Content

- Impact Of Depreciation Method

- How To Claim Depreciation

- Modified Accelerated Cost Recovery System

- What Is Depreciation? And How Do You Calculate It?

- Real Property

- How To Calculate Straight Line Depreciation

Generated by expenses involved in the earning of the accounting period’s revenues. An allocation of costs may be required where multiple assets are acquired in a single transaction. Purchase price allocation may be required where assets are acquired as part of a business acquisition or combination. Common sense requires depreciation expense to be equal to total depreciation per year, without first dividing and then multiplying total depreciation per year by the same number. The group depreciation method is used for depreciating multiple-asset accounts using a similar depreciation method. The assets must be similar in nature and have approximately the same useful lives.For example, due to rapid technological advancements, a straight line depreciation method may not be suitable for an asset such as a computer. A computer would face larger depreciation expenses in its early useful life and smaller depreciation expenses in the later periods of its useful life, due to the quick obsolescence of older technology. It would be inaccurate to assume a computer would incur the same depreciation expense over its entire useful life.

Impact Of Depreciation Method

The accumulated depreciation is equal to the sum of the incurred depreciation expenses. The depreciated cost can also be calculated by deducting the sum of depreciation expenses from the acquisition cost. The fixed tangible assets typically come with a high purchase cost and a long life expectancy. Expensing the costs fully to a single accounting period doesn’t portrait the benefits of usage over time accurately.Casualty loss deductions are subtracted from your adjusted tax basis in the property as of the year the loss occurred. Once you have a deductible casualty loss, you must use the new, adjusted basis of the property, instead of the original basis, for depreciation purposes. What’s more, you can no longer use the tables to compute your depreciation expense. Instead, you’ll have to use the actual formulas on which the tables are based.

- Theoretically, this makes sense because the gains and losses from assets sold before and after the composite life will average themselves out.

- Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month.

- Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes.

- To claim depreciation expense on your tax return, you need to file IRS Form 4562.

- Care should be taken to make sure the comparison is fair and the decision is not biased toward the purchase of the lower priced asset.

Some of the most common methods used to calculate depreciation are straight-line, units-of-production, sum-of-years digits, and double-declining balance, an accelerated depreciation method. The Modified Accelerated Cost Recovery System is the current tax depreciation system used in the United States. Depreciable assets lose value, wear out, decay, get used up, or become obsolete as they are used in the business to generate income. An example would be a piece of equipment that is purchased and then used in the business over a period of years. These cash outflows are a transaction that exchange one asset for another asset . Total assets, liabilities, and equity on the balance sheet remain unchanged.

How To Claim Depreciation

With workflows optimized by technology and guided by deep domain expertise, we help organizations grow, manage, and protect their businesses and their client’s businesses. Wolters Kluwer is a global provider of professional information, software solutions, and services for clinicians, nurses, accountants, lawyers, and tax, finance, audit, risk, compliance, and regulatory sectors. On the other hand, expenses to maintain the property are only deductible while the property is being rented out – or actively being advertised for rent. This includes things like routine cleaning and maintenance expenses and repairs that keep the property in usable condition. For example, let’s say the assessed real estate tax value for your property is $100,000.

Modified Accelerated Cost Recovery System

Most income tax systems allow a tax deduction for recovery of the cost of assets used in a business or for the production of income. Where the assets are consumed currently, the cost may be deducted currently as an expense or treated as part of cost of goods sold. The cost of assets not currently consumed generally must be deferred and recovered over time, such as through depreciation. Some systems permit the full deduction of the cost, at least in part, in the year the assets are acquired. Other systems allow depreciation expense over some life using some depreciation method or percentage. Rules vary highly by country, and may vary within a country based on the type of asset or type of taxpayer. Many systems that specify depreciation lives and methods for financial reporting require the same lives and methods be used for tax purposes.

Is depreciation a cash expense?

Depreciation is a non-cash expense, which means that it needs to be added back to the cash flow statement in the operating activities section, alongside other expenses such as amortization and depletion.For economic depreciation, see Depreciation and Fixed capital § Economic depreciation. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. It is calculated by simply dividing the cost of an asset, less its salvage value, by the useful life of the asset. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. A depreciation schedule is required in financial modeling to link the three financial statements in Excel. But in addition to the original basis of the asset, you may also need to know your adjusted basis if you sell, trade or dispose of the asset,or suffer a casualty loss. During the period you use the asset, you may have to adjust for additions or improvements, or casualty losses to the asset.A different percentage is applied to the original basis calculation to determine each year’s depreciation deduction. If you acquire property by gift, your depreciable basis is same as the donor’s basis at the time of the gift. Useful life refers to the window of time that a company plans to use an asset. Useful life can be expressed in years, months, working hours, or units produced. Salvage value is the amount of money the company expects to recover, less disposal costs, on the date the asset is scrapped, sold, or traded in.It costs the company $10,000 to have the machine torn down and put back together again. This cost is added to the original purchase price of the machine bringing the total cost to $110,000. The company then uses a depreciation method, such as the straight-line method, to gradually charge the $8,000 depreciable cost to expense over the useful life of the machine.

