Content

- Can A Limited Liability Company Llc Issue Stock?

- Proposed Collection; Comment Request For Forms 1065, 1066, 1120, 1120

- How C And S Corporations Are Similar

- Special Considerations When Filing Form 1120

- Turbotax Online Guarantees

- Economic Sanctions & Foreign Assets Control

- Credits & Deductions

These include wages, distributions, loans, and reimbursement for business expenses. If you are using public inspection listings for legal research, you should verify the contents of the documents against a final, official edition of the Federal Register. Only official editions of the Federal Register provide legal notice to the public and judicial notice to the courts under 44 U.S.C. 1503 & 1507.Learn more here. The Public Inspection pageon FederalRegister.gov offers a preview of documents scheduled to appear in the next day’s Federal Register issue. The Public Inspection page may also include documents scheduled for later issues, at the request of the issuing agency. Deborah is an editor at Square, where she writes about investment, finance, accounting and other existing and emerging payment methods and technologies. The experts at H&R Block will help you file your Expat taxes with ease.

Is Apple AC or S corporation?

C corporations are the publicly traded companies you see everyday on Wall Street such as Microsoft, Intel, or Apple. … When businesses choose to be taxed at the owner level this classifies them as an S corporation.This includes organizations described in section 501 that provide commercial-type life insurance. See Instructions for Form 1120-L for additional information. Once IRS Form 2553 is filed and approved by the IRS, a corporation is classified as an S Corp. S Corporations benefit from pass-through taxation much like an LLCor partnership.A corporation must file Form 1120S, US Income Tax Return for An S Corporation if it elected to be an S corporation by filing Form 2553, Election by a Small Business Corporation, the IRS accepted the election, and the election remains in effect. Do not file Form 1120S, US Income Tax Return for An S Corporation for any tax year before the year the election takes effect. Shareholders in an S Corp are required to report their percentage of the company’s financial activity on their individual federal income tax return. Each shareholder will then be taxed at their individual tax rate. If you’re the owner of a foreign corporation and you do business in the U.S., your business has specific tax filing obligations. One of these tax obligations is filing Form 1120-F, which serves as your corporation’s U.S. income tax return. Schedule C is a simple way for filing business taxes since it is only two pages long and lists all the expenses you can claim.Based on the client’s needs and desired outcome, she has the forethought to cover different angles that would be overlooked from a legal standpoint but have consequence in business. She conducts risk assessments and minimizes client’s risk and exposure to potential liability. Additionally, she specializes in drafting and negotiating agreements.Negotiating is a passion of hers; in law school, she was a member of the Alternative Dispute Resolution Society and won the intraschool negotiation competition. She treats every client as a top priority; thus, she will not take on many cases at a time because she wants to give each client the focus and attention they deserve. She has sharp attention to detail and is a forceful advocate for every client.

Can A Limited Liability Company Llc Issue Stock?

The business structure of an S corporation allows it to “pass-through” to the shareholders the income, gains, deductions, and credits for federal tax purposes. What this generally means is that the status as an S corporation avoids double taxation on both the corporation as a whole and the shareholders. Well, whether you are a newly formed C corporation or an existing limited liability company taxed as a corporation, you will definitely want to take note of Form 1120. Ultimately, this form will tell you how much business tax you owe for the year. Each type of entity requires a different tax form on which you report your business income and expenses. Regardless of the form you use, you generally calculate your taxable business income in similar ways. The single member LLC can file using a Form 1120 or 1120S only if it has filed Form 8832, Entity Classification Election, to elect to be treated as an association taxable as a corporation.While S corporations have significant advantages, some downsides include being subject to many of the same rules that corporations must follow, including high legal and tax service fees. Form 1120-S reports the income, losses, and dividends of each S corporation shareholder. What’s unique about Form 1120-S is that it indicates the ownership percentage of each shareholder of an S corporation.

Proposed Collection; Comment Request For Forms 1065, 1066, 1120, 1120

We provide templates for everything from job postings to offer letters. Send links to docs and tax forms via text message so new hires sign digital copies. Business tax audit support does not include reimbursement of any taxes, penalties, or interest imposed by tax authorities. Our small business tax professional certification is awarded by Block Advisors, a part of H&R Block, based upon successful completion of proprietary training. Our Block Advisors small business services are available at participating Block Advisors and H&R Block offices nationwide. Income details, like gross receipt amount, cost of goods sold, interest, dividends, royalties, rent, and capital gain.

