Content

- Injured Vs Innocent Spouses

- Where To Mail Form 8857

- How To Claim Innocent Spouse Relief

- Equitable Relief

- Forms & Instructions

If abuse is present, it changes how IRS will view other factors including the knowledge factors. The non-requesting spouse’s alcohol and drug abuse can be considered abuse of the requesting spouse. Abuse of the requesting spouse’s child is considered as part of the abuse determination. Would paying the tax cause the requesting spouse economic hardship? Economic hardship is presumed for those taxpayers whose household income is below 250% of the federal poverty guidelines.

What is equitable relief IRS?

IRS Equitable relief is the most general type of relief under the innocent spouse rules. … This form of innocent spouse relief is the only one that allows you to get relief from an underpayment of tax. It can also apply to an understatement of tax.Clients with tax debt are already under a significant amount of stress as it is. Providing viable options for tax relief can be a significant and important part of your tax practice and earn you clients for life.

Injured Vs Innocent Spouses

Even a homemaker who earns no income is considered to be liable and responsible for the full amount of any unpaid tax, interest and penalties. For those taxpayers who were once married but are now divorced or widowed are fair game for the IRS or California Franchise Tax Board if they were married during the tax year in question.What is the requesting spouse’s current marital status? If, at the time innocent spouse relief is sought, the requesting spouse is widowed, divorced, legally separated, or living apart for at least 12 months from the other spouse, this factor favors granting relief. Many married taxpayers are not aware that they are not legally required to file a joint tax return with their spouse. Filing a joint tax return is often financially advantageous for the couple.Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation. You must prove that, at the time when you signed the joint return, you didn’t know, and had no reason to know, that incorrect statements were entered on the tax return. A survivor may appeal an unfavorable decision to Tax Court. A survivor can also file a case in Tax Court requesting innocent spouse relief if IRS has not issued a final determination notice within six months of receiving a request for relief on Form 8857. Whether the requesting spouse has made a good faith effort to comply with the income tax laws in the tax years following the tax year or years to which the request for relief relates.

Where To Mail Form 8857

There are three varieties of innocent spouse relief, and each has its own specific requirements. Any other information you give the IRS to make a decision on your request for relief could be shared with your spouse or ex-spouse. If you have concerns about your privacy or the privacy of others, you should redact or black out personal information in the forms you submit. Your tax refund is withheld by the IRS to pay the debt. The last kind of relief only deals with when couples live in a community property state.Many taxpayers who are no longer married also apply for the separate election liability. This provision can provide similar relief to the innocent spouse rule but it requires that the spouses no longer be married due either to divorce or death. Since filing errors can significantly affect married taxpayers who file jointly, the IRS offers Innocent Spouse Relief. The IRS looks at everything from the nature of the error to your financial situation, your educational background, how much you participated in the activity that created the problem, whether the issue is part of a pattern and other factors.

How To Claim Innocent Spouse Relief

It then discusses the requirements of innocent spouse relief today under Section 6015 of the Code and provides guidance on the factors the IRS and federal courts look to in determining whether to grant innocent spouse relief. Finally, it concludes with typical circumstances in which innocent spouse relief can be raised, either administratively or judicially. Form 1040-X is used by taxpayers who need to amend an error in a previously filed annual federal tax return.

- The IRS will use the information you provide on the form, and any attachments you submit, to determine if you are eligible for relief.

- Many married taxpayers are not aware that they are not legally required to file a joint tax return with their spouse.

- This type of tax relief allows a joint-filer to be relieved of the responsibility of paying tax, interest, and penalties if the other joint-filer improperly reported items on the jointly filed tax return.

- As Tax Day approaches, it is important to be aware of this relief option for your clients filing jointly.

- The application for separation of liability relief must completed via Form 8857 no later than 2 years after the date the IRS first attempted to collect the taxes in question from you.

- But the tax debt must be attributable to your spouse’s income, not yours.

The existence of the requesting spouse’s mental or physical health issues favors granting relief. Others have ruled that the spouse cannot receive relief unless they have carefully reviewed the tax return and personally investigated suspicious sections. Many commentators believe that these requirements place an undue expectation on well-educated claimants. Another difference lies in the extent to which the court might decide that the taxpayer shares in the liability even if they were unaware of the error. Under the separate election liability rule, the court may determine that the taxpayer bears some liability for taxes owed due to the oversight.

Equitable Relief

Sec. 6015 provides an election that allows a qualifying spouse to limit his or her liability for a deficiency from a joint return to the spouse’s allocable portion of the deficiency. Leah’s story…This is precisely what happened inLeah’s casewhen she filed her own tax return for tax year 2013.

Forms & Instructions

If a divorce or separation agreement places sole responsibility for paying the tax on the non-requesting spouse, this factor favors granting relief, although it does NOT guarantee it. However, it is still important that attorneys representing survivors in family court ask the judge to hold the abuser solely responsible for the debt. Whether the requesting spouse is no longer married to the nonrequesting spouse as of the date the IRS makes its determination. If the requesting spouse is married to the nonrequesting spouse, this factor is neutral. If the requesting spouse is no longer married to the nonrequesting spouse, this factor weighs in favor of relief. To apply for relief, a taxpayer must file IRS form 8857.

Separation Of Liability Relief

Since this can significantly affect the financial situation of married taxpayers who file jointly, the IRS introduced Innocent Spouse Relief. Separation of Liability Relief.It is only available when the joint tax return understated the amount of tax due. It is only available when the requesting spouse is divorced, legally separated, or has lived apart from the other spouse for at least 12 months before requesting relief.

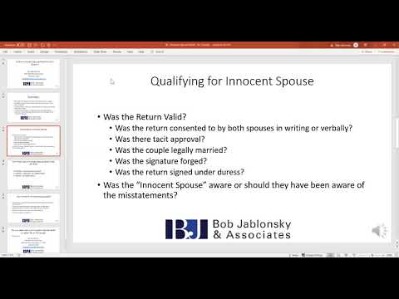

What Qualifies For Innocent Spouse Relief?

Mr. Ayar has a Master of Laws in Taxation – the highest degree available in tax, held by only a small number of the country’s attorneys. The clinic listed herein is partially funded through matching grants provided by the Internal Revenue Service pursuant to the Internal Revenue Service Restructuring and Reform Act of 1998. The partial funding by the IRS does not imply that the clinics have a preferential relationship with the IRS. The decision of whether to use these clinics is your own and their use will not affect your rights before the IRS. Or, when done editing or signing, create a free DocuClix account – click the green Sign Up button – and store your PDF files securely. Or, click the blue Download/Share button to either download or share the PDF via DocuX. We are a not-for-profit corporation, and your donations are tax deductible to the extent allowable by law.For additional information about qualifying for equitable relief, including how the IRS will take into account abuse and financial control by the nonrequesting spouse in determining whether equitable relief is warranted. Innocent Spouse Relief provides you relief from additional tax you owe if your spouse or former spouse failed to report income, reported income improperly or claimed improper deductions or credits. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice.