Content

- Online Master Of Public Health

- Cash Accounting

- How To Write A Marketing Plan For A Tax Preparation Business

- Accrual Accounting

- Tax Accounting Businesses

- Financial Accounting

After completing a bachelor’s degree, individuals must then take and pass the certified management accountant exam. According to PayScale.com, the average salary for a management accounting is $59,405. Individuals interested in becoming a forensic accountant would benefit from taking auditing, cost accounting, risk management, forensic accounting, managerial accounting, and taxation. Most forensic accountants go on to become CPAs or to obtain their certified fraud examiner credentials.

Online Master Of Public Health

This type of accounting is often used in fraud and embezzlement cases, as it provides a detailed explanation of the nature and extent of a financial crime. Managerial accounting includes budgeting and forecasting, cost analysis, financial analysis, reviewing past business decisions and more.

Cash Accounting

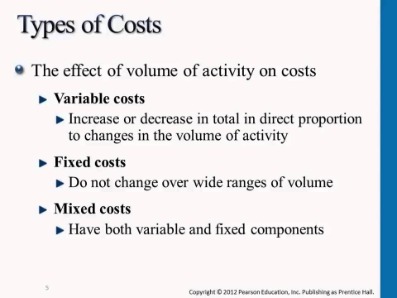

It looks at a company’s fixed and variable costs and how they affect a business and how these costs can be better managed, according to Accounting Tools. This means that whether an accountant is writing an invoice for your business, testifying in an embezzlement trial, or preparing a fortune 500 company’s financial statements, the end result must always be factual. Used internally, cost accounting is typically used in a manufacturing environment, though it can be used for service businesses as well. Management accounting is a form of accounting used in businesses worldwide. Management accounting is designed to provide management with the information necessary to make high-level decisions for the business. Management reports focus internally while financial statements focus on company performance. While very small businesses frequently use cash accounting, all larger businesses as well as publicly traded businesses are required to use accrual accounting.

What is sale entry?

What is a sales journal entry? A sales journal entry records a cash or credit sale to a customer. It does more than record the total money a business receives from the transaction. Sales journal entries should also reflect changes to accounts such as Cost of Goods Sold, Inventory, and Sales Tax Payable accounts.Analysts, managers, business owners, and accountants use this information to determine what their products should cost. In cost accounting, money is cast as an economic factor in production, whereas in financial accounting, money is considered to be a measure of a company’s economic performance. Tax accounting firms focus on tax preparation and planning for companies of all sizes, and also for individuals. The Internal Revenue Code establishes tax laws for individuals and businesses. Many tax accounting firms require their employees to periodically take continuing education courses to stay abreast on changing tax laws, accounting software and tax planning strategies. According to the Bureau of Labor Statistics, tax accounting firms are especially busy during tax season and employees often work long hours during this time. A staff accountant is a great option for anyone who has a bachelor’s degree in accounting and who wants a variety of work.You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. This institute created many of the systems by which accountants practice today. The formation of the institute occurred in large part due to the Industrial Revolution. Merchants not only needed to track their records but sought to avoid bankruptcy as well. When the client pays the invoice, the accountant credits accounts receivables and debits cash. Double-entry accounting is also called balancing the books, as all of the accounting entries are balanced against each other. If the entries aren’t balanced, the accountant knows there must be a mistake somewhere in the general ledger.

How To Write A Marketing Plan For A Tax Preparation Business

This field uses a unique accounting framework to create and manage funds, from which cash is disbursed to pay for a number of expenditures related to the provision of services by a government entity. Government accounting requires such a different skill set that accountants tend to specialize within this area for their entire careers. Additionally, tax accounting is used to accurately calculate tax due, lower tax liability, complete tax returns accurately, and file tax forms in a timely manner. This is necessary for individuals, businesses, government entities, and nonprofits. Management accounting information is shared exclusively with others in an organization.

What SSS means?

Definition. SSS. Selective Service System (US government)However when comparing managerial and financial accounting, the latter is designed to inform shareholders, investors, and financial institutes about the performance of a business for a specified period of time. Instead, financial accounting provides an accurate look at business performance over a specified period of time in the form of financial statements. The completed statements are provided to outside stakeholders such as investors and financial institutions. The primary purpose of financial accounting is to track, record, and ultimately report on financial transactions by generating financial statements. Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money. Appointment Scheduling Taking into consideration things such as user-friendliness and customizability, we’ve rounded up our 10 favorite appointment schedulers, fit for a variety of business needs.

Accrual Accounting

Financial statements are usually audited by accounting firms, and are prepared in accordance with generally accepted accounting principles . GAAP is set by various standard-setting organizations such as the Financial Accounting Standards Board in the United States and the Financial Reporting Council in the United Kingdom. As of 2012, “all major economies” have plans to converge towards or adopt the International Financial Reporting Standards .

- Accounting AccountEdge Pro AccountEdge Pro has all the accounting features a growing business needs, combining the reliability of a desktop application with the flexibility of a mobile app for those needing on-the-go access.

- Individuals interested in becoming a management accountant should study risk management, managerial accounting, cost accounting, auditing, corporate finance, taxation, and interpersonal communications.

