Content

- Recording An Accrued Expense

- What Are Accrued Expenses And When Are They Recorded?

- Expense Recognition

- Accrued Expense Meaning

- Detailed Review Of The Income Statement

- Example Of An Accrued Expense

To illustrate an accrued expense, let’s assume that a company borrowed $200,000 on December 1. The agreement requires that the company repay the $200,000 on February 28 along with $6,000 of interest for the three months of December through February. As of December 31, the company will not have an invoice to process and will not be paying the interest until it is due on February 28. Accounting PeriodAccounting Period refers to the period in which all financial transactions are recorded and financial statements are prepared. Dividends PayableDividend payable is that portion of accumulated profits that is declared to be paid as dividend by the company’s board of directors.

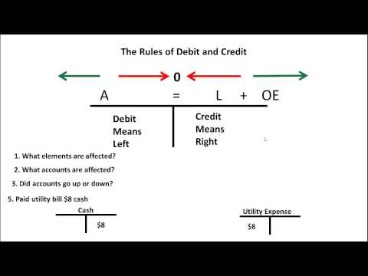

- Accrued Expense – one that has been incurred by the end of the accounting period but has not been paid.

- Unlike conventional expenses, the business will receive something of value from the prepaid expense over the course of several accounting periods.

- Similarly, the salesperson who sold the product earned a commission at the moment of sale .

- Accounts payable (also sometimes just called “payables”) usually are short-term debt obligations to vendors or companies that must be paid for the services or goods bought through credit.

As such, it’s crucial to have a solid grasp on your firm’s accrued liabilities. Find out everything you need to know about this vital accounting term, including our guide to the differences between accrued liabilities and accounts payable. An accrued expense, also known as accrued liabilities, is an accounting term that refers to an expense that is recognized on the books before it has been paid. Since most businesses operate using accrual basis accounting, expense recognition is guided by the matching principle. For an expense to be recognized, the obligation must be both incurred and offset against recognized revenues. Most financial reporting in the US is based on accrual basis accounting. Under the accrual system, an expense is not recognized until it is incurred.

Recording An Accrued Expense

An important issue in accounting is when to recognize expenditures. When a business recognizes an expenditure, it records the amount in its financial records. The expenditure offsets the income the business earned and is used to calculate the business’s profit.Until the dividend declared is paid to the concerned shareholders, the amount is recorded as a dividend payable in the head current liability. You might also have an accrued expense if you incur a debt in a period but don’t receive an invoice until a later period.

What Are Accrued Expenses And When Are They Recorded?

The major difference between the two methods is the timing of recording revenues and expenses. In the cash method of accounting, revenues, and expenses are recorded in the reporting period that the cash payment is made. Although it is easier to use the cash method of accounting, the accrual method can reveal a company’s financial health more accurately.

What is accrued expense journal entry?

Accrued expense journal entry is passed to record the expenses which are incurred over one accounting period by the company but not paid actually in that accounting period. … Accrued expense refers to the expense that has already incurred but for which the payment is not made.Accrued expenses are short-term or current liabilities that you can find on your company’s balance sheet and general ledger. Depending on your accounting system and accountant, they might also be called accrued liabilities or spontaneous liabilities. If you record an accrual for revenue that you have not yet billed, then you are crediting the revenue account and debiting an unbilled revenue account. The unbilled revenue account should appear in the current assets portion of the balance sheet. Thus, the offsets to accruals in the income statement can appear as either assets or liabilities in the balance sheet. You only record accrued expenses in your books if you run your business under the accrual basis of accounting. Although the accrual method of accounting is labor-intensive because it requires extensive journaling, it is a more accurate measure of a company’s transactions and events for each period.Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial. The Coordinating Board has a website where research expenses are required to be posted by award. A. Each institution shall record the accrual at the functional and natural class level. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post.For example, one-off purchases for which you haven’t received a bill. Using the same example from above, the delivery of the raw material is insufficient to cause the cost of those goods to be recognized as an expense. The raw material will be used to make items that will be sold to the public. When the items that used the raw materials are sold, then the costs related to the raw material are recognized. Expenses are outflows of cash or other assets from a person or company to another entity.

