Content

- What Is The Process Of An Irs Audit?

- What Exactly Does An Auditor Do?

- How To Prepare For An External Audit:

- Industry Certification Through Auditing

- How To Prepare For An Irs Audit:

- What Do Independent Auditors Do?

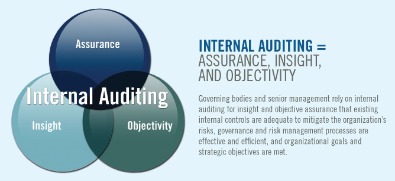

Independence of the audit organization is a key component of a third-party audit. Third-party audits may result in certification, registration, recognition, an award, license approval, a citation, a fine, or a penalty issued by the third-party organization or an interested party. An audit is the examination of the financial report of an organisation – as presented in the annual report – by someone independent of that organisation. The financial report includes a balance sheet, an income statement, a statement of changes in equity, a cash flow statement, and notes comprising a summary of significant accounting policies and other explanatory notes. Internal controls are processes and records that ensure the integrity of financial and accounting information and prevent fraud. You should have an audit trail so you can prove where your numbers come from and auditors can easily trace your transactions.Due to the increasing number of regulations and need for operational transparency, organizations are adopting risk-based audits that can cover multiple regulations and standards from a single audit event. This is a very new but necessary approach in some sectors to ensure that all the necessary governance requirements can be met without duplicating effort from both audit and audit hosting resources.

What Is The Process Of An Irs Audit?

A company’s management has the responsibility for preparing the company’s financial statements and related disclosures. The company’s outside, independent auditor then subjects the financial statements and disclosures to an audit. The procedures the outside auditor uses must be sufficient to allow the auditor to obtain enough competent evidence to express an opinion on the fairness of the financial statements and whether they conform to GAAP in all material respects. If the auditor cannot reach that conclusion, then the auditor must either require the company to change the financial statements or decline to issue a standard audit report. An audit can be conducted internally by employees of a business or an outside firm. Having audits done by an outside party can be helpful as it removes any biases when it comes to the state of a company’s financials.Business should keep at least an electronic photocopy of cash register tapes, canceled checks, invoices and other financial documentation until the end of the current accounting period. Ensure that all archive records can be accessed quickly to shed light on any potential issues. To benefit the organization, quality auditing should not only report non-conformance and corrective actions but also highlight areas of good practice and provide evidence of conformance. In this way, other departments may share information and amend their working practices as a result, also enhancing continual improvement. An IRS audit is a formal investigation conducted by the Internal Revenue Service in order to verify that the information entered your business’ tax return is accurate and correct. Internal audits are performed by the employees of a company or organization. Instead, they are prepared for the use of management and other internal stakeholders.

What Exactly Does An Auditor Do?

Auditing has been a safeguard measure since ancient times, and has since expanded to encompass so many areas in the public and corporate sectors that academics have started identifying an “Audit Society”. These example sentences are selected automatically from various online news sources to reflect current usage of the word ‘audit.’ Views expressed in the examples do not represent the opinion of Merriam-Webster or its editors. Employing automation to assess company assets is now a necessity, especially since humans can’t accurately audit all the assets within a company. For example, the service level agreement should include a clause where host companies can audit the vendor facility. Hutchinson reportedly contacted Jordan Fuchs, Georgia’s deputy secretary of state, about a trip Meadows planned to attend an election audit, the committee said. In just 5 minutes, we’ll get to know you, your business, and the kind of help you’re looking for.The biggest difference between an internal and external audit is the concept of independence of the external auditor. The effectiveness of an information system’s controls is evaluated through an information systems audit.

How To Prepare For An External Audit:

With nonprofit organizations and government agencies, there has been an increasing need for performance audits, examining their success in satisfying mission objectives. There are also new types of integrated auditing becoming available that use unified compliance material .

- Based on the risks and controls identified, auditors consider what management does has done to ensure the financial report is accurate, and examine supporting evidence.

