Content

- What Is Meant By Nonoperating Revenues And Gains?

- What Is Not Included In Operating Income?

- Accountingtools

- Importance Of Profit & Loss In Sole Proprietorship

- Non Operating Income

- Documents For Your Business

- Related Courses

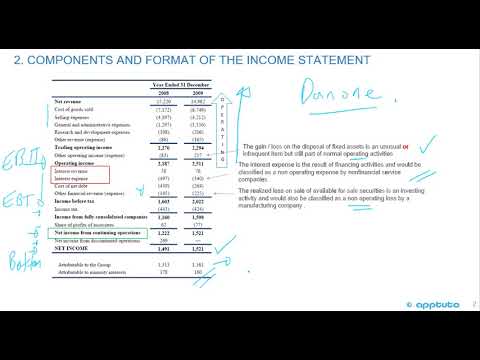

While preparing a company’s income statement, you should consider the effects of both operating and non-operating components. Earnings are perhaps the single most studied number in a company’sfinancial statements because they show profitability compared with analyst estimates and company guidance.It establishes a transparent image of the entity, and all the stakeholders, including employees and investors, feel more comfortable in taking the risk along with the entity’s growth plans. Interest income is the amount paid to an entity for lending its money or letting another entity use its funds. On a larger scale, interest income is the amount earned by an investor’s money that he places in an investment or project.

What Is Meant By Nonoperating Revenues And Gains?

Differentiating what income was generated from the day-to-day business operations and what income was made from other avenues is important to evaluate a company’s real performance. That is why firms are required to disclose non-operating income separately from operating income. Revenue refers to the total income a business generates from the sale of goods or services. It is also referred to as gross sales, and is shown at the top of a business’s income statement.

Is non-operating income considered revenue?

Non-operating income is the part of the business income that is clearly distinct from income derived from core business activities. It refers to the revenue and costs generated from sources other than business operations such as gains or losses from investments.In addition to running its core business, the company also made some investments, which brought in $10,000 in dividends and $8,000 in interest income. During the year, the company paid a $6,000 interest for its previous financing and sold a piece of land at a loss of $4,000.

What Is Not Included In Operating Income?

Operating income excludes non-operating items such as investments in other businesses, taxes and interest payments. However, for financial service companies, the interest income is typically reported as a component of operating activities. A non-operating expense is an expense incurred by a business that is unrelated to its core operations. Separating non-operating income from operating income gives investors a clearer picture of how efficient a company is at turning revenue into profit. When a business earns revenue, the first thing to do is to properly record it in the accounting books. This was historically a manual task with pen and paper, but modern accounting software now automates a business’s record-keeping functions and reconciliations. Amounts thus credited or charged shall be concurrently included in the accounts in which the securities are carried.One of these financial reports — the income statement — shows both operating and non-operating income and expenses. There are times when a business earns a one-off income amount from an investment or the sale of equipment or a piece of property. This would be classified as non-operating revenue and can alter a business’s earnings significantly, making it difficult for investors to determine how well the company’s main business line actually fared during a specific period. Remember that operating revenue refers to the amount of money a business makes from its core business activities. For example, how much money People Health makes from administering lab tests for clients is their operating revenue. Every year, businesses realize income or experience losses related to their maintenance of cash accounts in banks. Usually, banks pay businesses interest on their account balances, and in some cases, businesses realize dividends or other returns on securities investments they own.A non-interest expense is an operating expense incurred by a bank, and it is separate from the interest expense on customer deposits. Daniel Liberto is a journalist with over 10 years of experience working with publications such as the Financial Times, The Independent, and Investors Chronicle. Daniel is an expert in corporate finance and equity investing as well as podcast and video production. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. “Determining Operating/Nonoperating Revenues/Expenses in Proprietary Funds.” Accessed Oct. 1, 2021. Cash discounts on bills for material purchased shall not be included in this account. Write Down Of AssetsWhen the carrying value (purchase price – accumulated depreciation) of an asset exceeds its fair value, it is referred to as a write down.Losses from taxes — or income from tax refunds — generally are not considered an operating activity, even though businesses pay taxes or claim tax credits in every accounting year. The term “earnings before interest and taxes” is often used interchangeably with net operating income. In some cases, taxes will be separated between operating and non-operating income statements, with taxes on activities like owning property and making sales included as an operating item. Other taxes, like income, franchise and excise taxes, are itemized as as non-operating expense. Many non-operating gains or losses are non-recurring, which leaves room for accounting manipulation. A company may record a high non-operating income to hide its poor performance on core operations.