Expense Recognition

As you can see, accounts payable and accrued liabilities might sound similar. However, there’s one clear difference between them that it’s important to understand. Accrued expenses are expenses a company accounts for when they happen, as opposed to when they are actually invoiced or paid for. An accrual method allows a company’s financial statements, such as the balance sheet and income statement, to be more accurate. Generally, you accrue a liability in one period and pay the expense in the next period. That means you enter the liability in your books at the end of an accounting period.

Accrued Expense Meaning

You might be thinking that accrued liabilities sound a whole lot like accounts payable. Accrued expenses and accounts payable are similar, but not quite the same. In the reporting period of March, the company should record its cash payment on March 25 for its utility bill. This entry includes a counter account for the utility payable from the previous period and a cash account. Accrued expenses are expenses that have occurred but are not yet recorded in the company’s general ledger.

Why would Accrued expenses increase?

The purpose of increasing accrued expenses is to delay cash payments. Companies often use expense accruals to self-finance their operations. Other accrued expenses include salary payable and interest payable.And in the next period, you reverse the accrued liabilities journal entry when you pay the debt. Since accrued expenses are expenses incurred before they are paid, they become a company’s liabilities for cash payments in the future. Therefore, accrued expenses are also known as accrued liabilities. Both accrued expenses and accounts payable are accounted for under “Current Liabilities” on a company’s balance sheet. A prepaid expense is the reverse of an accrued expense, since a liability is being paid before the underlying service or asset has been consumed.

Detailed Review Of The Income Statement

They encompass the total amount of these items bought through credit, and with these entries, the invoices have been recorded. Because an invoice has already been received, these are accurate, measurable numbers. Prepaid expenses are payments made in advance for goods and services that are expected to be provided or used in the future. While accrued expenses represent liabilities, prepaid expenses are recognized as assets on the balance sheet. Accrued expenses, also known as accrued liabilities, generally include anything where you have received a product or service but have not yet paid for them.Encumbrances should not be included with expenses, and liabilities are not to be reported since the amounts are not yet owed under the accrual basis. In demonstrating and showing examples of accrued expenses, we are using MS Excel. If you are unfamiliar with Microsoft’s spreadsheet program, be sure to check out our free Excel crash course. On the balance day, the accrued expense of utility is treated as a current liability owed to the utility company, and an expense incurred by the company in February. The balance sheet is one of the three fundamental financial statements. The financial statements are key to both financial modeling and accounting. Accrued expenses are recorded in estimated amounts, which may differ from the real cash amount paid or received later.

Example Of An Accrued Expense

In general, the sooner the accounts are closed after year-end, the greater the likelihood that there will be unrecorded invoices. Using the accrual method, you would record a loss of $2,000 for this month ($2,000 in income minus $4,000 in accounts payable). Routable can help you automate your AP process, reduce manual data entry, and give you the flexibility to scale transactions in the future.

Expenses

Usually, an accrued expense journal entry is a debit to an Expense account. The methods for determining the amount of expenses to accrue include specific identification, the use of a lag analysis, or a combination of both. The methods used to arrive at the best estimate should be used consistently and based on supportable documentation.Principal Of Accrual AccountingAccrual Accounting is an accounting method that instantly records revenues & expenditures after a transaction occurs, irrespective of when the payment is received or made. Once an accrued expense receives an invoice, the amount is moved into accounts payable. A balance sheet shows what a company owns (its “assets”) and owes (its “liabilities”) as of a particular date, along with its shareholders’ equity. Accrued expenses are expenses a company needs to account for, but for which no invoices have been received and no payments have been made. The term accrual is also often used as an abbreviation for the terms accrued expense and accrued revenue that share the common name word, but they have the opposite economic/accounting characteristics.In many cases, these guidelines indicate there is a trial period where no time is awarded to the employee. This does not prevent an employee from calling in sick immediately after being hired, but it does mean that they will not get paid for this time off. However, it does prevent an employee, for example, scheduling a vacation for the second week of work. After this trial period, the award of time may begin or it may be retroactive, back to the date of hire. Within these guidelines, the rate at which the employee will accumulate the vacation or sick time is often determined by length of service . For most employers, a time-off policy is published and followed with regard to benefit accruals. These guidelines ensure that all employees are treated fairly with regard to the distribution and use of sick and vacation time.Accrual accounting is built on a timing and matching principle. When you incur an expense, you owe a debt, so the entry is a liability. B) Other controls include reconciling the accrued expense accounts to the subsidiary ledger if the accounting system facilitates the use of subsidiary ledgers.