- Business Checking Accounts BlueVine Business Checking The BlueVine Business Checking account is an innovative small business bank account that could be a great choice for today’s small businesses.

- Construction Management This guide will help you find some of the best construction software platforms out there, and provide everything you need to know about which solutions are best suited for your business.

An auditor is also required to identify circumstances in which the generally acceptable accounting principles have not been consistently observed. In the midst of evolving business and technology trends, the nature of an accountant’s work has shifted dramatically. Accountants who can embrace new mobile accounting platforms and software, as well as understand new tax codes and investment opportunities, will be primed for success. Even outside of this window, tax accountants still have other duties. Robert Half, a recruiting firm, notes how “organizations have audits, strategic financial planning, bookkeeping and many other tasks to deal with year-round” in which tax accountants can prove beneficial. Careers with the type of salary and job outlook as accounting typically require quite a bit of education and experience. However, in accounting you can experience those types of benefits with a bachelor’s degree, which is the common requirement for most accounting and auditing positions.

Tax Accounting Businesses

Larger businesses often employ accountants in-house to help them comply with these standard accounting principles. Management accounting is useful to all types of businesses and tax accounting is required by the IRS. Furthermore, forensic accountants may be called upon to help recreate or reconstruct financial data, and are frequently asked to testify in court to explain their findings. Forensic accountants are frequently used in fraud and embezzlement cases, using data collection and preparation techniques, data analysis, and reporting methods. Cost accounting is considered a form of management accounting, focusing on the future, and is primarily used as an aid in the decision-making process rather than as a way of reporting past performance. Accountants can also investigate white collar crimes, audit businesses, or work exclusively in government and manufacturing environments. Finance managers are responsible for the financial health of a company, group, or organization.By 1880, the modern profession of accounting was fully formed and recognized by the Institute of Chartered Accountants in England and Wales. However, modern accounting as a profession has only been around since the early 19th century. In most other countries, a set of standards governed by the International Accounting Standards Board named the International Financial Reporting Standards is used. Each branch has its own specialized use that reveals different insights into a business’s financial status. This category of accounting doesn’t follow GAAP but it does follow standard accounting practices taught in accounting school.Accounting firms specialize in other financial tasks, such as tax, management consulting, mergers and acquisitions and forensic accounting. The types of accounting firms required by a business depend on their accounting and business needs. Although certified public accountants are best known for their work on both federal and state taxes, they manage much more than that. In many industries, a CPA may be hired to manage the organization’s staff accountants. Because a CPA has an extensive, focused education that required the passage of specialized exams, they’re often treated as an organization’s financial advisor. CPAs may also specialize in certain fields, such as forensic accounting .

What Does An Accounts Payable Specialist Do?

Controllers typically report to the CFO, although as some companies, controller and CFO jobs may be combined. It contributes to better cash flow and liquidity management for taxpayers, as well as better retirement plans and investment opportunities. Forensic AccountingForensic accounting employs a mix of accounting, auditing, and investigative acumen by recording accounting documents, preparing reports, and performing financial analysis for use in legal proceedings.Corporate tax filings are generally more complicated, so more experience may be needed to work as a tax accountant in that environment. Tax accounting focuses on taxes rather than public financial statements. It focuses on transactions that impact a business’s tax burden, and how those items relate to proper tax calculation and preparation of tax documents. It is governed by the Internal Revenue Code, which must be strictly followed when individuals and companies prepare their tax returns. The focus here is on generating financial statements like budgets, product costings, cash flow projections and business acquisition analysis reports.Standard reports like balance sheets, profit and loss statements and cash flow statements are generated in a way to help managers analyze past decisions and plan for the future. Tax accountants prepare state and federal income tax documents for a client. Some tax accountants may be self-employed, others work for accounting firms, and some are in-house as part of the accounting staff. More senior tax accountants also provide strategic advice for their client or employer. They handle a range of financial services, from corporate finance to tax preparation.

Financial Accounting

They help to direct investment activities and cultivate strategies that will lead to long-term financial success. Chief Financial Officers are senior corporate officers accountable for overseeing and managing the financial risks of a corporation. They are usually in charge of financial planning and record-keeping as well. CFOs oversee cash flow, performance, liability, partner and shareholder relations, and budgets.Business Checking Accounts Business checking accounts are an essential tool for managing company funds, but finding the right one can be a little daunting, especially with new options cropping up all the time. CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle. Construction Management This guide will help you find some of the best construction software platforms out there, and provide everything you need to know about which solutions are best suited for your business. Controllers have a significant background in accounting work and are often promoted from within the accounting department.

Managerial Accounting

It includes the employment of business forms, accounting personnel direction, and software management. Managerial accounting involves financial analysis, budgeting and forecasting, cost analysis, evaluation of business decisions, and similar areas.The IRS requires that businesses use one accounting system and stick to it . Whether they use the cash or accrual method determines when they report revenue and expenses. This branch of accounting centers around the management of property for another person or business. The fiduciary accountant manages any account and activities related to the administration and guardianship of property.