Content

- Is The Payback Period The Same Thing As The Break

- Payback Period Formula And Calculation

- Advantages And Disadvantages To Payback Period Method

- How To Calculate Payback Period

- Payback Period Example

- Payback Period Example With Even Cash Flows

- What Mistakes Do People Make When Using The Payback Method?

- Payback Period For Capital Budgeting

Acting as a simple risk analysis, the payback period formula is easy to understand. It gives a quick overview of how quickly you can expect to recover your initial investment. The payback period also facilitates side-by-side analysis of two competing projects. If one has a longer payback period than the other, it might not be the better option. Obviously, those projects with the fastest returns are highly attractive.When you access this website or use any of our mobile applications we may automatically collect information such as standard details and identifiers for statistics or marketing purposes. You can consent to processing for these purposes configuring your preferences below. If you prefer to opt out, you can alternatively choose to refuse consent. Please note that some information might still be retained by your browser as it’s required for the site to function. For freelancers and SMEs in the UK & Ireland, Debitoor adheres to all UK & Irish invoicing and accounting requirements and is approved by UK & Irish accountants.

Is The Payback Period The Same Thing As The Break

Small businesses and large alike tend to focus on projects with a likelihood of faster, more profitable payback. Analysts consider project cash flows, initial investment, and other factors to calculate a capital project’s payback period. The other project would have a payback period of 4.25 years but would generate higher returns on investment than the first project. However, based solely on the payback period, the firm would select the first project over this alternative. The implications of this are that firms may choose investments with shorter payback periods, at the expense of profitability. In an Energy Conservation Option usually the annual money saving is only due to energy savings and hence it is the product of the energy saved and the price of energy.

Payback Period Formula And Calculation

Since the payback period focuses on short term profitability, a valuable project may be overlooked if the payback period is the only consideration. This formula can only be used to calculate the soonest payback period; that is, the first period after which the investment has paid for itself.

- If the company expects an “uneven cash flow”, then that has to be taken into account.

- They discount the cash inflows of the project by a chosen discount rate , and then follow usual steps of calculating the payback period.

- When the cumulative cash flow becomes positive, this is your payback year.

- Perhaps in his case the profit might be worth it, depending on what else is going on in his business.

- By calculating how fast a business can get its money back on a project or investment, it can compare that number to other projects to see which one involves less risk.

- Additionally, one can utilize other capital budgeting analysis methods including net present value and internal rate of return .

Payback period is a valuable calculation for industries that are subject to projects quickly becoming obsolete. Full BioAmy is an ACA and the CEO and founder of OnPoint Learning, a financial training company delivering training to financial professionals. She has nearly two decades of experience in the financial industry and as a financial instructor for industry professionals and individuals. Another way to prevent getting this page in the future is to use Privacy Pass. You may need to download version 2.0 now from the Chrome Web Store. GoCardless is authorised by the Financial Conduct Authority under the Payment Services Regulations 2017, registration number , for the provision of payment services. Brandon is the creator of Bizness Professionals and author behind each post.

Advantages And Disadvantages To Payback Period Method

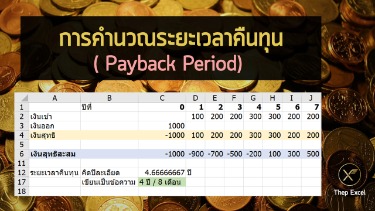

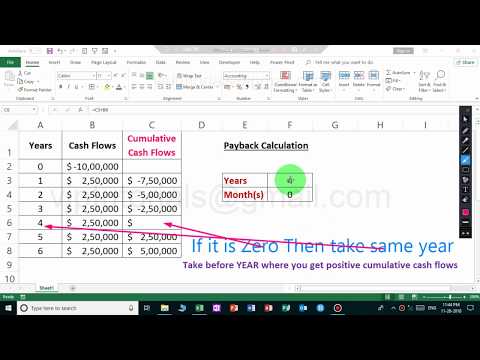

The payback period is an effective measure of investment risk. The project with a shortest payback period has less risk than with the project with longer payback period.We’ll use the second formula to calculate the payback period in the screenshot below. The more detail provided for initial cash outlays and cash inflows into a project, the more accurate the payback period will be. The shortest payback period is generally considered to be the most acceptable. This is a particularly good rule to follow when a company is deciding between one or more projects or investments.If the cumulative cash flow drops to a negative value some time after it has reached a positive value, thereby changing the payback period, this formula can’t be applied. This formula ignores values that arise after the payback period has been reached. The analysis is focused on how quickly money can be returned from an investment, which is essentially a measure of risk. Thus, the payback period can be used to compare the relative risk of projects with varying payback periods. The accounting rate of return is a formula that measures the net profit, or return, expected on an investment compared to the initial cost. The discounted payback period is a capital budgeting procedure used to determine the profitability of a project.

