Content

- Example Of The Current Ratio Formula

- A Refresher On Current Ratio

- Liquidity Ratio

- Definition Of Working Capital

- Quick Ratio

- Managing Working Capital

- Current Ratio Formula

The ratio is an indication of a firm’s market liquidity and ability to meet creditor’s demands. In many cases, a creditor would consider a high current ratio to be better than a low current ratio, because a high current ratio indicates that the company is more likely to pay the creditor back.

What does a current ratio of 2.1 mean?

So a ratio of 2.1 means that a company has twice as much in current assets as current debt. A ratio of 1:1 means the total current assets are equivalent to the total current debt. This number indicates that a company has just enough in current assets to cover all its current liabilities, but has no extra buffer.Finally, the operating cash flow ratio compares a company’s active cash flow from operating activities to its current liabilities. Apple, meanwhile, had more than enough to cover its current liabilities if they were all theoretically due immediately and all current assets could be turned into cash. However, the more current assets you accumulate , the more you may want to consider reinvesting some of it into the growth of your business. High current assets are a signal that cash inflows are coming, so now might be the time to examine your options for growth.While the balance sheet does not show performance over time, it does show a snapshot of everything your company possesses compared to what it owes and owns. This is why there are several useful liquidity ratios that can be calculated, like the current ratio. Net working capital is calculated as current assets minus current liabilities. It is a derivation of working capital commonly used in valuation techniques such as discounted cash flows . If current assets are less than current liabilities, an entity has a working capital deficiency, also called a working capital deficit.

Example Of The Current Ratio Formula

To use the quick ratio formula for Jane’s pet store, you’ll need to eliminate both inventory and prepaid expenses in the calculation, since neither can be converted to cash within 90 days. Simply take your current asset total and divide the total by your current liability total.

A Refresher On Current Ratio

If the value of a current ratio is considered high, then the company may not be efficiently using its current assets, specifically cash, or its short-term financing options. While a low current ratio may indicate a problem in meeting current obligations, it is not indicative of a serious problem.The current ratio is a financial ratio that measures whether or not a firm has enough resources to pay its debts over the next 12 months. Along with other financial ratios, the current ratio is used to try to evaluate the overall financial condition of a corporation or other organization. Financial ratios may be used by managers within a firm, by current and potential shareholders of a firm, and by a firm’s creditors. Financial analysts use financial ratios to compare the strengths and weaknesses in various companies. Ratios can be expressed as a decimal value, such as 0.10, or given as an equivalent percent value, such as 10%. There are several other liquidity ratios that you may encounter when researching the current ratio, but it’s important to remember that these ratios measure slightly different things.It indicates that the company is in good financial health and is less likely to face financial hardships. What counts as a good current ratio will depend on the company’s industry and historical performance. Publicly listed companies in the U.S. reported a median current ratio of 1.94 in 2020. For example, a company may have a very high current ratio, but its accounts receivable may be very aged, perhaps because its customers pay slowly, which may be hidden in the current ratio. Analysts must also consider the quality of a company’s other assets versus its obligations.

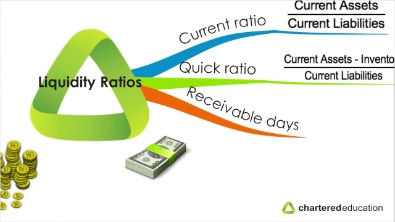

Liquidity Ratio

From a business perspective, that cash would be better spent on investments or growth initiatives. The ratio indicates the extent to which readily available funds can pay off current liabilities.

- If the inventory is unable to be sold, the current ratio may still look acceptable at one point in time, even though the company may be headed for default.

- This metric is determined by dividing relevant income for the 12 months by the cost of capital used.

- It is a derivation of working capital commonly used in valuation techniques such as discounted cash flows .

- Long-term liabilities can include bonds, mortgages, and loans that are payable over a term exceeding one year.

- Current liabilities are often understood as all liabilities of the business that are to be settled in cash within the fiscal year or the operating cycle of a given firm, whichever period is longer.

Reference to products in this publication is not intended to be an endorsement to the exclusion of others which may be similar. Persons using such products assume responsibility for their use in accordance with current directions of the manufacturer. The information represented herein is believed to be accurate but is in no way guaranteed.

