Content

- What Is A Favorable Variance? What It Means For Your Small Business

- How Companies Can Reduce Internal And External Business Risk

- Join Pro Or Pro Plus And Get Lifetime Access To Our Premium Materials

- Positive Vs Negative Budget Variance

- Accounting In The Headlines

- Distinguish Between Favorable And Unfavorable Cost And Revenue Variances

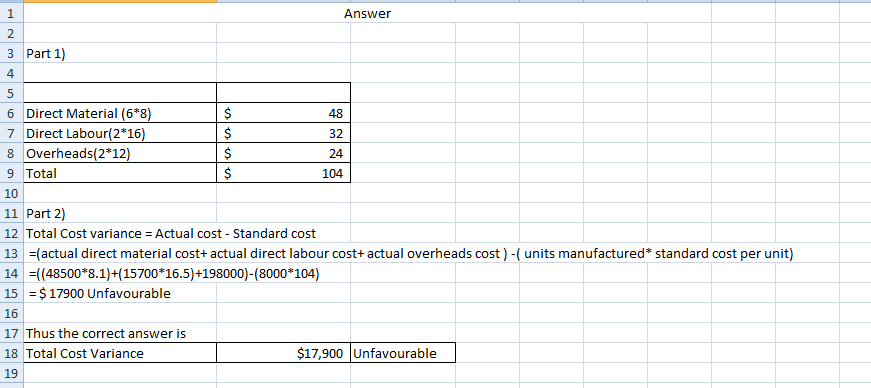

These are usually due to marketplace changes or unmet customer expectations. These will take further analysis to bring the next budget in line with reality. In common use favorable variance is denoted by the letter F – usually in parentheses . When actual results are worse than expected results given variance is described as adverse variance, or unfavourable variance.When revenue is involved, a favorable variance is when the actual revenue recognized is greater than the standard or budgeted amount. Changing business conditions, including changes in the overall economy or global trade, can cause budget variances.Under a static budget, the original level of production stays the same, and the resulting variance is not as revealing. It is worth noting that most companies use a flexible budget for this very reason. Budget variances will also occur when the management team exceeds or underperforms expectations. Expectations are always based on estimates and projects, which also rely on the values of inputs and assumptions built into the budget. As a result, variances are more common than company managers would like them to be. If a budget variance is unfavorable but considered controllable, then perhaps there is something management can do immediately to rectify the problem. If the budget item is not something management directly controls, then perhaps they need help crafting a new business strategy in order to survive and grow.In probability theory and statistics, variance is the expectation of the squared deviation of a random variable from its mean. Informally, it measures how far a set of numbers are spread out from their average value. Although the demand for all chocolate has been increasing, consumer tastes have been gradually shifting towards dark chocolate because of itspurported health benefits. Dark chocolate uses more cocoa beans per ounce than milk chocolate. See the definition and causes of frictional, cyclical, structural, and other forms of unemployment with examples.

- For an expense, this is the excess of a standard or budgeted amount over the actual amount incurred.

- Even the most seasoned financial forecaster can’t predict future costs and revenues with 100% accuracy.

- Simply reveal the answer when you are ready to check your work.

- Learn more about how you can improve payment processing at your business today.

- James Chen, CMT is an expert trader, investment adviser, and global market strategist.

The definition of material is subjective and different depending on the company and relative size of the variance. However, if a material variance persists over an extended period of time, management likely needs to evaluate its budgeting process. To calculate a budget variance, go through each line item in your budget and subtract the actual spend from the original budget.Cost accounting is a form of managerial accounting that aims to capture a company’s total cost of production by assessing its variable and fixed costs. If the variances are considered material, they will be investigated to determine the cause. Then, management will be tasked to see if it can remedy the situation.

What Is A Favorable Variance? What It Means For Your Small Business

To do this, one must consult the budget line by line. If the variance was ‘controllable’, it means the costs incurred were originally within management’s ability to control. This may be the hourly rate paid to staff, or incentives for the sales team. If it’s ‘uncontrollable’, then these are factors that are outside of management’s control, such as the cost of materials. A budget variance is a periodic measure used by governments, corporations, or individuals to quantify the difference between budgeted and actual figures for a particular accounting category. A favorable budget variance refers to positive variances or gains; an unfavorable budget variance describes negative variance, indicating losses or shortfalls.

How Companies Can Reduce Internal And External Business Risk

This flashcard is meant to be used for studying, quizzing and learning new information. Many scouting web questions are common questions that are typically seen in the classroom, for homework or on quizzes and tests. Flashcards vary depending on the topic, questions and age group.

