Content

- Learn The Basics Of Accounting For Free

- Cost Of Sales

- Advantages Of Cost Sheet

- Content: Cost Sheet

- Actual Cost Tracking Vs Normal Costing

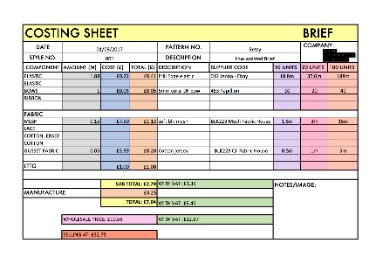

If a cost sheet includes sales and profit, it is called a statement of cost and profit. In a cost sheet, the total cost and the unit cost of a product are presented in analytical form showing the details of various elements of cost in total and /or per unit depending on the requirements. Cost sheets are generally prepared under the unit costing method. A cost sheet is an efficient way to keep tabs on direct costs and indirect expenses incurred as part of your operations.The estimated figures are obtained using part-information which are adjusted for future changes in other overheads. Thus material, labour and other overhead are predetermined according to anticipated changes in the future price levels. Overheads to be charged in estimated cost sheet can be calculated using suitable method of absorption like percentage of material, labour hour, machine hours etc. Since a cost sheet is only a statement, it can be prepared in any format so as to suit the needs of the organization. A typical cost sheet does not include total sales and profit.

Learn The Basics Of Accounting For Free

A simple use of cost accounting is the presentation of cost analysed by the component elements of cost. Usually this presentation is made in the form of a statement known as Cost Sheet. It is a statement showing the items that form a part of cost of products or services. It shows the total cost components by stages and cost per unit of output during a period. A process cost sheet should be broken up into stages of production and elements of the final product. Direct materials, labor and expenses costs should make up the first step, followed by indirect materials, labor and expenses. The third step of a cost sheet will consist of office expenses.It pays out $5,000 in wages plus $3,000 in other direct expenses. Based on the formula, the company’s prime costs equal $9,500. Your prime costs would be the money spent on raw material like purchasing flour bags, paying workers’ wages, and other direct production expenses. All the other overheads which are neither directly contributing to the production operations, nor they can be termed as labour or material expense, are called indirect expenses.While the item isn’t ready for sale, your knowledge of costs and market value helps you to fix a cost estimate and make a profit. How do you fix prices for your product or service as a small business? Apart from conducting market research and checking out competitors’ pricing systems, it would be best to monitor how many resources go into different aspects of your company. This could be set at a scale of cost per pallet of product, per individual product or per shipment of product.Every cost account is a part of integrated cost accounting system of the entire organisation. When producer produces one product having variation in size, shape or quality etc. then he wants to know the item-wise difference of cost regarding the sizes, shapes or quality of the product.

Cost Of Sales

Furthermore, one must understand the difference between normal and abnormal gains and losses. Process cost accounting tries to account for costs during each stage of a process, and then sums them with the next stage until you have a finished product. Industries such as hotels and hospitals, institutions in which a service is provided, will do their accounting by focusing on operation cost. Operation cost can be broken down into fixed costs and variable costs. In essence, certain costs can reasonably be expected to be not only recurring but constant, while others can less predictable. If fixed costs can be reduced and controls can be put in place for the variable costs, profit will naturally increase. Somewhere between batch cost accounting and operation cost accounting is process cost accounting.

- The cost sheet is generally prepared periodically, say weekly, monthly, quarterly and yearly.

- It is made to predict or determine the cost which will be incurred by the organization, the potential or profitability of the product or service and to fix a suitable selling price.

- A cost sheet is an important document prepared by the costing department.

- The labour or human resource engaged in all the activities other than manufacturing of goods or services which are essential to carry out the business and assist the production operations is called indirect labour.

- Since a cost sheet is only a statement, it can be prepared in any format so as to suit the needs of the organization.

- Cost account is a ledger account maintained in the Cost Ledger on the principles of double entry.

- These expenses are also considered a part of the purchase cost of raw-materials as the raw-materials cannot be physically brought to the purchasing industry without incurring these expenses.

Generally, the valuation of the stock of work- in-progress is made on the basis of works cost. The only difference is that in the case of a cost statement, a separate column for cost per unit in respect of various cost elements is not prepared alongside the column of total cost. In case of cost statement, the total cost per unit can be ascertained by dividing the total cost by the number of units produced. It discloses the total cost as well as the cost per unit of output and provides for the comparison of costing results of a particular period with any of the preceding periods through comparative columns. In short, it is a statement prepared on memorandum basis and does not form part of the double entry system in cost accounts.A cost sheet is an exercise in collection of information regarding all the costs incurred in the industry and arranging them in a certain order. The information required to prepare a cost sheet is gathered from several records in the organization. Cost sheets are more common for production-based businesses, but they also come in handy for service providers. As long as you need to track resources for your business operations, a cost sheet is a must-have. All necessary details about the job and costs incurred to complete the job are written on the job cost sheet.

