job cost sheet. The calculation of the overhead rate has a basis on a specific period.