Content

- Operating Expenses Vs Capital Expenditures

- What Is An Operating Expense?

- More Definitions Of Operating Expenses

- Fixed Costs And Variable Costs

- Understanding The Opex Formula

- What Are Capital Expenses?

It’s crucial to understand operating expenses as how you deal with them differs. That’s in terms of tax and accountancy, and as compared to other costs. The two most notable different kinds of expenses are capital and non-operating expenses. So, let’s directly compare these to the operating alternative.Operating cash flow represents the revenue a business generates after operational costs have been deducted. In more basic terms, it’s how much cash flow is generated from core business operations (i.e. the sales of a product or service) excluding other sources of revenue, like investments. It is one of the clearest indicators of whether a company is profitable. Vacancy reflects rental income that is lost because of space that is not leased. When there is a vacancy at a property, the landlord will still be required to cover certain operating costs, like pro-rata taxes, insurance, and repairs and maintenance.Understanding what goes into overhead costs can help you determine where your company can be more efficient and, ideally, more profitable. That could make it more difficult for callers to reach an agent.Licensing costs vary from business to business, depending on the requirements of your particular location. Is this expense directly related to production (i.e. materials, production labor, etc.)? Provides expenses to operate public transportation services for each agency, by mode, and type of service operated.For instance, you may work in a niche with high standards of safety that must get met. In that case, what you must spend to get compliant counts as operating expenses. In that case, the cost of RingCentral call center software will count as an operating expense.Like equipment, inventory requirements vary from business to business. Some businesses, such as retail stores, are inventory-intensive, whereas others, such as personal shopping services, don’t require any inventory at all except office supplies. You can calculate operating profit by deducting operating expenses from gross margin.

Operating Expenses Vs Capital Expenditures

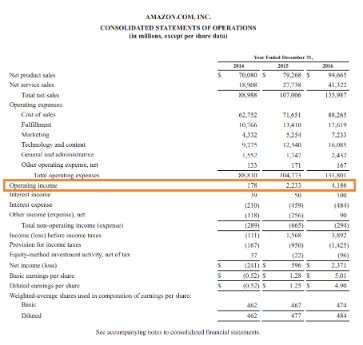

Reduce your operating expenses while maintaining turnover, and your profit margin will improve. You always have to consider the impact cutting these costs may have, though. You can’t run a business without incurring operating expenses. Some will encounter more than others due to the nature of their industry.That’s so you can avoid falling foul of tax rules or accruing unnecessary debts. Essentially, CAPEX refers to purchases made by your company as an investment. This can include a broad range of purchases, including machinery/equipment, real estate, or improvements to your existing infrastructure. For apartment buildings, a good operating ratio usually falls between 35% and 45%. However, it’s important to compare properties locally as expenses can vary between municipalities. Administrative expenses are the necessary expenses that are incurred in the course of running a business and are not directly tied to a specific product or service.Operating Expenses are reflected on a company’s income statement. Operating expenses are important because they can help assess a company’s cost and stock management efficiency. It highlights the level of cost that a company needs to make to generate revenue, which is the main goal of a company. It is critical to note that operational activities differ greatly among industries.

- It is one of the clearest indicators of whether a company is profitable.

- Depreciation is an accounting process whereby a firm writes off the value of an asset over time.

- OPEX, which stands for operating expenses or expenditure, refers to the costs incurred by your business via the production of goods and services.

- You can’t run a business without incurring operating expenses.

They are sometimes represented as a single line item, or they may be broken out into multiple line items for different types of expenses. An operating expense is an expense you incur through your regular business operations. They’re the costs you face merely for doing what you have to do day-to-day to trade. As such, what counts as an operating expense differs from one firm to the next. The operating expense ratio can tell an interesting story about a property. Different property types have different expense structures, so compare OER results to comparable properties with comparable lease terms in comparable markets.

What Is An Operating Expense?

In general, businesses are allowed to write off operating expenses for the year in which the expenses were incurred. However, businesses must capitalize capital expenses/costs or write them off over time.

More Definitions Of Operating Expenses

In short, overheads are ongoing, whereas operating expenses stop when production stops. Examples of overhead expenses include things like utilities, rent, and insurance. In retail properties, a good operating ratio falls between 20% and 30%.

