Content

- Journal Entries In A Perpetual Inventory System

- Difference Between Perpetual & Periodic Inventory System

- Principles Of Accounting I

- Is It Necessary To Take A Physical Inventory When Using The Perpetual Inventory System?

- Perpetual Vs Periodic

- Perpetual Inventory System Journal Entries Quiz

- Lifo Perpetual Inventory Method

- How To Use A Perpetual Inventory System For Your Ecommerce Business

Perpetual inventory is an accounting method that records the sale or purchase of inventory through a computerized point-of-sale system. The perpetual method allows you to regularly update your inventory records to help prevent situations like running out of stock. Businesses have a variety of options for tracking inventory, including the periodic inventory method, perpetual inventory method, or a mixture of both methods.The second journal entry records the cost of the sale and removes the item from the store’s inventory as she no longer has it. Specific Identification – clearly, this will be your favorite method…it is the easiest to calculate in our examples because it specifically tells you which purchases inventory comes from. This is most often used for high priced inventory – think car sales for example. When a car dealership purchases a blue BMW convertible for $20,000 and later sells it for $60,000…they will want to show the exact cost of the BMW it sold as opposed to the cost of another car. So, specific identification exactly matches the costs of the inventory with the revenue it creates.

Journal Entries In A Perpetual Inventory System

It provides a real-time view of inventory levels at any given moment in time. A perpetual inventory does not need to be adjusted manually by the company’s accountants, except to the extent it disagrees with the physical inventory count due to loss, breakage or theft. A point-of-sale system drives changes in inventory levels when inventory is decreased, and cost of sales, an expense account, is increased whenever a sale is made. Inventory reports are accessed online at any time, which makes it easier to manage inventory levels and the cash needed to purchase additional inventory. A periodic system requires management to stop doing business and physically count the inventory before posting any accounting entries.

What happens in a perpetual inventory system?

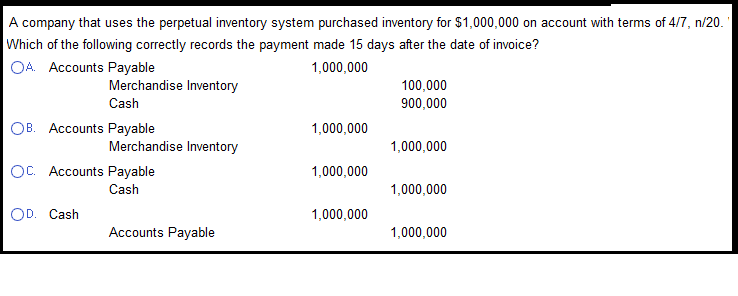

In a perpetual inventory system, software records changes into a sales revenue account each time the company makes a sale or purchases new inventory. This process of recording sales ensures that the accounting records reflect accurate balances in the accounts affected. The software also records the price charged.Under the perpetual inventory system, in addition to making the entry to record a sale, a company would c) debit Cost of Goods Sold and credit… Under the perpetual inventory system, in addition to making the entry to record a sale, a company… Rider Inc.—Journal Entries—Perpetual Inventory SystemIf the net method is applied by Rider Inc. the initial purchase entry is recorded as $245. On the other hand, some cons may include additional training for employees to use the system, setup costs, and incorrect inventory levels from mistakes such as entering the wrong quantity. If you or your employees make mistakes while entering inventory, fixing the error can be time-consuming. Some pros of perpetual inventory include its ability to provide up-to-date inventory information instantly, its easy access system, and how it reduces the requirement to count physical inventory.

Difference Between Perpetual & Periodic Inventory System

These updates include sales and purchases through computerized point-of-sale systems and enterprise asset management software. With a periodic inventory system, a business calculates current inventory counts at the end of an accounting period or financial year and reports on it.

Principles Of Accounting I

It provides a detailed overview of inventory on hand and goods sold. Since a perpetual inventory system accounts for inventory continuously, your end-of-year inventory balance is calculated instantaneously when the year ends. This helps to make sure you have accurate inventory numbers to report on for accounting purposes. A perpetual inventory system has a lot of advantages for ecommerce businesses of all sizes. Not only does it help track inventory data in real-time, but it also helps eliminate labor costs and human error.

- It can help you run a leaner warehouse and provide essential input into other business functions.