Advantages Of Cost Sheet

All costs relating to the job should be included in the cost sheet . Helps the management to compare various elements of cost to previous results and standard costs. The preparation of a cost statement is an essential document for the application of kaizen costing in the business.Cost and volume of materials consumed, direct wages and other direct expenses in a particular period. While calculating the cost per unit, the costs should be divided by the actual units produced till the stage of cost of goods sold. There after it should be divided by the actual units sold. Opening and closing balances of raw material will be adjusted while calculating amount of raw material consumed.Administrative and Ordering Costs are classified as Operating Expenses, not as Manufacturing Costs, hence are not shown in the Job Cost Sheet. Job cost sheet is not only used to charge cost to jobs but is also a part of the company’s accounting record. It is used as a subsidiary ledger to the work in process account because it contains all details about the job in process. Alternately, by examining a larger-scale cost sheet, you can identify more widespread issues and find out which costs accumulate significantly over time. Maybe one location is particularly wasteful, or your direct costs are rising due one supplier refusing to offer bulk discounts. By adjusting multiple points along a supply chain, you can spend more money on direct material costs and less on shipping or storage, which will result in a net gain. Cost accounting takes different approaches depending on the industry.

Content: Cost Sheet

Your cost sheet’s fourth step includes the cost of distribution and sales, such as shipping, storage and any retail-related expenses. Depending upon the format of the job cost sheet, it may also include subtotals of costs for direct materials, direct labor, and allocated overhead. The sheet also computes the final profit or loss on the job by subtracting all of the compiled costs from a total of all billings to the customer. In a job order costing system, a job cost sheet is maintained for each job. It shows information about the total cost of a particular job. Each job sheet breaks the costs down in terms of direct materials, direct labor, and manufacturing overhead assigned to individual jobs.

Actual Cost Tracking Vs Normal Costing

The development of a cost sheet can be a major production, especially if it is compiled by hand. Even if it is drawn from a database of compiled costs, a cost accountant must still review it for duplicate, missing, or incorrect entries before issuing it. A cost sheet is normally issued along with an explanatory page that points out any unusual costs incurred or variances that management should be aware of. Job cost sheet is a document used to record manufacturing costs and is prepared by companies that use job-order costing system to compute and allocate costs to products and services. Process cost accounting is appropriate when producing large numbers of similar but slightly different products, such in as printing, dry cleaning or chemical production.Unlike a cost sheet, a cost account deals with the result of a one operation or job and does not disclose the result of the whole operation for a given period of time. In an estimated cost sheet, the business projects the expenses for production, forecasts the profit per item, and uses this information to fix the ideal cost per unit. This completed job cost sheet can be given to management to compare with production estimates and revenues from product. Management can use job cost sheets not only to improve production efficiencies and cut costs, but they can also use these sheet to help estimate product sale prices. For instance, Gibson might see the job cost sheet and realize the job actually cost $4,500 to make, but it only quoted the customer $3,900 initially. A job cost sheet usually includes the customer name, address, job number, job description, date started, date completed, and estimated completion date.

What is overhead key in SAP?

Specifies which overhead is applied to a reference object (such as a material), which forms a link between overhead conditions and the following: A material master record. A sales order item.If the scrap materials are derived or obtained in the course of manufacturing process, the amount realised from the sale of such scrap, if any, should be deducted from works overhead or from the works cost. The opening stock and closing stock of finished goods should be adjusted before the arrival of cost of goods sold. If the output or production in units is not given in the problem, then, per unit column need not be taken in the cost sheet. Further, the adjustment for opening and closing stocks of work-in-progress and finished goods is made in the same way as is done in the cost sheet. It helps in cost control by comparison of various elements of cost with the help of standard costing. It helps the management to compare the cost of any two periods and ascertain the inefficiencies, if any, in production.While preparing a cost sheet, it is necessary to ascertain the cost of raw materials consumed. Bigg defines a cost sheet as “the expenditure which has been incurred upon production for a period is extracted from the financial books and stores records and set out in a memorandum statement. It is prepared at convenient intervals such as, weekly, fortnightly, monthly, quarterly, half-yearly or annually or as and when required by the management. Within the strict meaning of the term it does not include sale proceeds and profit earned. If these are included it is called as “Statement of Cost and Profit”. You should account for any expenses incurred by your business operations, including the factory rent and work costs.

Types Of Cost Sheets

It helps in presenting the total cost, the different elements of cost and cost per unit. This statement is usually prepared under the output costing method, where the object is to ascertain the per unit cost of production. Cost sheet is a statement presenting the items entering into cost of products and services, analysed by their elements, functions and even by their behaviour. It is a statement prepared to show the different elements of cost.

Additional Methods Of Cost Accounting

How granular you make each cost sheet is up to you, and each will contain different information depending on the scale. A cost sheet covering cost per shipment over the course of a year will display different gains or losses when compared to a cost sheet that covers weekly cost per individual product. After making an adjustment of the opening finished goods and the closing finished goods to the cost of production, we acquire the cost of production of goods sold. Thus, Cost sheet presents the cost information pertaining to a cost centre or cost unit, bringing out the nature of various components of costs. It discloses the different elements of cost and total cost. Cost Sheet enables the manufacturer to ascertain exact cost per unit in a scientific manner.Scrap cannot be considered finished goods however it also has a saleable value. This value is adjusted in the cost sheet by being deducted from the factory cost. From the following particulars, prepare a statement of cost of production for the year ended 31st March, 2008 and show what percentage each individual item of cost bears to the total cost. The opening stock and closing stock of raw-materials should be adjusted before the arrival of cost of materials consumed. The cost statement can be extended to ascertain the sales value or the profit. In that case, if desired profit rate is given then sales value will be arrived at by adding desired profit to the total cost. But if sales value is given, the profit will be the difference between sales value and the total cost.