Accountingtools

Gains often involve the disposal of property, plant and equipment for a cash amount that is greater than the carrying amount of the asset sold. An example would be a retailer’s disposal of a delivery truck for a cash amount that is greater than the truck’s carrying amount. Fair value of donated services must be recorded when there is the equivalent of an employer-employee relationship and an objective basis for valuing such services. The value of services donated by organizations may be evidenced by a contractual relationship which may provide the basis for valuation. 9020 UNRESTRICTED CONTRIBUTIONS. All contributions, donations, legacies and bequests, that are made to the hospital without restrictions by the donors, must be credited to this account. When a hospital receives contributions in significant amounts, such contributions should be clearly described and fully disclosed in the income statement. The disposition of nonoperating telecommunications plant not previously used in the provision of telecommunications services.

Importance Of Profit & Loss In Sole Proprietorship

Another way to look at non-operating income is revenue generated from a one-time, non-reoccurring transaction. Using the example above, People Health will never be able to sell the lab equipment again once the transaction has occurred. The fact that transactions like this are not reoccurring is also the reason why non-operating income activities are not part of the operating revenue. Earnings QualityQuality of earnings refers to the income generated from the business’s core operations and does not include the one-off revenues generated from other sources. Quality evaluation helps the financial statement users to make judgments about the “certainty” of current income and the future possibilities. This is why the most common accounting approach is to exclude non-operating income from the income statements and recurrent profits. Companies with a higher level of non-operating income are regarded as having poorer earnings quality.

- 9210 DOCTORS’ PRIVATE OFFICE RENTAL EXPENSES. This account contains the expenses incurred in connection with the rental of office space and equipment to physicians, and other medical professionals for use in their private practice.

- On a larger scale, interest income is the amount earned by an investor’s money that he places in an investment or project.

- In contrast, non-operating revenue tends to show one-time income and expenses that do not form part of a business’s core functions.

- The income statement of a business which typically covers a period of time, such as a quarter or a year, gives a snapshot of the company’s financial health.

The income that is classified as non-operating depends primarily on what business you’re in. An accountant for an ice cream shop would likely categorize income from the sale of an old snow blower as non-operating, while an accountant for a used equipment store would categorize that same transaction as operating income. In some cases, non-operating items are referred to as income from secondary activities, while the business’s normal operations are considered primary activities. Non-operating items on an income statement includes anything that does not relate to the business’s main profit-seeking operations, such as interest, dividends and capital gains or losses.Dividends received and receivable from affiliated companies accounted for on the equity method shall be included in Account 1410, Other noncurrent assets, as a reduction of the carrying value of the investments. 9220 OFFICE AND OTHER RENTAL EXPENSE. This cost center contains the expenses incurred in connection with the rental to other than physicians, other medical professionals and non-retail rental activities. 9130 RETAIL OPERATIONS REVENUE. This account must be credited with revenue earned from other retail operations such as gift shop, barber shop, beauty shop, drug store or newsstand located in space owned by the hospital. Both tend to experience sudden ups and downs as operating performance tends to remain more or less the same for stable companies. It appears at the bottom of the income statement, after operating profit line item. From the entity’s point of view, reporting such income and expenses shows that the entity has nothing to hide.

