Content

- How To Calculate Overhead Rate

- Determine Your Monthly Overhead Costs

- Software Features

- Purchase Price Allocation Ppa: Definition And Examples

- How To Calculate And Track Overhead Costs For Your Small Business

- How To Calculate Manufacturing Overhead

- Overhead Rate Formula

- Overhead Rate Per Employee

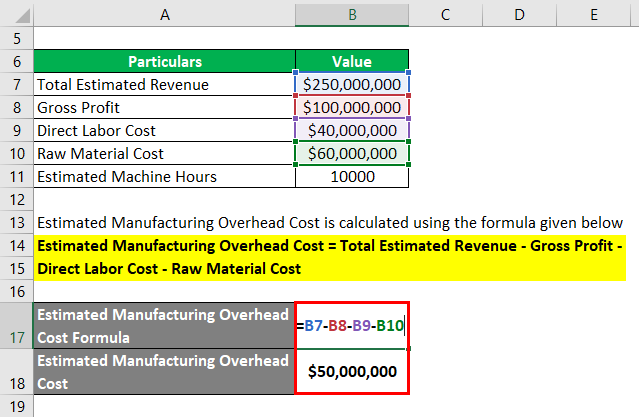

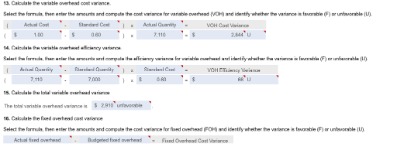

To calculate this, divide the overheads by the estimated or actual direct material costs. For calculating manufacturing overhead costs, you need to add all the indirect industrial costs brought about while manufacturing an item. None of these expenses is directly tied to the actual manufacturing process. However, it would be impossible for the business to manufacture its products to a high standard without these. This is why they’re considered indirect costs and part of your organization’s overhead. Aside from direct manufacturing costs, you must know how to calculate manufacturing overhead. Manufacturing overhead costs enable you to calculate the total cost of producing a specific good.Operating expenses are costs that are directly related to the production of a product or delivery of a product or service—and to producing revenue. These include raw materials, parts, labor, and equipment, and can vary according to business activity. Some organizations also split up these costs into manufacturing overheads, selling overheads and administrative overhead costs. While administrative overhead includes costs front office administration and sales, manufacturing overhead is all of the costs that a manufacturing facility incurs, other than direct costs. The labor hour rate is calculated by dividing the factory overhead by direct labor hours. You also need to take into account applied overhead costs and how to find manufacturing overhead applied.

How To Calculate Overhead Rate

If that is the case, simply substitute your per-unit numbers in the billable hours equation. All of this tracking should be relatively easy to do with proper accounting software. But exactly how you categorize overhead costs will differ from business to business. While overhead costs are not directly linked to profit generation, they are still necessary as they provide critical support for the profit-making activities. For example, a retailer’s overhead costs will be widely different from a freelancer. These ongoing expenses support your business but are not linked to the creation of a product or service. For example, if your business has six technicians, the overhead costs are divided between them.There’s more to manufacturing than the men and women handling raw materials and making a product out of them. There are also maintenance workers, janitors, and quality control staff who all play crucial roles in enabling those employees to complete their assignments.

Determine Your Monthly Overhead Costs

Critical thinking skills are required to make sense of the any of the financial ratios in a company. In order to calculate your overhead costs, you would take your overhead costs, which are $2,075 and divide them by your sales for the period, which total $32,000. Whether you work alone or have a staff of 50, overhead expenses are a part of doing business.It can price them appropriately to cover all of its costs and thereby generate a long-term profit. If the overhead rate is not included in the cost of a product, then there is a risk that the company will significantly underprice its products or services, and eventually go bankrupt. If the rate of overhead is increasing because of a plant expansion it may not be a negative indication. Additionally, if labor hours or cost are increasing while a company experiences a decrease in productivity then the overhead rate variance might appear favorable though it is not.

- You currently lease a building that houses both administrative staff and a small manufacturing area.

- These costs fluctuate from month to month and could even be zero at times.

- Overhead absorption is required by both GAAP and IFRS for external financial reporting.

- By separating manufacturing overhead from other types of overhead costs, it’s possible for the business to conduct a more thorough examination of its profitability.

Or, you might price them too high, resulting in unsold inventory and a hit to your bottom line. Of course, management also has to price the product to cover the direct costs involved in the production, including direct labor, electricity, and raw materials. A company that excels at monitoring and improving its overhead rate can improve its bottom line or profitability. Overhead expenses are generally fixed costs, meaning they’re incurred whether or not a factory produces a single item or a retail store sells a single product. Fixed costs would include building or office space rent, utilities, insurance, supplies, maintenance, and repair. Unless a cost can be directly attributable to a specific revenue-generating product or service, it will be classified as overhead, or as an indirect expense.

Software Features

If you need to know how to calculate manufacturing overhead applied costs, you first need to know what would count as an applied cost. Manufacturing overhead refers to the indirect costs of creating a product.

