Content

- Janitorial Supplies Commercial & Industrial Cleaning

- Corvus Janitorial Recognized As 2021 Sugarcrm Customer Of

- What Is The Difference Between Equipment And Supplies?

- What Does It Mean To Pay For Janitorial Expenses?

- Responses To Chart Of Accounts Complete List With Descriptions For Quickbooks

- Supplies Definition And Meaning Accountingcoach

- How To Depreciate Equipment On Federal Taxes

With a background in small business accounting, I felt inclined to educated small Cleaning Business owners on Bookkeeping! Bookkeeping is one of the most crucial tasks you can do for your Cleaning business. One thing you’ll also have to track is depreciation.This is where having a consistent pricing formula and consistent cleaning system is so important. There should not be a large deviation in cleaning times of homes of similar size. If you use your personal phone for business purpose, that portion is generally deductible. To do this, multiply your phone’s monthly cost by the percentage of time you use it for business purposes. If you travel from jobsite to jobsite via bus or train, you’re in luck, as the cost of public transportation is deductible. But you must, however, follow the same guidelines as car-related expenses.Every month your bank will send you a statement that includes your deposits and withdrawals . With this information, you will want to reconcile all of the transactions into your chosen accounting program. Business owners need to keep a record of all transactions so managing their small business bookkeeping is hassle-free. Next, you will want to create a cleaning log in order to keep track of your jobs and the revenue coming in. This log will also help you see how long it takes to clean a home so you can determine whether you need to raise your prices for services, speed up your cleaning time, or both. The good news is you don’t have to be an accountant in order to manage your cleaning business finances like a pro. With the help of this guide and the countless accounting tools available, you’ll have everything you need to take control of your small business accounting.

Janitorial Supplies Commercial & Industrial Cleaning

In the cost of revenue or services, fixed costs will not be included. Other indirect expenses likes, fixed salaries, administrative expenses will not be included in the cost of revenue. When claiming actual expense is where you track all expenses related to your vehicle. This includes gas, repairs, maintenance, any lease payments or depreciation.

Are house cleaning services tax deductible?

Answer: Cleaning definitely is tax deductible, assuming that you have a home office (dedicated, not just a laptop on the lounge).Your accountant uses your recorded transactions to complete these reports and statements. The more organized your books are, the less prep work your accountant will have to do, and the less money it will cost you. Now a days there is a mileage tracking app out there called MileIQ that is GPS enabled and will track mileage for you and provide reports for you to record or provide to your accountant at income tax season. Any costs for normal replaceable supplies that you use in the course of your work can be deducted. For cleaners and housekeepers, this can include cleaning supplies like solvents, rags, gloves and more.As your business grows, you may want to outsource the clerical tasks of bookkeeping which will give you more time to focus on other tasks to grow your cleaning business. Either method you choose, if you are using your own vehicle, or are reimbursing your cleaners mileage, it is important to keep precise records of mileage used. Mileage and vehicle expense can be one of your largest tax write off’s for your maid service, therefore you will want to keep records of all of your travel so that you can save on your taxes.

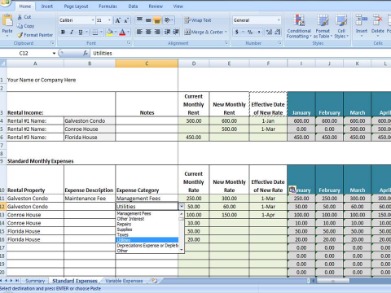

Corvus Janitorial Recognized As 2021 Sugarcrm Customer Of

According to the Bureau of Labor Statistics, the average hourly rate for an accountant in the U.S. is about $35. Most small businesses can expect to spend $150-$500 per consultation; these rates may vary depending on the project and your unique needs. Due to audits, some sponsors have specifically disallowed charging the costs of meals or refreshments to their awards. Care should be taken when charging these costs, and the specific agency guidance should be checked prior to charging. For additional guidance on the most appropriate G/L account to use for expenses within this range, please review the Recommended G/L Accounts for Common Purchases Matrix. When I was first staring out I had never heard the term speed cleaning.But using the right tools made cleaning easier!You should know how much money you are bringing in each day, week, month, and year. By knowing what your maid service’s revenue is, you will be able to set realistic goals to help you to grow your company. The answer to these questions help you scale your business so that you are always making a profit.You should create at least one bank account for your business that will be used to collect revenue, pay your business taxes, and cover operating expenses. If you are using an Excel Spreadsheet, you will want to separate out Cost of Goods Sold from all other business expenses. Cost of Goods Sold is the direct costs for you to clean a home. These expenses include cleaning supplies, driving expense from each client’s home, and labor cost . The first step in tracking your revenue for your maid service is to create a cleaning log. Keeping a detailed cleaning log serves two purposes.

What Is The Difference Between Equipment And Supplies?

You can depreciate commercial property for a period of 39 years, according to TurboTax. If you own your own office building or a warehouse for your janitorial trucks and supplies, you can depreciate that facility. Use this guide to create your business bank account, set up your accounting system, reconcile your transactions, and more.

What Does It Mean To Pay For Janitorial Expenses?

