The interest income and expense are then added or subtracted from the operating profits to arrive at operating profit before income tax. The balance sheet provides an overview of a company’s assets, liabilities, and shareholders’ equity as a snapshot in time. The date at the top of the balance sheet tells you when the snapshot was taken, which is generally the end of the reporting period. The answer to this question is in the definition; it is the complete report on the health of the business taking in cash flow, income and the balance sheet. The financial statement determines if a business has to ability to repay loans, if it has the cash flow to meet bills and purchase stock. It will also tell from where the business is generating cash and where the cash goes.

This leftover money belongs to the shareholders, or the owners, of the company. We all remember Cuba Gooding Jr.’s immortal line from the movie Jerry Maguire, “Show me the money! They show you where a company’s money came from, where it went, and where it is now. Operating revenue is the revenue earned by selling a company’s products or services.

Join 446,005 entrepreneurs who already have a head start.

The financial statement tells if the business is profitable, if it will stay profitable and if there are any large problems looming, such as a continuous drop in sales over time. Reading the financial statement will give an overall view of the condition of the business and if there are any warnings signs of possible future problems. You’ve probably heard people banter around phrases like “P/E ratio,” “current ratio” and “operating margin.” But what do these terms mean and why don’t they show up on financial statements? Listed below are just some of the many ratios that investors calculate from information on financial statements and then use to evaluate a company. If you can read a nutrition label or a baseball box score, you can learn to read basic financial statements.

If splitting your payment into 2 transactions, a minimum payment of $350 is required for the first transaction. We accept payments via credit card, wire transfer, Western Union, and (when available) bank loan. Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined. Please refer to the Payment & Financial Aid page for further information.

The balance sheet reports a company’s financial health through its liquidity and solvency, while the income statement reports a company’s profitability. A statement of cash flow ties these two together by tracking sources and uses of cash. Together, financial statements communicate how a company is doing over time and against its competitors. The financial statements are used by investors, market analysts, and creditors to evaluate a company’s financial health and earnings potential. The three major financial statement reports are the balance sheet, income statement, and statement of cash flows. The SEC’s rules governing MD&A require disclosure about trends, events or uncertainties known to management that would have a material impact on reported financial information.

These frameworks allow for some leeway in how financial statements can be structured, so statements issued by different firms even in the same industry are likely to have somewhat different appearances. Financial statements that are being issued to outside parties may be audited to verify their accuracy and fairness of presentation. Assets are generally listed based on how quickly they will be converted into cash. Current assets are things a company expects to convert to cash within one year. Most companies expect to sell their inventory for cash within one year.

Inclusion in annual reports

It allows you to see what resources it has available and how they were financed as of a specific date. It shows its assets, liabilities, and owners’ equity (essentially, what it owes, owns, and the amount invested by shareholders). If you’re new to the world of financial statements, this guide can help you read and understand the information contained in them. An ability to understand the financial health of a company is one of the most vital skills for aspiring investors, entrepreneurs, and managers to develop.

It provides insight into how much and how a business generates revenues, what the cost of doing business is, how efficiently it manages its cash, and what its assets and liabilities are. Financial statements provide all the detail on how well or poorly a company manages itself. Although financial statements provide a wealth of information on a company, they do have limitations. The statements are open to interpretation, and as a result, investors often draw vastly different conclusions about a company’s financial performance. Cash from financing activities includes the sources of cash from investors or banks, as well as the uses of cash paid to shareholders.

Build your dream business for €1/month

Our easy online application is free, and no special documentation is required. All applicants must be at least 18 years of age, proficient in English, and committed to learning and engaging with fellow participants throughout the program. We expect to offer our courses in additional languages in the future but, at this time, HBS Online can only be provided in English. More detailed definitions can be found in accounting textbooks or from an accounting professional. Below is a portion of ExxonMobil Corporation’s (XOM) balance sheet for fiscal year 2021, reported as of Dec. 31, 2021. We also allow you to split your payment across 2 separate credit card transactions or send a payment link email to another person on your behalf.

- The SEC’s rules governing MD&A require disclosure about trends, events or uncertainties known to management that would have a material impact on reported financial information.

- It’s the amount of money that would be left if all assets were sold and all liabilities paid.

- All three together produce an overall picture of the health of the business.

- A financial statement is a report that shows the financial activities and performance of a business.