Purchase Price Allocation Ppa: Definition And Examples

These expenses are often called indirect costs because they are not part of business activitiesthat generate revenue. While categorizing the direct and overhead costs, remember that some items cannot be attributed to a specific category. Some business expenses might be overhead costs for others but a direct expense for your business. Manufacturing overhead is important for running a manufacturing unit.Based on this result, Bob’s spending $0.25 on overhead for every dollar he earns in sales. Looking for a way to increase profits, get control of your expenses, and keep yo… Depending on the type, size, and accounting practices of your business, you may not need some of this information, but you can always tailor equations to your own particular circumstances. Your insurance bill arrives every twelve months, but you don’t want to leave it to chance that you’ll have enough money to cover this expense. Divide your premium by 12 and earmarkthat amount only for insurance at the end of the year. Taran Soodan is the founder of Very Good Marketing Agency, helping businesses with organic growth via SEO, content marketing, partnerships, and more.Identify all the manufacturing process’s indirect costs, then add all the indirect expenses to calculate the manufacturing overhead. Once you understand the difference between direct costs and indirect costs, it becomes much easier to recognize and calculate overhead costs. Overhead costs are not directly related to any specific product or service, and unlike items such as materials, do not directly generate a profit. However, overhead costs are still part of doing business and should be accounted for properly. The lower the overhead rate, the higher your profits and the more efficient your processes.Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.You can choose another time period, but most business people find one month to be the most useful. One of the largest overhead costs that all businesses contend with is payroll. The wages you pay your employees likely make up the bulk of your monthly expenditures.

How To Calculate And Track Overhead Costs For Your Small Business

To calculate your allocated manufacturing overhead, start by determining the allocation base, which works like a unit of measurement. Now that you know what you spend every month on electricity, insurance, wages, etc., add up those numbers to calculateyour monthly overhead costs. Company A, a consulting company calculates they have $120,000 in monthly overhead costs. Since overhead costs generally have to be paid monthly, you must know your total minimum monthly cost—how much money you need to make just to stay in business. That’s simply because no business can operate for long at this level. It becomes even more important should your business be impacted by factors beyond your control, such as a natural disaster or global pandemic.There are a few business expenses that remain consistent over time, but the exact amount varies, based on production. For example, companies have to pay the electricity bill every month, but how much they have to pay depends on the scale of production. For instance, during months of heavy production, the bill goes up; during the off season, it goes down. Variable costs, in this case, are expenses such as materials, labor, and other outlays that change based on hours worked and units produced. For example, your business may find it more useful to examine overhead costs on a per-unit basis rather than according to billable hours.Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Overhead costs must be paid regardless of the company’s current volume of business. Calculate the labor cost which includes not just the weekly or hourly pay but also health benefits, vacation pay, pension and retirement benefits paid by the employer. The income statement and balance sheet must have COGS and inventory value.This is why it’s very important to have a handle on your overhead costs. By separating manufacturing overhead from other types of overhead costs, it’s possible for the business to conduct a more thorough examination of its profitability. Overhead rate is a cost allocated to the production of a product or service. The depreciation on the office building wouldn’t be added to overhead costs because it has no direct or indirect involvement in the production of the product.Using the general manufacturing costs exclusively gives you an incorrect and incomplete view of your business. Once the proper data is available overhead rate calculations are quite simple.To allocate the overhead costs, you first need to calculate the overhead allocation rate. This is done by dividing total overhead by the number of direct labor hours. Selection of allocation base includes direct machine hours and direct labor hours. A business assigns overhead costs to products on the basis of an allocation base. Actual overhead costs are any indirect costs related to completing the job or making a product.Let’s assume a company has overhead expenses that total $20 million for the period. The company wants to know how much overhead relates to direct labor costs. The company has direct labor expenses totaling $5 million for the same period. Direct costs required to create products and services, such as direct labor and materials, are excluded from overhead costs.

Want More Helpful Articles About Running A Business?

Not including your overhead costs when pricing a product or service can result in a significant loss of profit if a product is priced too low. Conversely, an incorrect estimate of overhead costs might cause you to overprice your products, resulting in sluggish inventory movement and obsolete stock gathering dust on a shelf. This measure is useful as an estimate of how efficiently resources are utilized. The lower the percentage, the more effectively your business is utilizing its resources. Divide the monthly labor cost into the total overhead cost for the month and multiply by 100 to express it as a percentage. Once you have identified your manufacturing expenses, add them up, or multiply the overhead cost per unit by the number of units you manufacture.Once you’ve categorized the expenses, add all the overhead costs for the accounting period to get the total overhead cost. For example, most businesses categorize legal expenses as overhead costs. However, if you own a law firm, these expenses directly contribute to production and hence are part of your direct costs. Businesses have to take into account both overhead costs as well as the direct expenses to calculate the long-term product and service prices. Divide the total overhead cost by the total labor cost for the month and multiply by 100 to express it as a percentage.