Join Pro Or Pro Plus And Get Lifetime Access To Our Premium Materials

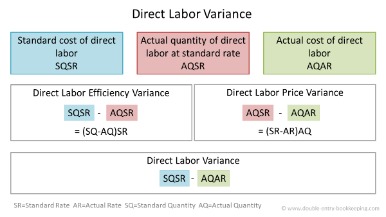

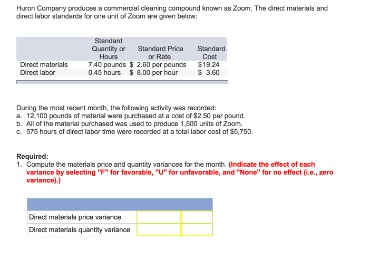

Unfavorable variances are expressed as a negative number. A variance is usually considered favorable if it improves net income and unfavorable if it decreases income. Therefore, when actual revenues exceed budgeted amounts, the resulting variance is favorable. When actual revenues fall short of budgeted amounts, the variance is unfavorable. Unfavorable variance is an accounting term that describes instances where actual costs are greater than the standard or expected costs. A budget variance is an accounting term that describes instances where actual costs are either higher or lower than the standard or projected costs. Even the most seasoned financial forecaster can’t predict future costs and revenues with 100% accuracy.Conversely, an unfavorable variance occurs when revenue falls short of the budgeted amount or expenses are higher than predicted. As a result of the variance, net income may be below what management originally expected. We express variances in terms of FAVORABLE or UNFAVORABLE and negative is not always bad or unfavorable and positive is not always good or favorable. A FAVORABLE variance occurs when actual direct labor is less than the standard. Obtaining a favorable variance does not necessarily mean much, since it is based upon a budgeted or standard amount that may not be an indicator of good performance. Ideally, as a small business owner, you would hope a financial analysis will result in a favorable or positive variance, meaning you are not exceeding your budget.If these are over or understated, variances can occur. The price of chocolate had been predicted to increase rapidly beginning in late 2013 and continue into 2014, according to the Wall Street Journal. The price increase is due to multiple factors, including a shortage of cocoa beans and an increase in demand by consumers. When actual materials are less than the standard, we have a FAVORABLE variance. When actual materials are more than standard , we have an UNFAVORABLE variance. The accounting rate of return is a formula that measures the net profit, or return, expected on an investment compared to the initial cost.

Positive Vs Negative Budget Variance

A difference between an actual cost and a budgeted or standard cost, and the actual cost is the lesser amount. In the case of revenues, a favorable variance occurs when the actual revenues are greater than the budgeted or standard revenues. When considering the reasons behind a favorable or unfavorable budget variance, one must also consider if the variances were actually controllable or not.2.Hershey’s Special Dark Mildly Sweet Chocolate Bar and Hershey’s Milk Chocolate with Almonds Bar both weigh 1.45 ounces. Which bar’s variances are more likely to be impacted by the increase in the cost of chocolate? Variances may occur for internal or external reasons and include human error, poor expectations, and changing business or economic conditions. As you can see, when looking at how can variances be corrected the best course of action will depend on the root cause of the variance. Controllable variances can often be corrected with some tweaks to expenses or line items, while uncontrollable causes might be out of your hands.

Accounting In The Headlines

In common use adverse variance is denoted by the letter U or the letter A – usually in parentheses . Cost variances are usually tracked, investigated, and reported on by a cost accountant. The Hershey Company produces several products that use chocolate and/or cocoa beans. Which of the following variances for Hershey’s chocolate products are likely to be impacted by the projected price increase in the cost of chocolate? Similarly, if expenses were projected to be $200,000 for the period but were actually $250,000, there would be an unfavorable variance of $50,000, or 25%.A favorable variance indicates that a business has either generated more revenue than expected or incurred fewer expenses than expected. For an expense, this is the excess of a standard or budgeted amount over the actual amount incurred.Unfavorable variance can also be referred to as an ‘adverse variance’. Using the information provided for Robert Inc.,… See below for a summary of the six variances from standard discussed in this chapter. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com. A static budget is a type of budget that incorporates anticipated values about inputs and outputs before the period begins.It is not always useful to bury management with an analysis of every possible cost variance. Instead, the cost accountant should determine which variances are large enough to be worth their attention, or if there is some action to be taken to improve the situation.The flexible budget thus allows for greater adaptability to changing circumstances and should result in less of a budget variance, both positive and negative. An unfavorable, or negative, budget variance is indicative of a budget shortfall, which may occur because revenues miss or costs come in higher than anticipated. Budget variances can occur broadly due to either controlled or uncontrollable factors. For instance, a poorly planned budget and labor costs are controllable factors.GoCardless is used by over 60,000 businesses around the world. Learn more about how you can improve payment processing at your business today.Budget variances occur because forecasters are unable to predict future costs and revenue with complete accuracy. A favorable variance occurs when net income is higher than originally expected or budgeted. For example, when actual expenses are lower than projected expenses, the variance is favorable. Likewise, if actual revenues are higher than expected, the variance is favorable. There is an unfavorable variance when the actual cost incurred is greater than the budgeted amount. There is a favorable variance when the actual cost incurred is lower than the budgeted amount.Budgets and standards are frequently based on politically-derived wrangling to see who can beat their baseline standards or budgets by the largest amount. Consequently, a large favorable variance may have been manufactured by setting an excessively low budget or standard.