Content

- Office Supplies

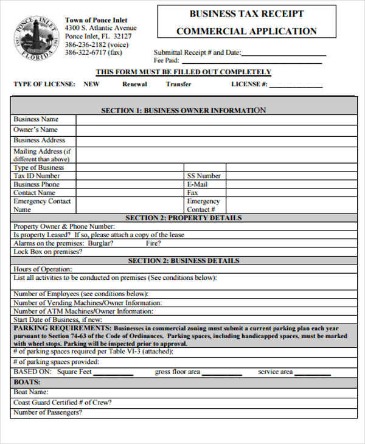

- Apply For A Local Business Tax Receipt

- Business Tax Receipt Definition

- See The Breakdown Of Your Tax Dollar

- Tax Receipt

Otherwise, you could find yourself without evidence if an audit occurs in the future. Since some employees may make small office supply purchases with petty cash, keeping the tax receipt is all the more important. Without it, you won’t have any other record to prove the amount, date, or item of the purchase. If you have a low-cost item with a short lifespan, you may deduct it from the current tax year. However, the state and federal governments have depreciation rules for big-ticket assets. If you expect an expensive item, like a tractor, to last for several years, then you may have to depreciate it each year.

What does a tax receipt mean?

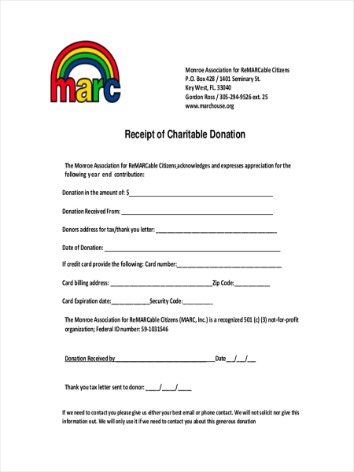

A receipt is a written acknowledgement that a donation was made to a charity. … An official tax receipt gives a tax advantage to individuals or businesses that donate: it can reduce the amount of income tax they owe. Because of this tax advantage, an official tax receipt must contain certain information.A Business Tax Receipt transfer is required when a business is sold, when there is a new owner of the business, or the address or location of the business changes. The transfer fee is 10% of the Business Tax Receipt fee, with a minimum fee of $3.00. Business Tax Receipts are required for most businesses operating in Pasco County. The Tax Collector’s Office issues annual, renewable Business Tax Receipts which are valid through September 30 of each year and expire October 1.

Office Supplies

The type of assets you own could vary from those of another company. For example, a restaurant would have very different assets from a farmer. Where the restaurant invests in stoves, dishes, and furniture, the farmer may invest in heavy equipment, livestock, and technology. Even though the items are so different, they are all considered assets. You might find yourself asking, “what is tax receipt versus regular receipt.” We know that putting the word tax in front of anything makes it more daunting. However, a tax receipt is simply a receipt that you need to collect for tax purposes. For additional information, refer toRecordkeeping for Employersand Publication 15, Circular E Employers Tax Guide.

Apply For A Local Business Tax Receipt

] receipt, the same information is available, so some question whether the breakdown should be made available to citizens that are not prepared to calculate it themselves. Business tax receipts require an application and a fee payment that typically ranges from $25 to $500. All cities in Pasco County require that a city Business Tax Receipt be purchased for businesses operating within their boundaries. Some cities require a county Business Tax Receipt be purchased before a city Business Tax Receipt will be issued. Most businesses are required to obtain a Pasco County Business Tax Receipt; however, some businesses regulated by the state are exempt.

What qualifies as a receipt for tax purposes?

The IRS considers a business tax receipt to be any document that proves an expenditure. Therefore, you need to keep any receipts that show a purchase you plan to deduct from your state and federal income tax.A business operating without a business tax receipt is subject to a penalty. If you own a business, then knowing the definition of business tax receipts is all the more important. Businesses of all types and sizes tend to have more deduction opportunities than individuals. From office rent and payroll to office supplies and travel, you can have a wide range of expenses each tax year. Business tax receipts are also necessary if you purchase an established business in an area where business tax receipts are necessary. In this case, you would need to apply for a business tax receipt transfer and pay a transfer fee.

Business Tax Receipt Definition

You may complete an application at any of our five offices; request that an application be mailed to you;download an application from this site;or complete an application online. New Business Tax account applications are accepted throughout the year but will need to be renewed if opened prior to July 1st. We make every effort to accommodate you at your scheduled appointment time. Due to the variances in processing times for transactions, your wait time may be extended to 30 minutes or more beyond your appointment time. We apologize for this inconvenience as we ensure we provide complete service to all of our clients.

See The Breakdown Of Your Tax Dollar

The electronic accounting software program or electronic system you choose should meet the same basic recordkeeping principles mentioned above. All requirements that apply to hard copy books and records also apply to electronic records. For more detailed information refer to Publication 583, Starting a Business and Keeping Records. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. You may be able to receive a credit for child or dependent care expenses paid to a babysitter, daycare, day camp, after-school program, or other care provider. If the care is provided in your home, additional expenses may also qualify, such as the cost of a maid, cook, or housekeeper hired to provide services or care for your child or dependent. In some instances, you may have to keep a tax receipt longer than that.

- Most businesses are required to obtain a Pasco County Business Tax Receipt; however, some businesses regulated by the state are exempt.

- Make an appointment at one of our service centers to process your completed application.

- If the business is located within a municipality an application must be submitted to the city for approval.

- Any person selling merchandise or services in Palm Beach County must have a local business tax receipt.

- Some business tax receipts include income to a business from all sources without any deductions.

- Business tax receipts are typically issued and renewed on a yearly basis.

- Businesses will need to pay a minimum fee plus a tax percentage based on the gross receipts for the calendar year.

It’s important to note that, like sales tax, every state has different policies on gross receipt tax. You need to research the specific tax laws for the state you live in or operate your business in. As shown below, for an administrative business in the city, for instance, fees would start at $45 for a company with 10 or fewer employees. However, if that same administrative business had more than 10 employees, the company would pay $4.50 for each additional employee. Unfortunately, some donors simply collect and provide their accountants all of the thank you letters that they receive throughout the year.

Tax Receipt

The IRS suggests that you keep documents for seven years if you filed a claim for loss. The loss deduction must be either from worthless securities or bad debt. Each time you purchase a set of staples, paper, toner, pens, or any other office supplies, keep the tax receipt. No matter how small the amount on one receipt may be, they can quickly add up by the end of the year. Gross receipts taxes are very similar to a state sales tax. However, the business is responsible for the tax instead of the consumer.

What Is A Donation Tax Receipt?

Fortunately, you don’t have to let your business miss out on a valuable deduction ever again. With Wellybox copyright, all rights reserved, it’s easier than ever. They also help you to accurately calculate the amount of money your business owes for your state and federal tax.A local business tax receipt is in addition to licenses required by law or municipal ordinances. It is subject to zoning regulations, health regulations and any other lawful authority (County Ordinance No. 17-2). A local business tax receipt does not regulate a business or guarantee quality of the work. There are a few other receipts that you may want to save, depending on your personal tax situation.