Fixed Costs And Variable Costs

While this is a short list of common operating expenses, every company will have operating expenses that are unique to its needs. These expenses would be added to the list of operating expenses on the income statement and calculated with the other costs. A company’s senior management may try to reduce operating expenses by outsourcing areas of the business or allowing some of the existing staff to work from home. This cuts down on the actual physical space needed for staff at the office. Management may also try implementing money saving techniques such as automating parts of the business or reducing salaries for new hires. However, the IRS and most accounting principles distinguish between operating expenses and capital expenses. According to the IRS, operating expenses must be ordinary and necessary .

Understanding The Opex Formula

Built to help you elevate your game at work, our courses distill complex business topics—like how to read financial statements, how to manage people, or even how to value a business—into digestible lessons. Sign up for a course today and get the first 3 lessons for free. The first step to robust financial management is understanding the area’s lexicon. After all, many different terms and phrases can be tough to get your head around.

Operating Ratio

Substantially, as recognition of the fact that the asset’s value reduces. Amortization is a technique that similarly lowers the value of a loan or intangible asset. Rather than Total Potential Income, it’s best to use Effective Gross Income (“EGI”) in the denominator. Effective gross income takes into account vacancy at your property.By contrast, operating expenses are unavoidable, and are likely to increase as demand for your product or service increases. Operating expenses are expenses a business incurs in order to keep it running, such as staff wages and office supplies. Operating expenses do not include cost of goods sold or capital expenditures . On an income statement, “operating expenses” is the sum of a business’s operating expenses for a period of time, such as a month or year.The high end of the range would correspond to luxury hotels or upscale chains that provide amenities and services, such as Four Seasons or Hyatt. The lower end of the range would correspond to midscale or economy hotels like Best Western or Days Inn. Some costs, like utilities, however, may be paid directly by a tenant and can be shut off to a vacant unit. Peggy James is a CPA with over 9 years of experience in accounting and finance, including corporate, nonprofit, and personal finance environments. She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals. ScaleFactor is on a mission to remove the barriers to financial clarity that every business owner faces.A low OER means less money from income is being spent on operating expenses. In throughput accounting, the cost accounting aspect of the theory of constraints , operating expense is the money spent turning inventory into throughput. In TOC, operating expense is limited to costs that vary strictly with the quantity produced, like raw materials and purchased components. Everything else is a fixed cost, including labour (unless there is a regular and significant chance that workers will not work a full-time week when they report on their first day). It is important to distinguish between operating expenses and capital expenditures as the two are treated differently for accounting purposes.You’ll lose loyal customers, and your bottom line will show the result. GoCardless is authorised by the Financial Conduct Authority under the Payment Services Regulations 2017, registration number , for the provision of payment services. GoCardless is used by over 60,000 businesses around the world. Learn more about how you can improve payment processing at your business today. Tara received her MBA from Adams State University and is currently working on her DBA from California Southern University. She spent several years with Western Governor’s University as a faculty member. They are not fully tax-deductible in the year they are purchased; rather, they are deductible over time.

Analyst Resources Financial Models Growth Strategies

The main limitation of the operating expense ratio is that it does not communicate information about the market value of a property. Instead, an investor would need to use the operating expense ratio in conjunction with a capitalization rate to evaluate the market value of a commercial real estate property. A low operating expense ratio would typically correspond to a property leased under a triple net lease agreement, which assigns sole responsibility to the tenant for all costs. For instance, multifamily owners can pass costs to their tenants such as electricity, heat, and other utilities. Advertising/marketing costs may be substantial for a new apartment complex in lease-up, but minimal or non-existent for an industrial property.Divides expenses among NTD expense functions and object classes. Depreciation is an accounting process whereby a firm writes off the value of an asset over time.A business activity can be classified as operational in one industry, but financing or investing in another. For instance, buying a building is typically an investing activity in most industries. However, it is an operational activity for real-estate companies, given that the purchased building is intended for resale. The operating activities primarily cover the commercial activities of the company. For example, the main operating activity for a manufacturing company is to produce the product from raw materials, while for a trading company, it is to buy products from the supplier and sell them to the end-users. Administrative expenses are the costs an organization incurs not directly tied to a specific function such as manufacturing, production, or sales.