- This tax structure is called “double taxation” because the C Corp is taxed first at the corporate level, then shareholders are taxed again as individuals.

- This is because S Corps are not taxed at the corporate level.

- This course will unravel the mysteries of Schedules M-1 and M-2 for C corporations and S corporations.

- There are no tax implications with leaving money in an S Corp account.

- Each type of entity requires a different tax form on which you report your business income and expenses.

If you will be reporting your business earnings on Schedule C, you can search the IRS website for a copy or use TurboTax to generate the form for you after you input all of your financial information. This table of contents is a navigational tool, processed from the headings within the legal text of Federal Register documents. This repetition of headings to form internal navigation links has no substantive legal effect. The President of the United States issues other types of documents, including but not limited to; memoranda, notices, determinations, letters, messages, and orders. Learn about each business structure, and take a free quiz to determine which business entity is right for you. Find out the definition of a non-resident alien and see how it may affect your tax filing status. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

How C And S Corporations Are Similar

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.IRS Form 1120-S can be very complicated to fill out depending on the size of the corporation and the nature of the business. It is best to consult with a tax lawyeror licensed accountant before submitting tax documents to the IRS. A corporation must file Form 1120-S if it elected to be an S corporation by filing Form 2553, and the Internal Revenue Service accepted the election. For returns due after 2019, the minimum penalty for failure to file a return that is more than 60 days late has increased to the smaller of the tax due or $435, according to the IRS instructions for Form 1120. Instead of filing Form 1120 or Form 1120-A, certain organizations, as shown below, have to file special returns. Any corporation that engages in farming should use Form 1120 or, if they qualify, Form 1120-A to report the income from such activities.

Special Considerations When Filing Form 1120

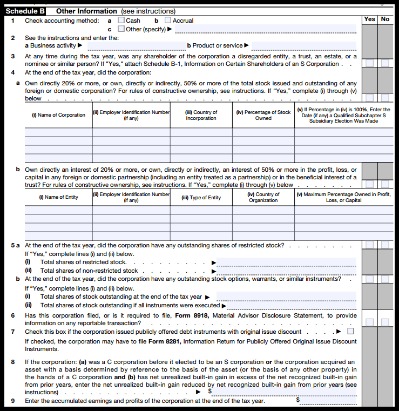

However, Schedules M-1 and M-2 have been known to throw many new tax preparers for a loop. This course will unravel the mysteries of Schedules M-1 and M-2 for C corporations and S corporations.

Turbotax Online Guarantees

TurboTax works with programs like QuickBooks and Quicken, so you can import information directly into your tax return. All section 468B designated and qualified settlement funds must file an annual tax return. See Form 1120-SF and the Instructions for Form 1120-SF for more information.More information and documentation can be found in our developer tools pages. These tools are designed to help you understand the official document better and aid in comparing the online edition to the print edition. Use the PDF linked in the document sidebar for the official electronic format. Be first in line to register for events, read exclusive interviews with HR experts, and watch tutorials on how to up your HR game every month. Become a top-talent magnet with PCMag’s Editors’ Choice for best all-around HR software in 2021—recruiting, onboarding, and performance tools, it’s all here. Start doing performance reviews that really improve performance.Corporations that have not elected or are not eligible for “S” status file Form 1120 tax returns. These companies must pay tax at the corporate level and the individual must then pay additional taxes on their Form 1040 tax returns. Every domestic life insurance company and every foreign corporation that would qualify as a life insurance company if it were a U.S. corporation must file Form 1120-L to compute and report the taxable income of a Life Insurance company.

Credits & Deductions

If you’re supposed to and you don’t, you may be penalized 5% of the unpaid tax, up to a maximum of 25%. IRS Schedule K-1 is a document used to describe the incomes, losses, and dividends of a business’s partners or an S corporation’s shareholders. Both S corporations and C corporations must also file articles of incorporation and hold regular meetings for directors and shareholders with detailed minutes.The IRS uses this information to determine how much profit and loss each shareholder will have. TurboTax Self-Employed will ask you simple questions about your life and help you fill out all the right forms. We’ll search over 500 tax deductions to get you every dollar you deserve and help you uncover industry-specific deductions. I run a small law firm in Pasadena, CA. I have been practicing for almost 10 years and the other attorneys at my firm each have 12+ years of experience.You have income that is “effectively connected” with a U.S. trade or business. In addition, if the corporation does not have significant inventory, it is able to use the cash method of accounting under S corporation terms. The Schedule K-1 is a form that can be attached to Form 1120-S or Form 1065.