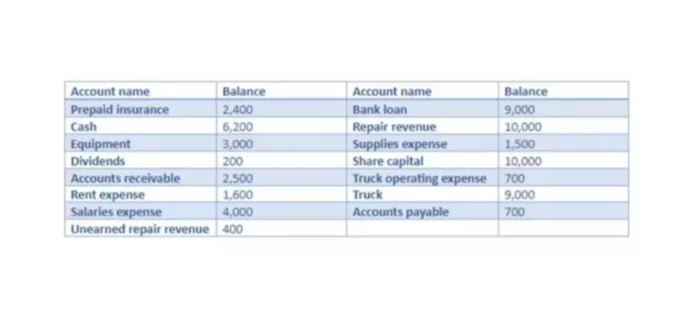

Typical sources of cash flow include cash raised by selling stocks and bonds or borrowing from banks. Likewise, paying back a bank loan would show up as a use of cash flow. A balance sheet provides detailed information about a company’s assets, liabilities and shareholders’ equity.

Operating Activities

Financial statements can cover any period of time, although they’re most commonly prepared at the end of a month, a quarter, or a year. If a company has a debt-to-equity ratio of 2 to 1, it means that the company has two dollars of debt to every one dollar shareholders invest in the company. In other words, the company is taking on debt at twice the rate that its owners are investing in the company. When you subtract the returns and allowances from the gross revenues, you arrive at the company’s net revenues. It’s called “net” because, if you can imagine a net, these revenues are left in the net after the deductions for returns and allowances have come out.

If you can follow a recipe or apply for a loan, you can learn basic accounting. Last, financial statements are only as reliable as the information being fed into the reports. Too often, it’s been documented that fraudulent financial activity or poor control oversight have led to misstated financial statements intended to mislead users. Even when analyzing audited financial statements, there is a level of trust that users must place in the validity of the report and the figures being shown.

- It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of it.

- Financing activities detail cash flow from both debt and equity financing.

- These types of electronic financial statements have their drawbacks in that it still takes a human to read the information in order to reuse the information contained in a financial statement.

- Our easy online application is free, and no special documentation is required.

Our platform features short, highly produced videos of HBS faculty and guest business experts, interactive graphs and exercises, cold calls to keep you engaged, and opportunities to contribute to a vibrant online community. Are you interested in gaining a toolkit for making smarter financial decisions and communicating decisions to key stakeholders? Explore our online finance and accounting courses, and download our free course flowchart to determine which best aligns with your goals. The section contains a description of the year gone by and some of the key factors that influenced the business of the company in that year, as well as a fair and unbiased overview of the company’s past, present, and future. Sign up for Shopify’s free trial to access all of the tools and services you need to start, run, and grow your business. Try Shopify for free, and explore all the tools and services you need to start, run, and grow your business.

Investing activities include any sources and uses of cash from a company’s investments in the long-term future of the company. A purchase or sale of an asset, loans made to vendors or received from customers, or any payments related to a merger or acquisition is included in this category. The CFS allows investors to understand how a company’s operations are running, where its money is coming from, and how money is being spent. The CFS also provides insight as to whether a company is on a solid financial footing. Primary expenses are incurred during the process of earning revenue from the primary activity of the business. Expenses include the cost of goods sold (COGS), selling, general and administrative expenses (SG&A), depreciation or amortization, and research and development (R&D).

The result is either a profit or loss, which is net of income taxes. This report is used to discern the ability of a business to generate a profit. Although this brochure discusses each financial statement separately, keep in mind that they are all related. The changes in assets and liabilities that you see on the balance sheet are also reflected in the revenues and expenses that you see on the income statement, which result in the company’s gains or losses. Cash flows provide more information about cash assets listed on a balance sheet and are related, but not equivalent, to net income shown on the income statement. And information is the investor’s best tool when it comes to investing wisely.

Instead of reporting just $23.5 billion of net income, ExxonMobil reports nearly $26 billion of total income when considering other comprehensive income. Also, purchases of fixed assets such as property, plant, and equipment (PPE) are included in this section. In short, changes in equipment, assets, or investments relate to cash from investing. Below is a portion of ExxonMobil Corporation’s income statement for fiscal year 2021, reported as of Dec. 31, 2021.

This is important because a company needs to have enough cash on hand to pay its expenses and purchase assets. While an income statement can tell you whether a company made a profit, a cash flow statement can tell you whether the company generated cash. A balance sheet shows a snapshot of a company’s assets, liabilities and shareholders’ equity at the end of the reporting period. It does not show the flows into and out of the accounts during the period.