Content

- Preparing A Product Line And Total Income Statement

- #3 Sum The Revenues

- How To Make A Profit & Loss Spreadsheet

- Format Of A Financial Statement

- Accounting Articles

- Step 6: Calculate Operating Expenses

- Ability To Calculate Operating Income

Apportionment divides business income subject to state corporate income or other business taxes to jurisdictions based on formulas to determine taxes due in each state. Incorrect apportionment can result in incorrect payments and state tax audits. For example, in the revenue section, it records all types of revenues no mater those revenues are from the operation or non-operation. This statement is straightforward and easy to go with while preparing the financial activity of your business. You need a simple statement that reports the net income of a business. Cost accounting is a form of managerial accounting that aims to capture a company’s total cost of production by assessing its variable and fixed costs.

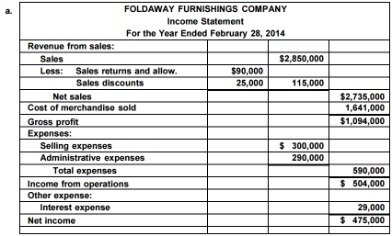

Preparing A Product Line And Total Income Statement

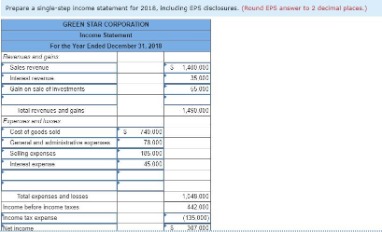

A single-step income statement may break down the sources of revenue and expenses, as the following example shows, but it doesn’t go into too much detail. Also, notice how the statement is clearly split into two areas — revenue and gains on the top, and expenses and losses on the bottom. A single-step income statement focuses on revenue, expenses, and the profit or loss of a business.

How do you calculate a single-step?

Format for Single-Step Income Statement It is called a “Single-Step Income Statement” because Net Income is computed in one single-step (Total Revenues – Total Expenses = Net Income).The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace.

#3 Sum The Revenues

Input in lines, the revenues sources that your business has to report for that period and then sum them up to determine the revenue subtotal. The number that is gotten will then be put into the Total Revenues line at the bottom of the Revenues category of the income statement. This method provides an in-depth look at the company’s financial activities as it offers details about the company’s wellbeing. An income statement can be defined as a financial document which a company prepares that describes its business and financial activities over a certain period.Operating income measures the amount of income from operations excluding all non-operating income and expenses. The second calculation subtracts the company’s operating expenses, such as office supplies and advertising costs, to arrive at the operating income. This can be useful, as it only takes into account the items that have to do with the company’s business activities, and excludes certain one-time costs and the performance of any investments the company holds.Such a statement gives a simple view of the company’s profit or loss. In this, we use a single equation to come up with the profit or loss. This method reports revenue, expenses, and profit or loss, but it does so in a single equation. In this, we total all revenues and expenses and subtract them from each other to get the net income. We total all revenues at the top of the statement, and then we total all expenses .In the single-step income statement, expenses and losses are subtracted from revenue and gains to come up with one number, the business’s net income. Your choice of format depends on what you intend to use your income statement for, and what level of financial detail you’re intending to provide. One of the most important advantages of single-stepping when creating an income statement is that this single-step format is very easy to prepare. It focuses on net income, so it is especially helpful if you need to make an assessment that is based on your business’s bottom line. Multi-step income statements follow a three-step process to calculate net income. The single-step income statement offers a straightforward accounting of the financial activity of your business. The management of a company might decide to prepare single-step income statements for single departments within the company as well as company divisions.

How To Make A Profit & Loss Spreadsheet

It is usually at the top of the report, while the expenses part is below. In a Multi-step income statement, the various expenses are grouped into operational expenses or non-operational expenses. Both the Single step income statement and Multi step income statement are two viable methods used by most companies in preparing their income statement. Hence, to know the difference between the two, we have to first define the Multi-step income statement. If you’re a sole proprietor or independent contractor, you can certainly get by using a single-step income statement.Like the single-step, this method also shows and uses all the information. But, it uses more than one equation to come up with the profit or loss for the company. In general, some companies may decide to use a combination of single and multi-step income statements for their internal use. This method is slightly more detailed than the single step income statement but not as detailed as a multi-step income statement. One of the biggest differences between a single-step income statement and a multi-step income statement is the ability to calculate gross profit. This metric is important for business owners that need more detailed information on both business profitability and financial performance.

