Content

- How A Sweetheart Deal Gives Gamestop Ceo A $179 Million

- Price Targets

- Sales Tax Calculator For Fresno, California, United States

- Count Your Losses

- What Is The Stock Price Of Gamestop?

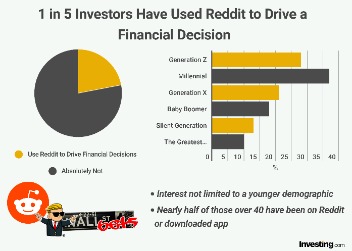

In recent weeks, some of those investors, fueled by social media chatter, have driven up the price of GameStop, a brick-and-mortar video game retailer that has been losing money. Their reasons for buying the stock vary, but some wanted to thwart the big investors that were betting that the share price would fall — otherwise known as shorting the stock. Trading in other mundane stocks, like Blackberry and the AMC theater chain, has surged as well. There’s a significant difference between the tax rates, since the IRS treats long-term gains more favorably. Short-term gains are taxed according to your tax bracket, with the highest marginal rate topping out at 37%.California is the state which has the highest tax rate (7.25%). Every time a trader sells a stock or a cryptocurrency, it counts as a taxable moment. Because traders may move in and out of different stocks and coins several times a week or day, they can be surprised when hundreds of pieces of paper arrive at their door. Shares of the video game retailer have surged more than 1,500% since the beginning of the year, driven by coordinated buying efforts of traders on popular social media sites such as Reddit.

How A Sweetheart Deal Gives Gamestop Ceo A $179 Million

I feel like when I traded in games at GameStop in the past, I paid tax according to my total after trades, not before it. Even the store manager said “I’ve never actually noticed the tax is on the full amount” but I didn’t press on it. Who knows what will happen to GameStop’s stock over the next days or weeks? But if you decide to cash in on your gains, there is no doubt that there will be tax consequences. But investors who haven’t sold shares, even if they are enjoying paper gains, won’t owe anything — a fact that some younger investors might not realize, experts say.

- Losses over that amount can be carried forward and used in subsequent years.

- Realized capital gains are taxed on the federal tax return at rates that, in large part, are determined by the holding period of the asset.

- We all heard a lot about the stock market in the last few months.

- Investors should consider the investment objectives and unique risk profile of Exchange Traded Funds carefully before investing.

- GameStop’s stock price grew more than 1,700% since the start of the year through Wednesday’s close, to almost $348 a share.

On the other hand, long term gains are assets held for more than a year and are taxed at preferential capital gain rates, which are 0, 15%, or 20% depending on the level of income. Property held for at least one year qualifies for the long-term capital gains tax, with a maximum rate of 20 percent. Property held for less than a year is taxed as ordinary income, subject up to a 37 percent tax rate. Some GameStop traders have indicated that they bought shares in 2019 and have held them for more than a year. In that case, they would be eligible for favorable long-term capital gain tax rates if they realized a gain upon selling. The top rate would be 20 percent; higher earners would also pay the extra 3.8 percent, for a rate of 23.8 percent. For example, in 2020 a married couple with income less than $80,000 ($40,000 if single) will pay zero percent tax rate on long term capital gains.

Price Targets

Useful for buying video game lots on eBay, garage sales, or valuing trade-ins at a retail store. The information provided is not warranted as to completeness or accuracy and is subject to change without notice. The Open to the Public Investing, Inc website provides its users’ links to social media sites and email. The linked social media and email messages are pre-populated. However, these messages can be deleted or edited by Open to the Public Investing, Inc users, who are under no obligation to send any pre-populated messages. Any comments or statements made herein do not reflect the views of Open to the Public Investing, Inc or any of its subsidiaries or affiliates.

Sales Tax Calculator For Fresno, California, United States

Later in the day, Robinhood said it would authorize “limited buys” in the companies starting Friday. Gamestop shares dropped 44% and AMC Entertainment fell 57% during Thursday’s trading day. By Friday afternoon trading, they were rallying in trading, and GameStop shares are now up more than 1,400% year to date while AMC shares were up more than 480%. “People want to perceive that when they make cash, they have to pay taxes to the IRS,” Conzo says.A prospectus contains this and other information about the ETF and should be read carefully before investing. Customers should obtain prospectuses from issuers and/or their third party agents who distribute and make prospectuses available for review. ETFs are required to distribute portfolio gains to shareholders at year-end. These gains may be generated by portfolio rebalancing or the need to meet diversification requirements.