- Also refer to forensic accountancy, forensic accountant or forensic accounting.

- These example sentences are selected automatically from various online news sources to reflect current usage of the word ‘audit.’ Views expressed in the examples do not represent the opinion of Merriam-Webster or its editors.

- Once the auditor is satisfied with their investigation, they will brief management on the results.

- As a result of the Sarbanes-Oxley Act of 2002, publicly traded companies must also receive an evaluation of the effectiveness of their internal controls.

- If you have board members or shareholders, you might conduct an internal audit to update them on your finances.

All information on your tax return is reviewed and confirmed, and you do not need to make any changes. These tax audits can be triggered by unusual or unordinary deductions and forms of income listed on your tax return, or you can also be selected at random. Internal audits may be scheduled in advance in order to give a department time to prepare documents and information, or they may be a surprise if unethical or illegal activity is suspected. Once the auditor is satisfied with their investigation, they will brief management on the results. During a meeting, an auditor will communicate the strengths and weaknesses of the department while offering their recommendations.

Industry Certification Through Auditing

The best preparation for an IRS audit is to get your records and files organized. If you are selected for an in-person audit, promptly collect and organize the records needed of you. Having tax returns and records such as receipts, bills, loan agreements, and account statements organized by year will allow for a smoother experience when dealing with the questions and concerns of an IRS audit agent. During an IRS audit, an agent will ask questions and ask you to present them with specific documentation. This will include evidence to back up tax deductions, forms of income, and tax credits that you have claimed on your tax returns. Mail audits are documentation requests from the IRS that a taxpayer will receive and respond to via mail. Typically, these requests will be so benign that you may not even realize that you have been audited at all.

Who prepares the audit report?

Auditor’s Report The auditor prepares the report after taking into account the provisions of the Companies Act, the accounting standards and auditing standards. Also, he lays the report before the company in the annual general meeting.The IRS may request additional information about certain items or issues, or suggest specific changes be made to your return. If the audit is regulatory, it is good practice to give departments notice so they can have any necessary financial documents and materials ready. Audited departments will also be involved in implementing the necessary changes recommended by the auditor such as new training requirements or revisions in compliance policies. Learn everything you need to know about the financial investigations into your business. We’ll teach you about the 3 types of audits there are, how to properly prepare for an audit, how they can affect your business, how to find the right auditor, and more. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. Within the U.S., the Internal Revenue Services performs audits that verify the accuracy of a taxpayer’s tax returns and transactions.

How To Prepare For An Irs Audit:

A system of quality audits may verify the effectiveness of a quality management system. Quality audits are also necessary to provide evidence concerning reduction and elimination of problem areas, and they are a hands-on management tool for achieving continual improvement in an organization. Internal audits are used to improve decision-making within a company by providing managers with actionable items to improve internal controls. They also ensure compliance with laws and regulations and maintain timely, fair, and accurate financial reporting.External auditor/Statutory auditor is an independent firm engaged by the client subject to the audit to express an opinion on whether the company’s financial statements are free of material misstatements, whether due to fraud or error. For publicly traded companies, external auditors may also be required to express an opinion on the effectiveness of internal controls over financial reporting. External auditors may also be engaged to perform other agreed-upon procedures, related or unrelated to financial statements. Most importantly, external auditors, though engaged and paid by the company being audited, should be regarded as independent and remain third party. For publicly traded companies, external auditors may also be required to express an opinion on the effectiveness of internal controls over cost reporting. These are Specialized Persons called Cost Accountants in India & CMA globally either Cost & Management Accountants or Certified Management Accountants.Regular audits can be more like a routine maintenance check than an invitation for IRS penalties. The accountants audited the company’s books at the end of the fiscal year.Outside auditors can be candid about their findings without affecting daily work relationships. An independent audit is an examination of the financial records, accounts, business transactions, accounting practices, and internal controls of a charitable nonprofit by an “independent” auditor. An auditor is an independent certified public accountant who examines the financial statements that a company’s management has prepared. The results facilitate improvements in internal controls and trigger managerial changes. In that case, it is necessary to bring in consultant auditors who conduct internal audits based on the specific company’s standards rather than separate procedures and standards. After both an internal or external audit, you will receive the auditor’s report. This consists of a written letter from the auditor that is attached to your company’s financial statements that expresses the auditor’s opinion on the compliance with standard accounting practices.

