Content

- Compare Accounts

- Other Insurance

- How To Estimate Your Expected Income

- What Is Adjusted Gross Income Agi?

- Get More With These Free Tax Calculators And Money

We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate.

How is Magi calculated for Medicare premiums?

Your MAGI is calculated by adding back any tax-exempt interest income to your Adjusted Gross Income (AGI). If that total for 2019 exceeds $88,000 (single filers) or $176,000 (married filing jointly), expect to pay more for your Medicare coverage.Yes, MAGI and AGI can be the same. For many people, the list of deductions that need to be added back to AGI in order to calculate MAGI will not be relevant. For instance, those who did not earn any foreign income would have no reason to use that deduction and would not add back those earnings to their AGI. For them, AGI and MAGI would therefore be the same number. Add back any deductions you qualify for, which can include student loan interest and IRA contributions. MAGI can be defined as your household’s adjusted gross income after any tax-exempt interest income, and certain deductions are factored in. As defined in Section 86 ) which is not included in gross income under section 86 for the taxable year.

Compare Accounts

Original supporting documentation for dependents must be included in the application. If H&R Block makes an error on your return, we’ll pay resulting penalties and interest. One state program can be downloaded at no additional cost from within the program.This MAGI calculator helps you in Modified Adjusted Gross Income calculation with the known values of adjustable tax income, non–taxable social security benefits, tax-exempt interest and excluded foreign income. Still questioning, “what is modified adjusted gross income” and about how to calculate it? They’re dedicated to knowing the nuances of taxes and can help you understand your tax return to maximize available credits and deductions.

Other Insurance

You can also use tax preparation software, which will help you find legal ways to lower your AGI. The lower your AGI, the lower your tax bill will be. That means it’s often in your best interest to lower your AGI as much as possible. How much you can do this will depend on your different earnings and sources of income. One way to lower your AGI is to subtract as many tax-deductible expenses as possible from the total. Typically, your MAGI and AGI are close in value to one another. However, the small adjustments that tweak your AGI into your MAGI could have an important bearing on your overall tax return.

How To Estimate Your Expected Income

E-file fees do not apply to NY state returns. State e-file available within the program. An additional fee applies for online.

What Is Adjusted Gross Income Agi?

Deposit products offered by Wells Fargo Bank, N.A. Member FDIC. TIAA-CREF Individual & Institutional Services, LLC, and Nuveen Securities, LLC, Members FINRA and SIPC, distribute securities products.But the eligibility criteria for people who are blind, disabled, older than 64, or dual-eligible for Medicare and Medicaid are different, and can still include asset/resource limits rather than just an income-based system. The good news is that it’s calculated in a way that allows you more flexibility to dial in your MAGI in order to optimize your eligibility for premium subsidies. While most people are aware that subsidy eligibility is based on income, there’s still plenty of confusion in terms of how your income is actually defined under the ACA.

- Our website is not intended to be a substitute for professional medical advice, diagnosis, or treatment.

- The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis.

- Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

- This compensation may impact how and where listings appear.

- Software DE, HI, LA, ND and VT do not support part-year or nonresident forms.

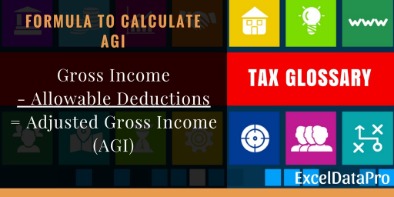

Your modified adjusted gross income determines whether you are allowed to claim certain benefits on your taxes. These include whether you can deduct contributions to an individual retirement account . It also impacts what you can put in a Roth IRA each tax year. Your eligibility to deduct is based on your Modified Adjusted Gross Income and whether you and if married, your spouse is covered1 by a workplace retirement plan , such as a 401, 403, SEP IRA, or SIMPLE IRA. In the US, subtracting the gross salary of a person from certain deductions is called as the adjustable gross income. Modified Adjusted Gross Income is where, certain items like foreign-housing deductions, student-loan deductions, IRA-contribution deductions are added to AGI.

Get More With These Free Tax Calculators And Money

Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return.

Step 3 Calculate Your Modified Adjusted Gross Income

Above is the top portion of form 1040 so we can calculate your Total Income and Adjusted Gross Income . Let’s see what goes into this calculation. Premium subsidy eligibility extends well into the middle class, especially with the American Rescue Plan’s subsidy enhancements that are in effect for 2021 and 2022. But the higher your MAGI is, the lower your subsidy amount will be.

Modified Adjusted Gross Income Magi Vs Adjusted Gross Income Agi

Additional state programs are extra. Most state programs are available in January. Online AL, DC and TN do not support nonresident forms for state e-file. Software DE, HI, LA, ND and VT do not support part-year or nonresident forms. Finding your taxable income is an important part of filing taxes. Learn how to calculate your taxable income with help from the experts at H&R Block. So, what is MAGI and the formula to calculate it?Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. Wondering how to report your child’s foreign accounts? Let the experts at H&R Block explain the forms required for reporting this information. For 2017 and earlier, the domestic production activities deduction and the tuition and fees deduction paid before 2021. Active participant status is a reference to an individual’s participation in various employer-sponsored retirement plans. Adjusted gross income equals your gross income minus certain adjustments.