Content

- What Are The Different Types Of Financial Ratios Used To Analyze Financial Performance?

- The Purpose Of Accounting

- Which Definition Best Describes Financial Accounting?

- Why It Is Mandatory For Companies To Abide By Gaap?

- 1 The Role Of Accounting

- How Long Is A Accounting Period?

The statements of changes in equity reports the amounts and sources of changes in equity investor’s investment in the firm over a period of time. Managerial accounting provides detailed financial and nonfinancial information for internal users who use the information for decision making, planning, and control purposes. Generally Accepted Accounting Principles (U.S. GAAP) a set of accounting rules that requires. This means that a “business entity or business organization” refers to the for-profit type of economic entity. Some authors use “business entity” to refer to both for-profit and not-for-profit organizations. Nonetheless, all economic entities whether business or non-profit rely on accounting in processing and providing financial information.

What Are The Different Types Of Financial Ratios Used To Analyze Financial Performance?

He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career. The Principle of Continuity states that asset valuations are based on the assumption the business will continue operations in the future. Parties who are interested in the activities of a business because they’re affected by them. The Principle of Permanent Methods refers specifically to accounting techniques and procedures.The Principle of Materiality says reports must clearly disclose a company’s genuine financial health. The Principle of Sincerity says accountants adhere to standards of honesty and accuracy in reporting.

What’s the primary purpose of accounting?

The purpose of accounting is to accumulate and report on financial information about the performance, financial position, and cash flows of a business. This information is then used to reach decisions about how to manage the business, or invest in it, or lend money to it.We’ll also discuss issues of ethics in the accounting communities and career opportunities in the accounting profession. In summarizing the outcomes of a company’s financial activities over a specified period of time, financial statements are, in effect, report cards for owners and managers. They show, for example, whether the company did or didn’t make a profit and furnish other information about the firm’s financial condition. They also provide information that managers and owners can use in order to take corrective action. —the basic principles for financial reporting issued by an independent agency called the Financial Accounting Standards Board . Users want to be sure that financial statements have been prepared according to GAAP because they want to be sure that the information reported in them is accurate.

The Purpose Of Accounting

Retained earnings is the amount of net income left over for the business after it has paid out dividends to its shareholders. A business generates earnings that can be positive or negative . The money not paid to shareholders counts as retained earnings.

Which Definition Best Describes Financial Accounting?

You need to know that these reports are not only accurate, but that they’re prepared in a similar manner. Generally Accepted Accounting Principles are a collection of commonly-followed accounting rules and standards for financial reporting. Accounting helps business owners prepare historic financial records as well as financial projections which can be used while applying for a loan or securing investment for the business. The results shown in financial statements can vary somewhat, depending on the framework used. The framework that a business uses depends upon which one the recipient of the financial statements wants.

- Retained earnings is the amount of net income left over for the business after it has paid out dividends to its shareholders.

- A business generates earnings that can be positive or negative .

- In the rest of this chapter, we’ll learn how to prepare a set of financial statements and how to interpret them.

- Branch of accounting that provides information and analysis to decision makers inside the organization to help them operate the business.

- Measure business transactions and communicate those measures to external users to make decisions.

- Then they required that all publicly traded companies use these to ensure forthright financial reporting that had the additional benefit of allowing apples-to-apples comparisons between businesses.

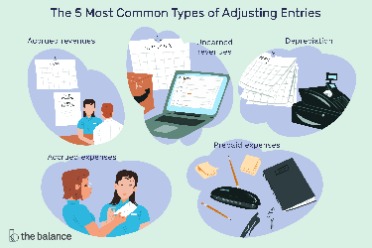

The company analyzes each account in the trial balance to determine whether it is complete and up to date for financial statement purposes. Every adjusting entry will include one income statement account and one balance sheet account. The purpose of accounting is to accumulate and report on financial information about the performance, financial position, and cash flows of a business.

Why It Is Mandatory For Companies To Abide By Gaap?

The financial statements are used internally by management to manage both the current operations and future activities of the firm. The financial statements also provide information for all types of investors to prepare an analysis using trends, ratios and industry comparisons. What is the primary purpose of financial accounting quizlet? What is the primary purpose of financial accounting? Measure business activities and communicate those measures to external users to make decisions.

What do you know about financial accounting?

Financial accounting is a particular type of accounting that includes a method of documenting, summarising, and reporting the transactions arising from business operations for a period of time. … Non-profit firms, companies, and small businesses use accountants in financial matters.Accountingverse is your prime source of expertly curated information for all things accounting.

1 The Role Of Accounting

The financial statements provide qualitative, quantitative, and financial information. One of the characteristics of the financial statements is relevance.GAAP is a common set of generally accepted accounting principles, standards, and procedures that public companies in the U.S. must follow when they compile their financial statements. An acronym for Generally Accepted Accounting Principles, GAAP represents a set of rules and procedures that define how corporate accounting should be done by businesses operating in the United States. Companies who list stock publicly for trading are required to use GAAP to generate financial documents and reports.

How Long Is A Accounting Period?

Branch of accounting that furnishes information to individuals and groups both inside and outside the organization to help them assess the firm’s financial performance. Define accounting and explain the differences between managerial accounting and financial accounting.

Which Financial Statement Is Typically Prepared First?

Then they required that all publicly traded companies use these to ensure forthright financial reporting that had the additional benefit of allowing apples-to-apples comparisons between businesses. Accounting is important for small business owners as it helps the owners, managers, investors and other stakeholders in the business evaluate the financial performance of the business. Accounting provides vital information regarding cost and earnings, profit and loss, liabilities and assets for decision making, planning and controlling processes within a business. GAAP is a collection of commonly-followed accounting rules and standards for financial reporting. The acronym is pronounced “gap.” IFRS is designed to provide a global framework for how public companies prepare and disclose their financial statements. If you loaned money to a friend to start a business, wouldn’t you want to know how the business was doing?An accountant or analyst versed in GAAP principles should be able to read and understand the accounting and financial reporting methods for any company following GAAP standards. Adjusting entries are required every time a company prepares financial statements.Publicly traded companies must use the accrual accounting method which is standardized under generally accepted accounting principles . Accounting is the process of measuring the economic activity of an enterprise in monetary terms and communicating the results to interested parties. The basic purpose of accounting is to provide financial information that is useful in making economic decisions. In this article you will learn the purpose of accounting and the different types of financial information. We already learned that accounting is the language of business; a means of communicating information about an economic entity to different users for decision-making.This information is then used to reach decisions about how to manage the business, or invest in it, or lend money to it. In the aftermath of the Great Depression, it was believed that this financial upheaval was caused, in part, by haphazard and even fraudulent financial reporting by publicly traded businesses. The federal government, in conjunction with professional accounting associations, set out to establish accounting standards and practices.Thus, a European investor might want to see financial statements based on IFRS, while an American investor might want to see statements that comply with GAAP. The balance sheet is one of the key reporting documents used in accounting. It is one of the most public documents for many companies.