What Do Independent Auditors Do?

Many business owners rely on financial statements to guide their business decisions. By verifying the accuracy of your financial records and finding errors, an audit can help straighten out your finances so you can make wise business decisions. The cost of an independent audit varies depending on the geographic region where the nonprofit is located and how large the organization is. Audit fees can exceed $20,000 for large nonprofits located in major urban areas. It is not unusual for an independent audit to cost $10,000, even for a small nonprofit. In most nations, an audit must adhere to generally accepted standards established by governing bodies.

Accounting Vs Auditing: What’s The Difference?

We are committed to our critical public interest role and instilling trust and confidence in the capital markets. You shouldn’t just expect validity from our service but expect a continual commitment to raise the standards of quality, a drive to find deeper insight, and a track record of creating an impact beyond your expectations. In statements on a specific object, audits look for what is called a “material error”. At Ageras, we specialize in helping business owners find the right auditor for their needs. Whether you need an auditor with industry knowledge or an auditor with a unique specialty, it is important that you choose one with a good reputation.An internal audit is initiated by you and conducted by someone within your business. You might have someone conduct an internal audit to prevent financial mistakes and check in on company goals.Organize your financial documents so the auditors can easily access records and get a clear view of your business. If you have board members or shareholders, you might conduct an internal audit to update them on your finances. They can examine business operations and management to make sure everything is functioning efficiently. A constantly evolving audit and assurance process, leveraging leading-edge technology, to deliver high quality services in an efficient and effective way that uphold integrity and drive value by focusing on what really matters. Audits are performed by the IRS to verify the accuracy of a taxpayer’s returns or other transactions. IRS audits usually carry a negative connotation and is seen as evidence of that the taxpayer did something wrong. The most commonly used external audit standards are the US GAAS of the American Institute of Certified Public Accountants and the International Standards on Auditing developed by the International Auditing and Assurance Standard.A properly executed audit will identify the areas of concern in a department and present them to management in an understandable way. This allows management to make informed decisions on how to correct issues going forward and create necessary action plans for discrepancies. The Big 4 advisory firms are the key players in the public accounting industry. If a taxpayer ends up not accepting a change, the issue will go through a legal process of mediation or appeal. The IRS and CRA now use statistical formulas and machine learning to find taxpayers at high risk of committing tax fraud. Audits can be performed by internal parties and a government entity, such as the Internal Revenue Service .You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. The Internal Revenue Service also routinely performs audits to verify the accuracy of a taxpayer’s return and specific transactions. When the IRS audits a person or company, it usually carries a negative connotation and is seen as evidence of some type of wrongdoing by the taxpayer. However, being selected for an audit is not necessarily indicative of any wrongdoing.For internal auditing, the Institute of Internal Auditors provides guidance for audit planning. The ASB also issues Statements on Auditing Standards that apply to preparing and releasing audit reports for nonissuers . AICPA members who audit a nonissuer are required by the AICPA Code of Professional Conduct to comply with these standards. Hypothetically, Susan has been the project manager of company X for 10 years, helping the company complete significant projects during that time.Review the range of credits and deductions claimed on the most recent tax return and look for areas of uncertain reporting like inflated expense numbers. Each element of a company’s accounting system, including individual T-accounts journal entries, the general ledger and current financial statements all need to be identified and reviewed. Gather sales receipts, invoices and bank statements to forward to the accounting department for processing. Ensure you keep timely and reliable documentation because unreliable accounting records create discrepancies in a company’s financial records.