Content

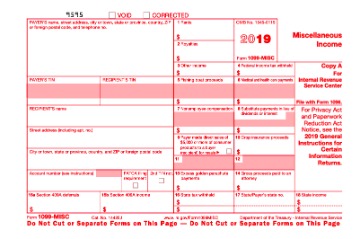

Fees apply to Emerald Card bill pay service. See Online and Mobile Banking Agreement for details. The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits.

Who do you believe made a better decision when they completed Form W-4 Ren or Susan support your response?

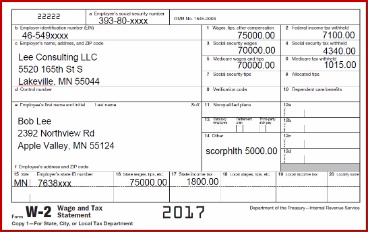

Who do you believe made a better decision when they completed Form W-4, Jenny or Susan? Support your response. – Personally I think Jenny did a better job even though she didn’t have all the facts this is because Jenney doesn’t have to do the extra work to file for the tax return like Susan does.The purpose of the W-2 form is to report how much the employee was paid over the past year and how much tax was withheld. The document is used by the IRS to determine if the employee paid the correct amount of taxes. Employees have their income, Social Security and Medicare taxes withheld from their pay by employers. This is sent to the IRS throughout the year and when it’s time for the annual return, employees will either receive a refund or a bill for the rest of the taxes they owe. Form W-2 (officially, the “Wage and Tax Statement”) is an Internal Revenue Service tax form used in the United States to report wages paid to employees and the taxes withheld from them. Employers must complete a Form W-2 for each employee to whom they pay a salary, wage, or other compensation as part of the employment relationship.

How Do I File W

You should update your filing system with the new W-4 information and adjust your payroll data accordingly. When your employee fills out a W-4, you should file it , but you do not need to send it to the IRS or Social Security Administration. You only need to file a W-4 form if you’re using it to meet state new-hire reporting requirements. There are over 20 federal laws that regulate relations between employers and employees. Here are six employment laws that you need to know. If adequate record-keeping measures are not taken, a business owner or employee can easily find themselves in a difficult legal situation.

Box 12:

The City sends wage and tax information to the Social Security Administration and the New York State Department of Taxation and Finance. Contains the amount of local wages reported to the locality identified in Box 20. Foreign Nationals who are nonresident aliens based on the substantial presence test are exempt from social security taxes. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider. Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. Faster access to funds is based on comparison of traditional banking policies for check deposits versus electronic direct deposit.The employee completes the W-4 form to give you information on their taxpayer ID number) and their withholding amounts. The purpose of this form is to provide the employee with information that must be included in their income tax form.Our partners cannot pay us to guarantee favorable reviews of their products or services. UpCounsel is an interactive online service that makes it faster and easier for businesses to find and hire legal help solely based on their preferences. We are not a law firm, do not provide any legal services, legal advice or “lawyer referral services” and do not provide or participate in any legal representation. Traditionally Form W-2 has been completed by paper.

Small Business

How long do you keep my filed tax information on file? How do I update or delete my online account? Box 13 of the W-2 requires information about deductions for employee benefit plans and other deductions that must be reported on the employee’s income tax return. The instructions for Form W-2 contain a reference guide for Box 13 codes.

- When filing by paper, Copy A of the form cannot be printed from the IRS website.

- Contains New York State retirement deductions under IRS Section 414, miscellaneous Tax information for CA and NJ, and United Way and Care Fund deductions.

- Many business owners run their businesses from home.

- Most employees must fill out this form when they start working for a company.

- In addition, if an individual does not pay the required amount of taxes, the IRS will also know this.

- Overpayment results in a refund, underpayment results in a bill.

OPA will verify your information with the Social Security Administration and then issue a corrected W-2. Filing W-2s online using Business Services online is free, fast, and secure! Our checklist offers information and tools to help you get started whether you are a new or returning Business Services Online user. This is a friendly notice to tell you that you are now leaving the H&R Block website and will go to a website that is not controlled by or affiliated with H&R Block. This link is to make the transition more convenient for you. You should know that we do not endorse or guarantee any products or services you may view on other sites.

Youre Our First Priority Every Time

Additional qualifications may be required. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials. Additional training or testing may be required in CA, MD, OR, and other states. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials, which may be non-refundable. Discount is off course materials in states where applicable. Discount must be used on initial purchase only.Most state programs are available in January. Online AL, DC and TN do not support nonresident forms for state e-file. Software DE, HI, LA, ND and VT do not support part-year or nonresident forms. In this post, we covered multiple subjects related to the W-2 tax form, including, “What is a W-2 form? ” and what the components of the form include.If more than 6.2% of that amount was withheld, OPA will issue you a refund in February. If you do not receive a refund that is owed to you, contact your agency’s Payroll Office. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment.

How To Fill Out Form W

Applicants must be 18 years of age in the state in which they reside (19 in Nebraska and Alabama, 21 in Puerto Rico.) Identity verification is required. Both cardholders will have equal access to and ownership of all funds added to the card account. Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings®account. When you use an ATM, in addition to the fee charged by the bank, you may be charged an additional fee by the ATM operator. See your Cardholder Agreement for details on all ATM fees.IRS Form W-2, Wage and Tax Statement, is an information return that must be completed and filed by employers each year. Instead, it reports how much the employee was paid during the year and how much tax was withheld. Every employer engaged in business must file a Form W-2 for each employee who is paid cash or non-cash compensation. There is so no matter how much pay the employee received. That is, there no minimum dollar amount that triggers this reporting obligation.H&R Block tax software and online prices are ultimately determined at the time of print or e-file. Although the IRS website includes detailed instructions for both forms, they still can be confusing. It’s helpful to consult a business accountant or tax advisor who has experience with IRS tax forms and can answer questions or help you fill things out. Don’t wait until the last minute to complete these forms. That can lead to errors or missed deadlines, which for W-2s can trigger a late penalty from the IRS. It’s best to have your employees fill out their W-4s on or before their first day of employment and input the relevant information into your payroll system as soon as possible. For W-2s, start working on them first thing in the new year to meet the Jan. 31 deadline.