Count Your Losses

No matter how much we heard, it was hard to learn and understand what was happening. Between industry-specific language and speculative rumors and outrage-based screaming, much of the reality of the situation got murky. The recent mania, however, is kicking up prices and investor attention on shares in a range of industries. GameStop is a videogame retailer and AMC is a movie chain.They have relationships with clearinghouses to buy and sell bulk amounts, not just the handful you might be trading. In other words, if a person makes a $5,000 profit on some stocks , but ends with $5,000 loss on others and those wins and loses are both held under a year, or over a year, it ends up making no difference on your tax bill. Those who recently flipped shares of GameStop, AMC or other “meme stocks” for a profit will have to pay up in April of 2022.undefinedHer goal is to help more individuals build a stock portfolio that’s bigger than their shoe collection. With a background in taxes and pageantry, Charlene is always ready to sprinkle a bit of glam and happiness into her work to help individuals achieve their goals. Stock market gains are great, but don’t forget to plan for taxes. Investors who have locked in gains can use an online calculator, such as this free one at TurboTax’s website, to estimate what they’ll owe.

What Is The Stock Price Of Gamestop?

That’s important to get a handle on now, rather than face a surprise tax bill when you prepare your taxes. GameStop’s stock price grew more than 1,700% since the start of the year through Wednesday’s close, to almost $348 a share. The disconnect between a stock’s share price and the company’s performance were writ large during the GameStop stock price surge at the end of January 2021. The combination of irrational exuberance and a concerted buy effort promoted on the WallStreetBets Reddit channel boosted the stock to astronomical heights untethered to more mundane fundamentals like price-t0-earnings ratio. This letter explains how to allocate your tax basis between your Barnes & Noble common stock and the GameStop Class B Stock you received pursuant to the Spin-OÅ. Barnes & Noble has received an opinion of counsel to the eÅect that the Spin-OÅ qualiÑes as a tax-free distribution for U.S. federal income tax purposes. Showing smoothed Calculated Tax Rate of Gamestop Corp with missing and latest data points interpolated.

Does GameStop charge tax on gift cards?

Many of the major players, like Amazon and Target, clearly state: “No sales tax is charged when purchasing gift cards; however, purchases paid for with gift cards may be subject to tax.” … GameStop is a repeat offender, perhaps because it doesn’t consider prepaid Xbox cards to be the same as gift cards (they are).Investment decisions don’t need to be pegged to tax implications, he said, but at least knowing the rules, like when more favorable tax rates apply, can help an investor proceed. A group of Reddit users manipulated the price of stocks such as GameStop, AMC and Blackberry, reaping huge gains overnight, it seems like everyone is talking about short selling and hedge funds. A speed bump can jolt Robinhood-type day traders if they sold shares at a loss and then bought more of the same stock within 30 days. The IRS won’t let them deduct the loss of what is termed a “wash sale.” With the volatility of the 2020 bull run, equity investors can face steep gains or losses. Taxpayers are taxed only on net gains — so they can subtract their losses from their gains to reduce their ordinary taxable income, up to $3,000. Losses over that amount can be carried forward and used in subsequent years.

99 Plus Tax

Historical and current end-of-day data provided by FACTSET. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only.

So You Just Made A Lot Of Money On Gamestop Theres One Catch: Taxes

But not only is this type of speculative trading extremely risky, it can also be expensive from a tax perspective. “I did let him know in advance that I survived through 2020 day trading and that my tax forms would be more complicated,” Ziemer said. “I just received them last week, so he’ll be getting all of them this week.” Many first-time investors who jumped into the 2020 bull run find themselves drowning in tax-time paperwork — as could be any other newbies who joined this year’s GameStop frenzy or Bitcoin bonanza for next year’s tax return. Scott Cashman is the Tax Manager for the firm’s Estate, Financial and Tax Planning practice area. He is responsible for the preparation and oversight of all fiduciary, individual and corporate income returns as well as estate and gift tax and nonprofit tax compliance.