If you own a janitorial business, you have many tax deductions available to you. However, you also have depreciation available to you. Depreciation differs from deductions in that deductions take the full price of expenses off your taxes in the year they occur. Depreciation takes off part of an asset’s value each year during the life of the asset. To make your janitorial service as profitable as possible, learn how to depreciate assets that belong to the company. These supplies include such items as paper, toner cartridges, and writing instruments. They are typically of such low cost that they are charged to expense as incurred.It becomes VERY difficult to separate out expenses and track income when you are depositing payments into your personal account and buying supplies from your personal accounts. The following five accounting tips will help you clean up your books, and keep you on the right path moving forward with your cleaning service accounting and tax obligations.

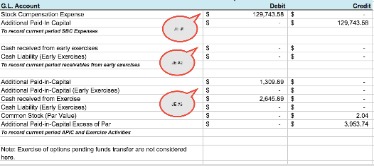

Responses To Chart Of Accounts Complete List With Descriptions For Quickbooks

At the end of the day you will be provided a list of your trips where you can swipe right if it was a business trip and left if it was personal. Only use your business account for business related expenses. A business owner does not need to know how to prepare Income Tax reports, how to file quarterly taxes, or how to create financial reports. These tasks can be done by your Certified Accountant. Hiring an accountant doesn’t have to be expensive either.

- This will help you to make better business decisions.

- Businesses that provide support services to employees who are leaving the business, such as resume assistance and career counseling, can deduct the cost of those outplacement services.

- The cleaning industry includes the services of cleaning and restoration to commercial and residential markets.

- Cleaning houses can indeed be a chore, but one that can be incredibly rewarding, especially when someone pays you to do it.

- For most businesses, web design is an ordinary or necessary expense, but often it should be treated as a capital expenditure.

- If you are going over in area’s you need to figure out why.

Now you have the basic steps you need to take your business bookkeeping into your own hands. Being in the cleaning industry requires that you stay on top of your bookkeeping and keep track of all your tax information. This expense falls under entertainment expenses if you are “entertaining” clients or employees, however only 50 percent of the expense can be deducted. If an employee pays for food delivery and you reimburse that amount, the reimbursed amount can be deducted as well. If we discuss the cost of goods sold, then we can describe it as “Cost of goods cost is the cost which incurred for selling the goods of an entity”. The term “cost of goods sold ” often used for manufacturing and trading businesses.

Supplies Definition And Meaning Accountingcoach

You can also generate reports and get a better idea of what to set aside come tax time. Cleaning and janitorial services are ordinary and necessary for most businesses to keep up an office space or storefront, thus they can be deducted. If you pay for web design services and the website being designed is the business, then you may be able to deduct the expense as a startup expense. The cleaning industry includes the services of cleaning and restoration to commercial and residential markets. The most popular services in cleaning include office interior spaces, office cleaning, window cleaning, glass cleaning, and some other customized services depends on the entity’s size and priorities.You cannot deduct legal fees for personal use under your business deductions, and legal fees for acquiring business assets must be added under property instead. Whether you are a Solopreneur or have 20 employees you need to keep up with your bookkeeping. Bookkeeping helps organize your financials for year end tax reporting. More importantly it allows you to be more informed about how much revenue your cleaning business is bringing in and how much your spending on expenses. I often hear, I clean by myself with no employees, I do not need to record my transactions. Or I have heard, but my accountant does my taxes for me, I do not need to do my bookkeeping. You are in business to make money, but if you do not track your financials you will never know how much money your Cleaning Business is making.Businesses that provide support services to employees who are leaving the business, such as resume assistance and career counseling, can deduct the cost of those outplacement services. Many other factors might not be covered in this short article. I always appreciate to comment and give your feedback if you have any question in your mind about the cost of sales of the cleaning industry. Cost of sale is a very crucial part of the expense to decision making; it necessary to understand the cost of sale to determine the service’s price and gross profit margins. Without understanding and calculating the cost of sales, it might not be possible for an entity to achieve its financial objectives. Any fixed cost like rents, administrative expenses, and utility expenses will not be part of the cost of sales. The cost of sales will be deducted from Sales Revenue for calculation of gross profits of the business.If you were eligible to enroll in one and chose not to, you cannot claim this deduction. Kevin Johnston writes for Ameriprise Financial, the Rutgers University MBA Program and Evan Carmichael. OFFICE SUPPLIES + SMALL EQUIPMENT These are tangible items you need to refill – think staples, paper, printer ink, pens, coffee, uniforms, etc. Small equipment purchases that are generally under $2500 can also be categorized here since they are not material.That is, you can’t deduct your commute to or from home. Consumable supplies does not include capital equipment or controllable property equipment. For all departments with a consumable supplies inventory of $5,000 or more, a separate perpetual inventory should be maintained.Items used to provide cleaning services will be part of the cost of sales or cost of service. To keep your cleaning business financials organized, it is important to separate your business accounts from your personal accounts.To make things easier, QuickBooks can help you track all of your expenses and automatically classify them as deductions, allowing you to maximize your tax return, save time and avoid some headaches. Your cleaning business provides a valuable service to businesses and homeowners in your area. You deserve to get paid for all your hard work, and have money left over to reinvest back into your business. That’s where automated accounting software comes in. With an online solution, you can invoice clients for services in a matter of minutes, get paid faster, and manage your books all in one place.