How To Calculate Payback Period

Let’s say the new machine, by itself, is working wonderfully and operating at peak capacity. But perhaps it’s a huge draw on the plant’s power, and its affecting other systems. Perhaps other machines need to be shut down for extended periods in order to allow this new machine to produce. Or maybe there’s something else going on at the plant that prevents it from functioning properly. By calculating how fast a business can get its money back on a project or investment, it can compare that number to other projects to see which one involves less risk. The longer an asset takes to pay back its investment, the higher the risk a company is assuming.

Is high IRR good or bad?

Keep in mind that IRR is not the actual dollar value of the project. It is the annual return that makes the NPV equal to zero. Generally speaking, the higher an internal rate of return, the more desirable an investment is to undertake.We suggest that it be used in conjunction with other analysis methods to arrive at a more comprehensive picture of the impact of an investment. The more information you have, the more accurate the payback period calculation will be and the more reliable of a measure it will be.

Payback Period Example

Payback ignores cash flows beyond the payback period, thereby ignoring the ” profitability ” of a project. The term is also widely used in other types of investment areas, often with respect to energy efficiency technologies, maintenance, upgrades, or other changes. For example, a compact fluorescent light bulb may be described as having a payback period of a certain number of years or operating hours, assuming certain costs. Here, the return to the investment consists of reduced operating costs.As the equation above shows, the payback period calculation is a simple one. It does not account for the time value of money, the effects of inflation, or the complexity of investments that may have unequal cash flow over time. Let’s say Jimmy does buy the machine for $720,000 with net cash flow expected at $120,000 per year. The payback period calculation tells us it will take him 6 years to get his money back. When he does, the $720,000 he receives will not be equal to the original $720,000 he invested.At that point, each year will need to be considered separately and then added up. The break-even point is the price or value that an investment or project must rise to cover the initial costs or outlay.

Payback Period Example With Even Cash Flows

But in the case of unequal cash inflows the PB period can be found out by adding up the cash inflows until the total is equal to initial cash outlay. This is the simplest and easiest way to understand but it does not give us the real picture as it does not consider ther time value of money or the cash flows occurring after PB period.The time value of money is an important consideration for a business. The equation does not calculate cash flows in the years past the point where the machine is expected to be paid off. It’s possible those cash flows will be higher than the previous years. Or the numbers suddenly start fluctuating downwards from year 3 on?She is a graduate of Bryn Mawr College (A.B., history) and has an MFA in creative nonfiction from Bennington College.He is currently a working professional, primarily in finance, and looks to provide resources to aspiring or current young professionals for well-rounded professional and personal development. Payback period must be looked at with awareness of the lifespan of an investment. Payback period is one of the easiest financial metrics to calculate and understand. “How to Determine the Payback Period on Investments.” Accessed Sept. 14, 2021. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.Although primarily a financial term, the concept of a payback period is occasionally extended to other uses, such as energy payback period . As you can see, discounting the payback period can have enormous impacts on profitability. Understanding and accounting for the time value of money is an important aspect of strategic thinking. For example, a project that costs $100,000 and pays back within 6 years is not as valuable as a project that costs $100,000 which pays back in 5years. The shorter time scale project also would appear to have a higher profit rate in this situation, making it better for that reason as well. The cumulative positive cash flows are determined for each period.Since this analysis favors projects that return money quickly, they tend to result in investments with a higher degree of short-term liquidity. This is a useful concept during times when long-term returns on investment are uncertain. In the waterfall chart, you can see visually that the project recoups its initial investment sometime between year 2 and year 3.A slightly more sophisticated financial analysis can be undertaken in an academic setting, as it commonly is in professional practice. As you can see in the example below, a DCF model is used to graph the payback period . A company may be tight on liquid assets or have plenty of liquidity. To analyze profitability, use profitability metrics like NPV, IRR, and cash on cash return.