Content

- Child Tax Credit

- Capital Gains Tax Rates & Brackets Long

- Tax Data

- Small Business

- How To Avoid The Social Security Tax Trap

No credit is allowed for an individual whose federal adjusted gross income exceeds $50,000 ($25,000 for married filing separately). This credit is in addition to the subtraction modification available on the Maryland return for child and dependent care expenses. A married couple who files a joint federal income tax return may file a joint State return even if one spouse is a nonresident and had no North Carolina income. However, the spouse required to file a North Carolina return has the option of filing the State return as married filing separately.Combine your allowable exclusions from line 8 of the worksheet and enter the total amount on line 10b of Form 502. To receive the benefit of the pension exclusion, be sure to transfer the amount from line 5 of the worksheet to line 10a of Form 502, and complete the remainder of your return, following the line-by-line instructions.

Child Tax Credit

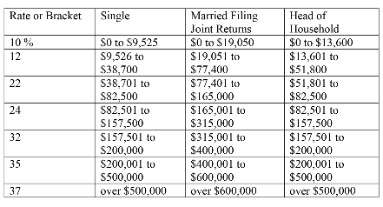

That’s because at the very highest tax brackets, the income levels that determine the tax brackets for married people filing jointly are less than double the income levels that determine the tax brackets for single people. It’s a phenomenon called “the marriage penalty,” and it means married couples end up in higher tax brackets faster than single people do. How long do you keep my filed tax information on file? If you’ve already e-filed or mailed your return to the IRS or state taxing authority, you’ll need to complete an amended return.

Capital Gains Tax Rates & Brackets Long

You and your spouse can also file separate tax returns if you’re married, but married filing separately taxpayers receive the least beneficial tax treatment under IRS rules. The Earned Income Tax Credit, also known as Earned Income Credit , is a benefit for working people with low to moderate income. If you qualify for the federal earned income tax credit and claim it on your federal return, you may be entitled to a Maryland earned income tax credit on the state return equal to 50% of the federal tax credit. The Maryland earned income tax credit will either reduce or eliminate the amount of the state and local income tax that you owe. Earned Income Tax Credit You cannot claim an earned income tax credit if you are a nonresident alien required to file a federal 1040NR. You must qualify and elect to be taxed as a resident alien with IRS on your worldwide income in order to claim the earned income tax credit. If you are a nonresident with military income and other income earned in Maryland, single, or have an unemployed spouse, you must file a nonresident Maryland Form 505, reporting total income and subtracting military pay.Eligibility for these credits is limited to funds budgeted. Applicants seeking certification will be approved on a first-come, first-served basis. Go to the Maryland Department of Health website at health.maryland.gov for more information. If the credit is more than your tax liability, the unused credit may not be carried forward to another tax year. If the credit exceeds your tax liability, the unused credit may not be carried forward to any other tax year. If the credit is more than the tax liability, the unused credit may not be carried forward to another tax year. Enter the names, Social Security numbers and relationships for all dependents on Form 502B. The total dependent exemptions should be carried over to part C of the Exemptions section on Form 502.

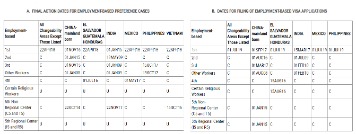

Tax Data

The maximum amount of credit allowed is $1,500 for each qualifying individual. The credit is limited to the amount paid, less any reimbursement, up to the maximum allowed credit. See Page 3 of the Instructions for Form 502CR to learn how to calculate the credit. Each spouse that qualifies may claim this credit. Complete a separate column on Form 502CR Part C for each spouse.

- If you are a nonresident with military income only – or military income and other income earned outside of Maryland – you do not have to file a Maryland income tax return.

- You can claim the same number of exemptions that were claimed on your federal return.

- Single taxpayers are eligible for a standard deduction of $12,400 for the 2020 tax year and $12,550 for the 2021 tax year.

- When you start a new job, you’ll fill out a W-4 and select a filing status to let your employer know how much money to withhold from each paycheck for taxes.

- To request a copy of a Maryland tax return you filed previously, send us a completed Form 129 by mail or by fax.

Your filing status, along with your income, helps determine your tax liability. People who file separately often pay more than they would if they file jointly. If you were legally divorced by the last day of the year, the IRS considers you unmarried for the whole year. If your spouse died during the tax year, however, the IRS considers you married for the whole year. You can file jointly that year, even if you don’t have kids in the house.Contributions must be made to a nonprofit organization approved by the Department of Housing and Community Development . The taxpayer must apply to and receive approval by the DHCD for each contribution for which a credit is claimed. If you are a qualified licensed physician or a qualified nurse practitioner who served without compensation as a preceptor, you may be eligible to claim a nonrefundable credit against your State tax liability.If you are a nonresident with military income only, you do not have to file a Maryland income tax return. Either you or your spouse has non-military income earned in Maryland. The tax should be calculated on Maryland earned income only.

Small Business

One spouse owes taxes, while the other would get a refund. One spouse suspects that the joint return might not be accurate.

How To Avoid The Social Security Tax Trap

This Maryland taxable net income will be used as the numerator of a nonresident factor. Your Maryland income without allowing you the non-Maryland subtractions will be the denominator. This nonresident factor applied to the tax that was calculated on your total income arrives at the Maryland tax. The special nonresident tax is applied to your Maryland net taxable income as calculated on Form 505NR. For more information, see the instructions in the Maryland nonresident tax booklet. There are several ways you can file your personal or business income tax returns on paper or electronically.

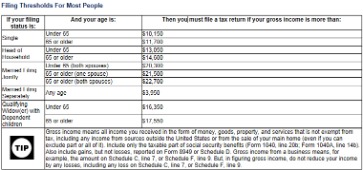

How much money do you have to make to not pay taxes?

The minimum income amount depends on your filing status and age. In 2020, for example, the minimum for single filing status if under age 65 is $12,400. If your income is below that threshold, you generally do not need to file a federal tax return.Complete the Pension Exclusion Computation Worksheet shown in Instruction 13 in the Maryland resident tax booklet. Be sure to report all benefits received under the Social Security Act and/or Railroad Retirement Act on line 3 of the pension exclusion worksheet – not just those benefits you included in your federal adjusted gross income.Determining your marital status will narrow your choices of filing status. As a general rule, your marital status on the last day of the Tax Year is your marital status for the entire Tax Year. Under certain circumstances, you might be able to file as Head of Household as a single person or even if you are technically still legally married. If you lived apart from your spouse for the last half of the year, and if you keep up a home for a dependent child, you might qualify for Head of Household. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment.Then, in the two years following, they are entitled to file as a qualifying widow or widower as long as they claim a dependent child, stepchild, or adopted child and have not remarried. Tax law imposes some other notable limitations on married couples who file separately.In other words, the IRS can collect the full amount from you personally if it turns out that you and your spouse owe $15,000 in taxes on your combined incomes, even if you only earned 10% of the money that produced those taxes. Your standard deduction for tax year 2020 is $12,400 if you’re single and you don’t qualify for the advantageous head-of-household status. This deduction increases to $12,550 for the 2021 tax year. If you don’t have enough assets or income to pay the full amount, you must include with Form MD 656 a complete financial statement, Form MD 433-A for individuals and/or Form MD 433-B for businesses. Visit any of our taxpayer service offices to obtain forms. If you are not certain which filing status to use, figure your tax both ways to determine the best status for you.