- Also, notice how the statement is clearly split into two areas — revenue and gains on the top, and expenses and losses on the bottom.

- Business Checking Accounts Business checking accounts are an essential tool for managing company funds, but finding the right one can be a little daunting, especially with new options cropping up all the time.

- We total all revenues at the top of the statement, and then we total all expenses .

- It simply adds up all of the revenue a company brings in from its business activities, as well as any other gains, such as from investments or interest income.

- In some periods, those non-operating revenues like sales of non-current assets could be larges.

And this is why it is used by most companies, as it offers a very straightforward account of your business’s financial activity. Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management. Income statements enable you to choose a monthly, quarterly, or yearly income statement period, depending on your needs. If you’re as meticulous an investor as you are student of income statements, head on over to our broker centerto find the best-matched broker for your needs.While both formats have advantages and disadvantages, your choice of format depends on what you intend to use your income statement for. Sole proprietorships, partnerships and other small businesses may use the single-step format, which is easier to prepare. For example, a real estate partnership’s income statement may have just one line for sales commissions, followed by the operating expense items, such as rent, supplies and administrative services. A small hardware store selling both hardware items and installation services may also use a single-step format. However, if it wants to show the gross profit on the hardware sales and the operating expenses separately, it would use the multi-step income statement.

Format Of A Financial Statement

Management prepares single step statements for single departments as well as company divisions to analyze the performance during a period and setbudgetgoals for the next period. The siloed breakdowns in multiple-step income statements allow for deeper analysis of margins and provide more accurate representations of the costs of goods sold. Such specificity gives stakeholders a sharper view of how a company runs its business, by detailing how the gross, operating, and net margins compare. In such a structure, a specific segregation/split is made between the revenue and expenses on the basis of whether they belong to the operational and non-operational stream. Under this method, there are three steps to calculate the net income or loss for a company.

Accounting Articles

Examples of indirect costs include salaries, marketing efforts, research and development, accounting expenses, legal fees, utilities, phone service, and rent. The multi-step income statement provides detailed reporting of your company’s revenues and expenses using multiple steps to arrive at net income.Multi-step income statement items include revenue, cost of goods sold, and expenses, which are calculated to arrive at net income. One of the top three financial statements, the income statement measures company performance. Also known as a profit and loss statement, the income statement provides an overview of revenues and expenses incurred during a specific period of time. On the other hand, some investors may find single-step income statements to be too thin on information.

Ability To Calculate Operating Income

This gives more insight into how effectively the business is generating a profit from its main activities. The type of income statement you choose depends on the level of financial detail you are looking for, and the type of business you operate. This difference brings about a mismatch between the income tax expense and the tax bill. Seeing that they are small businesses, the release of their financial statements is not regulated by the law, but it is still advised to prepare and release financial statements quarterly. Hence, for the sake of this article, we’d streamline the methods of income statements to one – Single Step Income Statement.We must also take note of the items contained in each of the categories and make sure they are all always recorded accurately. Looking for the best tips, tricks, and guides to help you accelerate your business? News Learn how the latest news and information from around the world can impact you and your business. Beginner’s Guides Our comprehensive guides serve as an introduction to basic concepts that you can incorporate into your larger business strategy. Alternatives Looking for a different set of features or lower price point? Business Checking Accounts BlueVine Business Checking The BlueVine Business Checking account is an innovative small business bank account that could be a great choice for today’s small businesses. The U.S. tax code is very complicated, and compliance is not optional.Such detail gives possible investors or creditors a better view of how your company runs its business. Thus, organizations have to be careful and minimize their taxable incomes if not, they would end up spending from their profits. And this would, in turn, reduce the profits supposed to be used for other purposes. Income tax expense is paid out of the profits the organization makes. This means that if the organization didn’t have to pay taxes, this money would serve as profit and used for other purposes like distribution amongst the stockholders.Before comparing the two, we first have a look at the term income statement. The Selling, General, and Administrative Expense (SG&A) category includes all of the administrative and overhead costs of doing business.