Content

- Tips For Collecting On Accounts Receivable

- Trade Receivables And Working Capital

- What Can I Do To Make People Pay Faster?

- Accounts Payable Vs Accounts Receivable

- What Does Accounts Receivable Mean?

- Disadvantages Of Accounts Receivable

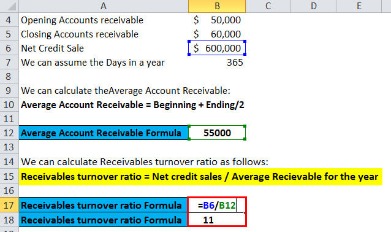

- What Is The Accounts Receivable Turnover Ratio?

- How Are Receivables Recorded In Accounting?

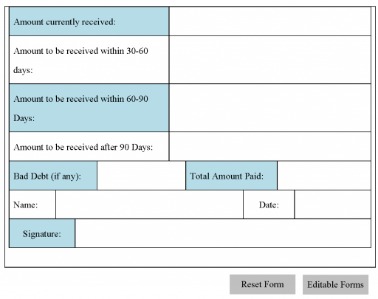

However, the other side of this equation is the buyer, who may wish to extend payment terms in order to increase their Days Payable Outstanding . This can result in a higher DSO for suppliers, which may not receive payment for 60 or 90 days in some cases. Accounts payable are the amounts that a company owes to its suppliers. Cost IncurredIncurred Cost refers to an expense that a Company needs to pay in exchange for the usage of a service, product, or asset. This might include direct, indirect, production, operating, & distribution charges incurred for business operations.Current assets are assets which are expected to be converted to cash in the coming year. In addition to trade receivables, current assets also include items such as cash, cash equivalents, stock inventory and pre-paid liabilities. An example of a common payment term is Net 30 days, which means that payment is due at the end of 30 days from the date of invoice. The debtor is free to pay before the due date; businesses can offer a discount for early payment.

Tips For Collecting On Accounts Receivable

Receivables of all types are normally reported on the balance sheet at their net realizable value, which is the amount the company expects to receive in cash. Business owners know that some customers who receive credit will never pay their account balances. If you are operating under the accrual basis, you record account receivable transactions irrespective of any changes in cash.

What is the difference between accounts receivable and bills receivable?

A bill receivable is a tangible bill of exchange that has a specified maturity date. Accounts receivable is an account balance that is due. It may have an indicative due date based on the extended credit period.Jane wants to buy a $5,000 hot tub but doesn’t have the money at the time of the sale. The hot tub company would invoice her and allow her 30 days to pay off her debt. During that time, the company would record $5,000 in their accounts receivable. When Jane pays it off, the money would go back to the sales amounts or cash flow. In that case, the money would still be owed, and the company would be out the money. That’s why accountants define accounts receivable differently than sales.

Trade Receivables And Working Capital

Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Here we discuss accounting for Accounts Receivables along with Industry examples. You may also have a look at these following articles to learn more about accounting. Since the magazine will be supplied monthly, but consideration is received in advance. Here we will use the same example as above but instead, Corporate Finance Institute sells $750 worth of inventory to FO Supplies.For example, let’s say that after a few months of waiting, calling him on his cellphone and talking to his family members, it becomes clear that Keith has disappeared and isn’t going to pay that $500 invoice you sent him.

What Can I Do To Make People Pay Faster?

Businesses keep track of all the money their customers owe them using an account in their books called accounts receivable. For tax reporting purposes, a general provision for bad debts is not an allowable deduction from profit – a business can only get relief for specific debtors that have gone bad. The important thing to notice is that the accounts receivable definition doesn’t limit itself to any type of business and customer.

- Offering them a discount for paying their invoices early—2% off if you pay within 15 days, for example—can get you paid faster and decrease your customer’s costs.

- Here is another example to help illustrate what this might look like.

- The entry would consist of debiting a bad debt expense account and crediting the respective accounts receivable in the sales ledger.

- The direct write-off method is not permissible under Generally Accepted Accounting Principles.

- If takes a receivable longer than a year for the account to be converted into cash, it is recorded as a long-term asset or a notes receivable on the balance sheet.

This strategy can increase sales, build customer relationships, and even create consumer loyalty. Even though these advantages are strong, companies must evaluate each customer on an individual basis to see if they are trustworthy enough to extend credit terms. Thus, in order to record an accounts receivable journal entry for a sale to a customer, we would debit AR and credit sales.

