Content

- Capex And Cash Flow

- Operating Margin Versus Return On Equity

- Depreciation And Amortization In Operating Expense

- Key Differences Between Operating And Non

- Operating Expenditures Summary

- Examples Of When Depreciation Is An Operating Expense

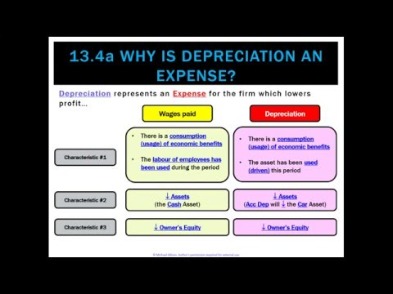

This is the total amount of state and federal income taxes paid. This figure represents the amount of income earned by the business before paying taxes. The number is computed by adding other income to the operating profit. Depreciation is a non-cash operating activity resulting from qualitative wear and tear in the use of assets. Still, it has been quantified by using accounting principles and assumptions in line with the enterprise’s own accounting policies. Therefore, depreciation costs of the equipment should be included in COGS.

Capex And Cash Flow

This depreciation will be reported on the manufacturer’s income statement in the section containing its SG&A expenses. Depreciation of a retailer’s store displays, warehouse equipment, delivery truck, and buildings used in its selling and general administrative functions.Depreciation replicates the period and scheduled conversion for a fixed asset into an expense as the asset is used during normal business operations. As the assets are used to generate operating income in the normal course of business, depreciation expense is considered an operating expense. Operational expenditure consists of those expenses that a business incurs to run smoothly every single day. They are the costs that a business incurs while in the process of turning its inventory into an end product. Hence, depreciation of fixed assets that are used in the production process is considered OpEx expenditure.

Operating Margin Versus Return On Equity

To calculate operating margin, divide operating income by sales. A high operating margin signifies that a company is making the most out of the dollar it earns. CapEx – Capital expenditures are not fully deducted in the accounting period they were incurred. In other words, they are not fully subtracted from the revenue when computing the profits or losses a business has made. However, intangible assets are amortized over their lifespan while the tangible ones are depreciated over their life cycle. All monies spent to get new inventory, including machinery or intellectual property, are grouped under CapEx spendings. When the annual depreciation amount is determined, the company recognizes depreciation expense.Capital expenditures entail huge investments in goods that are placed on the balance sheet and are then depreciated over the life of the asset. On the other hand, operating expenditures appear on the profit and loss A/C. If you are in an organization that anticipates quick growth or technological changes, OpEx should suit you best. Instead of purchasing a capital good and then getting stuck with it, you will be better of leasing one. Once you pay your leasing fee, there will be no further financial obligation on your part. But if you cannot avoid CapEx, and have no limited access to capital investments , you should go for it and make sure that you have a CapEx project management professional on a full-time basis. Now you have the answer to this, what is CapEx and OpEx, and it is upon you to decide which one to go with.Examples of non-operating expenses are interest payments on debt, restructuring costs, inventory write-offs and payments to settle lawsuits. By recording non-operating expenses separately from operating expenses, stakeholders can get a clearer picture of company performance. Operating income is a similar measure to earnings before interest and taxes , but EBIT also includes nonoperating income — nonrecurring or extraordinary items such as a lawsuit settlement. While EBIT is one measure of profitability, financial analysis goes further by excluding depreciation and amortization, as both are noncash expenses.In the period in which a product is sold, its cost will be reported as part of the cost of goods sold, which is likely to be the largest operating expense on a manufacturer’s income statement. Therefore, depreciation costs of the Plant and Equipment are included in COGS, as these fixed assets are used in the direct production of the inventory.

Depreciation And Amortization In Operating Expense

A significant upgrade to an existing asset is also considered a capital expenditure. To get a clear picture of the performance of a business, it generally makes sense to separate out expenses and income sources that aren’t directly related to core business operations. For example, a business might be profitable, but a one-time cost such as a write-off of obsolete inventory could result in a net loss. On the other hand, the company might sell a non-core business line, realizing a gain that temporarily boosts its bottom line. Examples of non-operating expenses include interest payments and one-time expenses related to the disposal of assets or inventory write-downs. Therefore, depreciation is a non-cash component of operating expenses. The same treatment goes for the amortization of intangible assets.

- It’s computed by subtracting taxes paid from net income before taxes.

- An expense incurred as a part of any regular business operations is considered an operating expense.

- Home Depot’s income statement for the 2019 fiscal year showed operating income of $15,843 million after deducting operating expenses from net sales.

- To estimate the value of the asset at the end of its life, the accountant considers whether another company could use the asset and potential scrap value of the equipment.

- To do so, the accountant picks a factor higher than one; the factor can be 1.5, 2, or more.

- Capital expenditure is incurred when a business acquires assets that could be beneficial beyond the current tax year.

The asset’s depreciation or amortization may be recorded as a non-operating expense if the asset is not used for the core business. In almost all scenarios, depreciation with amortization will be included in the operating expense section of the income statement. When the asset being depreciated is a fixed asset used for SG&A purposes, the depreciation will fall under operating expenses. Examples of fixed assets that would fall under this category include vans for sales people or an office fax system.The cumulative depreciation of an asset up to a single point in its life is called accumulated depreciation. ScaleFactor is on a mission to remove the barriers to financial clarity that every business owner faces. You don’t need to build EBITDA into your income statement, just have an extra line in your model showing what EBITDA is after backing out D&A from wherever it is embedded. You need to determine what the depreciation included in COGS is. Whether it is on a separate schedule or detailed on the IS doesn’t matter. D&A almost always include D&A from the PPE as well as other line items included in cost.

Key Differences Between Operating And Non

The accountant considers the type of asset, the potential technological advances for similar assets and the current condition of the asset to determine how long the company can use the asset. To estimate the value of the asset at the end of its life, the accountant considers whether another company could use the asset and potential scrap value of the equipment. The results of the first three calculations are used to determine the total change in cash and marketable securities caused by fluctuations in operating, investing and financing cash flow.Amortization works the same way but pertains to intangible assets such as goodwill, patents and copyrights. High operating income provides your business with cash for working capital needs and other expenses to keep business going. Operating income is the excess profit above your operating expenses, which also include depreciation and amortization expenses. Keeping tight control over operating expenses allows you to fully realize your company’s operating profit. An expense incurred as a part of any regular business operations is considered an operating expense. The periodic, schedule conversion of a fixed asset into expense as an asset is called depreciation and is used during normal business operations.

Operating Expenditures Summary

Capex, or capital expenditure, is a business expense incurred to create future benefit (i.e., acquisition of assets that will have a useful life beyond the tax year). For example, a business might buy new assets, like buildings, machinery, or equipment, or it might upgrade existing facilities so their value as an asset increases. The method records a higher expense amount when production is high to match the equipment’s higher usage. It is, obviously, most useful for depreciating production machinery. There are many assets that can be classified as other assets, and most business balance sheets have an “other assets” category as a catchall. Some of the most common other assets include cash value of life insurance, long-term investment property and compensation due from employees.

Is depreciation is non cash and non-operating expense which is to be provided for whether there are profits losses?

Depreciation is an operating expense if the asset being depreciated is used in an organization’s main operating activities. Depreciation is a non-operating expense if the asset being depreciated is used in a peripheral or incidental activity of an organization.Other income and expenses are those items that don’t occur during the normal course of business operation. For instance, a clothing maker doesn’t normally earn income from rental property or interest on investments, so these income sources are accounted for separately. A net figure is computed by subtracting other expenses from other income. This is the amount of profit earned during the normal course of operations. It is computed by subtracting the operating expenses from the gross profit.It’s important for business owners to understand how to calculate depreciation. Most importantly, it can help you to determine the true cost of doing business. After a certain amount of time, your assets may need to be replaced, and if this isn’t factored into your revenue projections, you may be underestimating the costs your business will need to deal with. In addition, depreciation is tax-deductible, which can have a major impact on your business’s bottom line. Hence, depreciation will not be considered as part of operating expenses in the short term.

What Do Most Businesses Choose Between The Two?

CapEx refers to a Capital expenditure while OpEx refers to an Operational expenditure. Capital expenditure is incurred when a business acquires assets that could be beneficial beyond the current tax year. Also, it could upgrade an existing asset to boost its value beyond the current tax year. Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling. See how the declining balance method is used in our financial modeling course. Financing activities are those external sources and uses of cash that affect cash flow. These include sales of common stock, changes in short- or long-term loans and dividends paid.Depreciation of equipment and building used in the manufacturing of products. This depreciation will be allocated to the goods produced and is considered part of a product’s indirect costs.

Operating Income Before Depreciation & Amortization

Depreciation can happen with almost any type of fixed asset, including machinery, computing equipment, office supplies, and so on. Companies often buy fixed assets for their company, but these assets don’t last forever. The company capitalizes these assets and depreciates the balance over the years that the asset is used, also known as its useful life. These words may not mean much yet, but keep reading to fully understand the question. A business that wants to boost its profits and book value can opt to incur a capital expense by purchasing a new machine rather than leasing one. It will have to deduct a small portion of it as an expense in that accounting year.

Examples Of When Depreciation Is An Operating Expense

The depreciation will be reported on the retailer’s income statement in the section containing its SG&A expenses. Depreciation is an operating expense if the asset being depreciated is used in an organization’s main operating activities. The double-declining balance method and sum-of-year’s digits method both let you write off more of an asset’s value in early years and less in the years later on. This comes from the fact that some assets are more productive when first bought. Assume you that all the fixed assets you have is just an equipment that is used in direct production of the products. Depreciation is listed under COGS if the fixed asset is directly involved with how the business generates revenue.