Content

- Automated Vendor Invoicing

- Data Capture And Extraction

- Recurring Invoice

- Fast Payments

- Purchase Order Invoicing

- When To Attach A Coding Block

In reality, invoice processing is made up of several smaller processes, some of which will require the human touch such as approving a cost or verifying for accuracy. While others are ripe for automation like data capture and approval workflows. If an invoice was mailed directly to the department, the department must attach and complete a coding block before sending the invoice to Accounts Payable. If Accounts Payable receives the invoice directly from the vendor, they will affix the coding blocks to invoices before faxing them to the department. Departments have five days from the day they receive an invoice to approve and return to Accounts Payable for processing.

Automated Vendor Invoicing

For example, a freelance writer might require 50 percent payment upfront before beginning a project.Using automation for routing approvals, including follow-up notifications, can dramatically reduce the amount of time it takes to get an invoice approved. If you can receive your invoices electronically, you can have all your vendor invoices sent to your AP automation system to save time on invoice receipt.

Data Capture And Extraction

Going over the five days could cause the invoice to become late, affecting the university’s delayed invoice rate. Assign someone to backup the individual primarily responsible for processing and approving invoices so invoices do not lay in a mailbox when someone is out of the office. For instance, let’s say you have an invoice in your system that needs verification. If the purchase order can be pulled from your integrated accounting system, your invoice automation software will help match your invoice data to the PO to ensure it’s valid. Thereby, providing your approvers with sufficient documentation to make a faster decision on the invoice itself. In our continuing efforts to improve our procure-to-pay stream of work, the University of Florida has updated its Accounts Payable software and related processes.They also include contacts that are responsible for taxes and international duties, as well as other established factors by international commerce regulations. Recurring invoices are for ongoing services, like web hosting or housecleaning, and are usually the same price every month.

- The team at SAP is again here to help with a free invoice policy template.

- At some point, you become inefficient and tend to apply heavy risks while you access the vendor information and invoice information.

- Delayed payments are closely reviewed and agencies are held accountable for late payments exceeding 1 percent of total volume processed.

- The biggest advantage of the vendor portal is that it allows your suppliers to self-manage everything about your transactions without having to resort to long email threads and calls.

- Payment data is then transmitted to the State’s Treasurer’s Office where payment is generated to the vendor.

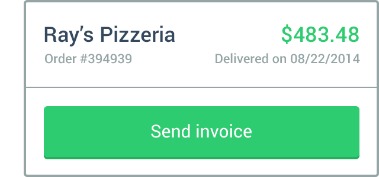

- The necessary information included in a vendor invoice is the amount owed, delivery fee, applicable tax, accepted payment methods, and the date of payment.

The statement module of the portal allows vendors to get a consolidated view of all the transactions they’ve done with you in one place. Empower your vendors to self-manage their transactions with you through our vendor portal. If the department receives an invoice for a commodity order, it must be forwarded to Accounts Payable where it will be charged to the department as designated on the purchase order.

Recurring Invoice

Going paperless starts with the invoices you receive from your vendors, but if they’re unwilling to send electronic invoices (e-invoices), you have two options. The first is to convince your vendors to invoice electronically by pointing out all the benefits.

Fast Payments

Often business owners require advance payment for their products or services. Vendor invoices include the amounts owed, sales taxes, freight and delivery charges, the date by which the payment should be made, and where to send the payment. The information you provide us is intended for internal use only, and we will not share, sell, or distribute your information. You will receive educational information and news about Concur products and services. Gaining visibility and automating your accounts payable processes puts you in control of those expenses. Our 10-step guide will walk you through step-by-step so you can stop paying invoices and start leveraging accounts payable. Your supplier can upload their invoices to you directly through the portal, which you can add as bills to Zoho Books.

Purchase Order Invoicing

All service providers/contractors are required to includeAPPROVED supporting documentation for the services and labor performed (i.e. time sheets including sub-contract/DBE details). Supporting documents must comply with contract terms and conditions. There will be a delay in payment or non-payment if an invoice is received without proper supporting documents when required. Thank you for your interest in providing goods or services to Huntsman. Since a clear and complete invoice helps in ensuring timely payment, we have outlined a few policies for streamlining the invoicing process.

Newsroom Invoicing & Spend Management

Description on each item being invoiced.Each invoice must itemize products, materials, supplies, parts, equipment, labor (i.e. installation or services) and list the related cost per item. Technical descriptions and/or model or part numbers are not sufficient descriptions. Verify that the goods/services have been received and that the billing amount is correct.Most invoicing platforms allow you to easily convert your quote or estimate into an invoice after a sale is made. Line of Credit Pay gives the customer the option to settle their bill over a period of time — typically on a monthly or quarterly basis.