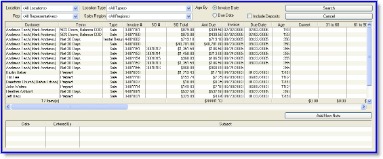

Accounts Payable Vs Accounts Receivable

If the customer proves to be creditworthy, the advantages of creating an account for them will outweigh theriskthat the customers will default on the purchase and the company won’t receive its payment. Typically customer credit limits are set and approved by the seller’s credit department depending on the creditworthiness of the customer. Companies have to be careful before granting credit to customers that they don’t know or have experience with since these customers can default of the debt and never pay for the product they purchased. During a recession, a business might be less willing to extend credit. Prepare entries for uncollectible accounts using the direct write off and allowance methods. Companies can also receive early payment if their customers give them access to early payment programs such as supply chain finance or dynamic discounting. These are initiated by the buyer rather than the seller and tend to provide funding at a lower interest rate than methods such as factoring.Following up with late-paying customers can be stressful and time-consuming, but tackling the problem early can save you loads of trouble down the road. For example, you can immediately see that Keith’s Furniture Inc. is having problems paying its bills on time. You might want to give them a call and talk to them about getting their payments back on track.

What Does Accounts Receivable Mean?

This promise to pay by the customer is an account receivable to the seller. Accounts receivable are amounts that customers owe a company for goods sold and services rendered on account. If takes a receivable longer than a year for the account to be converted into cash, it is recorded as a long-term asset or a notes receivable on the balance sheet. Under the accrual basis of accounting, the account is offset by an allowance for doubtful accounts, since there a possibility that some receivables will never be collected. This allowance is estimate of the total amount of bad debts related to the receivable asset. Accounts receivable, abbreviated as AR or A/R, are legally enforceable claims for payment held by a business for goods supplied or services rendered that customers have ordered but not paid for.

How do you treat accounts receivable?

To record a journal entry for a sale on account, one must debit a receivable and credit a revenue account. When the customer pays off their accounts, one debits cash and credits the receivable in the journal entry. The ending balance on the trial balance sheet for accounts receivable is usually a debit.Accounts receivable is an asset which is the result of accrual accounting. In this case, the firm has delivered products or rendered services , but no cash has been received, as the firm is allowing the customer to pay at a later point in time. With the accrual accounting, you record a transaction whether cash has been received or not. When a sale of services is made to a customer, you use your accounting software to create an invoice that automatically creates an entry to credit the sales account and debit the accounts receivable account. Often, a business offers this credit to frequent or special customers who receive periodic invoices. This allows customers to avoid having to make payments as each transaction occurs.Notes receivable are amounts owed to the company by customers or others who have signed formal promissory notes in acknowledgment of their debts. Promissory notes strengthen a company’s legal claim against those who fail to pay as promised. The maturity date of a note determines whether it is placed with current assets or long-term assets on the balance sheet. Notes that are due in one year or less are considered current assets, while notes that are due in more than one year are considered long-term assets. In previous units, you learned that most companies use the accrual basis of accounting since it better reflects the actual results of the operations of a business.Each industry has a different set of credit policy and hence, account receivable days differ by wide measures. Credit SalesCredit Sales is a transaction type in which the customers/buyers are allowed to pay up for the bought item later on instead of paying at the exact time of purchase. The balance of money due to a business for goods or services provided or used but not yet paid for by customers is known as Accounts Receivable. These are goods and services delivered by a business on credit to their customer with an understanding that payment will come at a later date. A customer often receives some sort of product or service but has an amount of time, or a term, to pay the amount owed. The term, which is often 30, 60, or 90 days, provides some flexibility to the client, customer, or other company to pay it off.Most department stores like JCPenny and Macy’s have their own credit cards, but smaller retailers are also starting to develop these programs as well. A non-trade receivable would be when someone owes the company money not related to providing a service or selling a product.

What Is The Accounts Receivable Turnover Ratio?

The seller may use its accounts receivable as collateral for a loan, or sell them off to a factor in exchange for immediate cash. Receivables are prized by lenders, because they are usually easily convertible into cash within a short period of time. Cost Of Goods SoldThe cost of goods sold is the cumulative total of direct costs incurred for the goods or services sold, including direct expenses like raw material, direct labour cost and other direct costs. However, it excludes all the indirect expenses incurred by the company. Receivables represent an extended line of credit from a company to client that require payments due in a relatively short time period, ranging from a few days to a fiscal year.The issuance of an invoice implies that the seller has granted credit to a customer. Credit limits may be reduced during difficult financial conditions when the seller cannot afford to incur excessive bad debt losses. Receivables are debts owed by customers to a company for purchased services or products on credit.