- The act of “taking inventory” pretty much disappears when you use a perpetual inventory system.

- Businesses can simplify the inventory costing process by using a weighted average cost, or the total inventory cost divided by the number of units in inventory.

- Accounting system that maintains an ongoing record of all inventory items; records increases and decreases in inventory accounts as they occur as well as the cost of goods sold to date.

- You can easily record, view, and access changes in your inventory.

A perpetual inventory system has the advantages of both providing up-to-date inventory balance information and requiring a reduced level of physical inventory counts. This high level of record accuracy allows a business to reliably promise firm delivery dates to customers, which enhances customer satisfaction. Its journal entries for the acquisition of the Model XY-7 bicycle are as follows. The overall cost of the inventory item is not readily available and the quantity is unknown. At any point in time, company officials do have access to the amounts spent for each of the individual costs for monitoring purposes. As a small business owner, keeping track of inventory is an essential part of running your business.

Is It Necessary To Take A Physical Inventory When Using The Perpetual Inventory System?

Your business can choose from several methods to account for inventory held in your perpetual system. When you use perpetual inventory, the POS system automatically makes changes to your inventory levels. You can access your inventory reports online anytime, making it easier to manage or purchase inventory. The LIFO perpetual inventory method is an inventory costing method.You cost it as if it was acquired at the current wholesale market price. And this costing is done every time a transaction is made, in real-time.

What is included in a perpetual inventory record?

Perpetual inventory is a method of accounting for inventory that records the sale or purchase of inventory immediately through the use of computerized point-of-sale systems and enterprise asset management software.That’s because businesses with lots of products take inventory rarely. And that means their inventory numbers are usually approximate, since they only get calculations a few times a year. When products are acquired, they’re immediately entered into a database.

Perpetual Vs Periodic

She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals. This journal entry will increase the amount of inventory that Marcia has on hand. You will now learn how to calculate the Cost of Goods Sold using 4 different methods. Remember, cost of goods sold is the cost to the seller of the goods sold to customers. Even though we do not see the word Expense this in fact is an expense item found on the Income Statement as a reduction to Revenue. You save time and get the ability to start making decisions that increase bar profitability.

Management Of Inventory

In a perpetual inventory system, the maintenance of a separate subsidiary ledger showing data about the individual items on hand is essential. On February 28, 2009, Best Buy reported inventory totaling $4.753 billion.The perpetual inventory system is more advanced and used more often than a periodic system. In a perpetual inventory system, companies record purchase and sale transactions as they occur.

Perpetual Inventory System Journal Entries Quiz

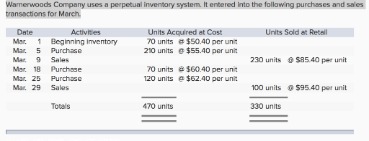

Perpetual inventory system is an inventory management method that records when stock is sold or received in real-time through the use of an inventory management system that automates the process. A perpetual inventory system will record changes in inventory at the time of the transaction. Perpetual inventory systems are in contrast to periodic inventory systems, in which reoccurring counts of products are utilized in record-keeping. Companies can use either a periodic or a perpetual system to record inventory transactions. In this lesson, you will learn about journal entries for a perpetual inventory system. Accounting system that maintains an ongoing record of all inventory items; records increases and decreases in inventory accounts as they occur as well as the cost of goods sold to date. Provide journal entries for a variety of transactions involved in the purchase of inventory using both a perpetual and a periodic inventory system.

Lifo Perpetual Inventory Method

Let’s look at why ecommerce businesses choose to use a perpetual inventory system. If Marcia moves to a perpetual inventory system, she will have access to better information about how much of each type of cat and dog food she has on hand at any point in time. Because sales are recorded as they occur, she will be able to identify which items are selling quickly so she can reorder before running out, as well as slower-moving items. Just start using BinWise Pro and every purchase and sale made is automatically accounted for.

How To Use A Perpetual Inventory System For Your Ecommerce Business

However, the company also needs specific information as to the quantity, type, and location of all televisions, cameras, computers, and the like that make up this sum. That is the significance of a perpetual system; it provides the ability to keep track of the various types of merchandise. However, perpetual inventory systems are not entirely correct all of the time. There are many factors that can affect the accuracy of your business’s inventory levels.