Non Operating Income

This kind of income is not usually considered part of their normal business, so it will be itemized on the income statement as non-operating or secondary income. Investments in assets that the business uses in its primary activities — such as plant assets — are not part of this item. Income statements can provide critical insight for investors regarding the health of a company, if they know how to read them. It’s important to consider both operating and non-operating items on a income statement because a business could seem profitable in its primary activities and still be facing huge losses from non-operating expenses. Understanding some of the non-operating items on an income statement and the risks they present is important for most private investors. Non-operating income gives an estimate of the proportion of income due to non-operating activities. It allows bifurcating the peripheral income and expenses from the mainstream income from the company’s core operations.To an investor, a sharp bump in earnings like this makes the company look like a very attractive investment. However, since the sale cannot be replicated or duplicated, it can’t be considered operating income and should be removed from performance analysis. Alternatively, if a technology company sells or spins off one of its divisions for $400 million in cash and stock, the proceeds from the sale are considered non-operating income. If the technology company earns $1 billion in income in a year, it’s easy to see that the additional $400 million will increase company earnings by 40%. The net balance of the revenue from and the expenses of property, plant, and equipment, the cost of which is includable in Account 2006, Nonoperating plant.Beware of management teams attempting to flag metrics that incorporate inflated, separate gains. Earnings before interest and taxes for example, includes income derived from activities not related to the core business and can often be advertised heavily by companies to mask underwhelming operational results. Non-operating revenue and expenses include those revenues and expenses not directly related to patient care, related patient services, or the sale of related goods.It allows the stakeholders to compare the pure operating performance of the company and also draw a comparison across the peers. Operating income is an accounting figure that measures the amount of profit realized from a business’s operations, after deductingoperating expensessuch as wages, depreciation, andcost of goods sold. In short, it provides information to interested parties about how much revenue was turned into profit through the company’s normal and ongoing business activities.

Are CEO salaries operating expenses?

An officer’s’ salary is generally considered to be wages according to the IRS. As such, it will be included in the company’s overhead expenses. On both the profit and loss statement and the company’s tax returns, the cost of goods sold is computed before overhead expenses are deducted.Non-operating income includes the gains and losses generated by other activities or factors unrelated to its core business operations. In a company’s accounting system, non-operating expenses are applied against non-operating income. When expenses exceed income in this category, the company has a non-operating loss. For some businesses, financial investments can be a source of non-operating losses. Businesses can invest excess cash in financial securities instead of distributing it to owners, enabling the company to earn a return on the investments while maintaining enough liquidity to address emergencies and opportunities. However, investments can lose money, resulting in non-operating losses when the company closes its books for the fiscal year. Examples of non-operating income include dividend income, asset impairment losses, gains and losses on investments, and gains and losses on foreign exchange transactions.

Documents For Your Business

Non-operating income is the portion of an organization’sincomethat is derived from activities not related to its core business operations. It can include items such as dividend income, profits, or losses from investments, as well as gains or losses incurred by foreign exchange and asset write-downs. Though non-operating income do not form part of core business activities it forms part of profits. Higher the non-operating income than operating income creates doubt about the operations of the organization and towards the purpose and activities of the organization. In a nutshell, non-operating income is good for the organization but it should be limited and should be less than the operating income so as to maintain the image in the market.For a non-financial business, the non-operating income that is earned through investing activities such as interest expense on debt securities will be reported as a non-operating item on the income statement. Non-operating income is the profit or loss a business earns outside of its core operating activities.Similarly, if you own a grocery store, the sale of groceries will be your operating income. For example, if the rental space floods and your company is forced to reimburse the renter for damage to personal equipment, the expenses involved in this side activity can exceed the money the company makes on the arrangement. Another category of non-operating activities that can result in losses includes one-time transactions.A business might attempt to use non-operating income to mask poor operational results. Some less ethical organizations try to characterize their non-operating income as operating income in order to mislead investors about how well their core operations are functioning. When income statements are prepared for daily business activities or generated for a short period of time, the non-operating income may be eliminated completely.

Related Courses

Non-operating revenue is income generated from non-core business activities like selling property, investments, and appropriations and grants. It’s not to be confused with operating revenue, which is income from core business activities. In many cases, income generated from activities that support core business activities are considered non-operating income. For example, income generated from parking fees, fines billed to clients for late- or non-payments, break room vending machines and cafeteria sales, and gift shop purchases may be included in non-operating income.