What Is Depreciation? And How Do You Calculate It?

Depreciation expense affects the values of businesses and entities because the accumulated depreciation disclosed for each asset will reduce its book value on the balance sheet. Generally the cost is allocated as depreciation expense among the periods in which the asset is expected to be used. Such expense is recognized by businesses for financial reporting and tax purposes.

Real Property

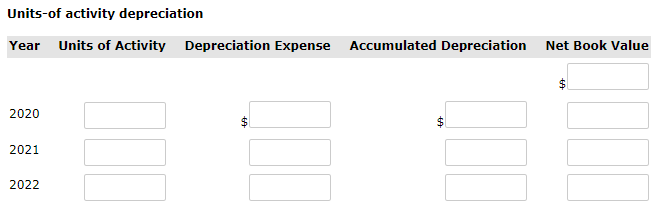

They take the amount you’ve written off using the accelerated depreciation method, compare it to the straight-line method, and treat the difference as taxable income. When you buy property, many fees get lumped into the purchase price. You can expense some of these costs in the year you buy the property, while others have to be included in the value of property and depreciated. Under this method, the more units your business produces , the higher your depreciation expense will be. Thus, depreciation expense is a variable cost when using the units of production method. When an asset is sold, debit cash for the amount received and credit the asset account for its original cost. Under the composite method, no gain or loss is recognized on the sale of an asset.The depreciated cost of an asset is the purchase price less the total depreciation taken to date. The depreciated cost method of asset valuation is an accounting method used by businesses and individuals to determine the useful value of an asset. It’s important to note that the depreciated cost is not the same as the market value. The market value is the price of an asset, based on supply and demand in the market.Since the asset is depreciated over 10 years, its straight-line depreciation rate is 10%. There are several methods for calculating depreciation, generally based on either the passage of time or the level of activity of the asset. The depreciated cost equals the net book value if the asset is not written off for impairment. The value of an asset after its useful life is complete is measured by the depreciated cost. Part V of the form relates to cars and other listed property and should generally be completed first. The total section 179 expensing election claimed for this type of property, if any, is entered on Line 29 and carried over to the front of the form to Line 7.Accumulated depreciation is the cumulative depreciation of an asset up to a single point in its life. Read this new report to understand why businesses everywhere are using Control of Work software to boost their own operations. But, you can expect the IRS to attack your allocation if it doesn’t reflect economic reality.Straight-line depreciation is the simplest and most often used method. The straight-line depreciation is calculated by dividing the difference between assets cost and its expected salvage value by the number of years for its expected useful life. The units of production method is based on an asset’s usage, activity, or units of goods produced. Therefore, depreciation would be higher in periods of high usage and lower in periods of low usage.

What Kind Of Assets Can You Depreciate?

If the purchase price of property included both depreciable property and non-depreciable property or if you use the property for both business and personal use you are required to allocate the basis. Depreciation expense under units-of-production, based on units produced in the period, will be lower or higher and have a greater or lesser effect on revenues and assets. If you can determine what you paid for the land versus what you paid for the building, you can simply depreciate the building portion of your purchase price. Depreciation is the process of deducting the total cost of something expensive you bought for your business. But instead of doing it all in one tax year, you write off parts of it over time. When you depreciate assets, you can plan how much money is written off each year, giving you more control over your finances. Another factor to consider is that large asset purchases are often financed with borrowed capital.Under this method, the annual depreciation is determined by multiplying the depreciable cost by a schedule of fractions. The most common types of depreciation methods include straight-line, double declining balance, units of production, and sum of years digits.

How To Calculate Straight Line Depreciation

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7 & 63 licenses. He currently researches and teaches at the Hebrew University in Jerusalem.The tractor book value would be reduced by $120,000 over those 12 years. Using straight-line depreciation, this results in depreciation expense of $10,000 per year for the tractor over its useful life. If you paid cash for this tractor, $140,000 would flow out of the business at the time of purchase and $20,000 would flow back into the business upon its sale at the end of 12 years. Neither of these transactions would affect the totals on the balance sheet and neither would represent an expense or income. Expense transactions would occur annually in form of non-cash depreciation expense. These depreciation expenses would reduce the asset book value of the equipment and, thus, have a negative impact on equity. Depreciated cost is the value of a fixed asset minus all of the accumulated depreciation that has been recorded against it.