Definition Of Working Capital

If inventory turns into cash much more rapidly than the accounts payable become due, then the firm’s current ratio can comfortably remain less than one. Inventory is valued at the cost of acquiring it and the firm intends to sell the inventory for more than this cost. The sale will therefore generate substantially more cash than the value of inventory on the balance sheet. Low current ratios can also be justified for businesses that can collect cash from customers long before they need to pay their suppliers. The cash asset ratio, or cash ratio, is also similar to the current ratio, but it only compares a company’s marketable securities and cash to its current liabilities.

Quick Ratio

This indicates poor financial health for a company, but does not necessarily mean they will unable to succeed. The operations current ratio is obtained by dividing total current assets by the total current liabilities and expressed as that result to one. Note that quick ratio is the same as the current ratio with the inventory removed. As discussed above, inventory can be tough to sell off so when you subtract it, nearly everything else in the liabilities is cash or easily turned into cash. “So this ratio will tell you how easy it would be for a company to pay off its short-term debt without waiting to sell off inventory,” explains Knight. “For businesses that have a lot of cash tied up in inventory, lenders and vendors will be looking at their quick ratio.” However, most people will look at both together, says Knight, often comparing the two.

Is 0.8 A good current ratio?

Lenders start to get heartburn if their customer’s company balance sheet shows a calculated current ratio of, say, 0.9 or 0.8 times. … Generally, if the ratio produces a value that’s less than 1 to 1, it implies a “dependency” on inventory or other “less” current assets to liquidate short-term debt.Current ratio is a financial ratio that measures whether or not a firm has enough resources to pay its debts over the next 12 months. However, you should remember that a higher current ratio doesn’t always mean that your business is in a healthier financial position. For example, a current ratio of 9 or 10 may indicate that your company has problems managing capital allocation and is holding too much cash in its accounts.Business Checking Accounts BlueVine Business Checking The BlueVine Business Checking account is an innovative small business bank account that could be a great choice for today’s small businesses. Designed for freelancers and small business owners, Debitoor invoicing software makes it quick and easy to issue professional invoices and manage your business finances. Learn more about how you can improve payment processing at your business today. Learn financial modeling and valuation in Excel the easy way, with step-by-step training. Notes payable are written agreements in which one party agrees to pay the other party a certain amount of cash. Our priority at The Blueprint is helping businesses find the best solutions to improve their bottom lines and make owners smarter, happier, and richer. That’s why our editorial opinions and reviews are ours alone and aren’t inspired, endorsed, or sponsored by an advertiser.

Solvency Ratio Vs Liquidity Ratios: What’s The Difference?

Current liability information found in the notes to the financial statements provide additional explanation on the liability balances and any circumstances affecting them. Accounting principles can sometimes require the disclosure of specific information for the benefit of the financial statement user. For example, companies that pay pension plan benefits require additional footnote disclosure that provide the user with additional details on pension costs and the assets used to fund it. The current ratio helps to provide insight into a company’s ability to pay their short-term obligations back with their short-term assets .

Managing Working Capital

Knowing the current ratio is vital in decision-making for investors, creditors, and suppliers of a company. The current ratio is an important tool in assessing the viability of their business interest. In finance, the Acid-test measures the ability of a company to use its near cash or quick assets to extinguish or retire its current liabilities immediately.If current liabilities exceed current assets , then the company may have problems meeting its short-term obligations . The current ratio, also known as the working capital ratio, measures the business’ ability to pay off its short-term debt obligations with its current assets. The current ratio and the quick ratio are both liquidity ratios used to measure the ability of a business to pay off debts. Working capital is a financial metric that represents the operational liquidity of a business, organization, or other entity. Along with fixed assets, such as property, plant, and equipment, working capital is considered a part of operating capital.The current ratio measures a company’s ability to pay current, or short-term, liabilities with its current, or short-term, assets, such as cash, inventory, and receivables. Current assets listed on a company’s balance sheet include cash, accounts receivable, inventory, and other current assets that are expected to be liquidated or turned into cash in less than one year. The acid-test, or quick ratio, measures the ability of a company to use its near cash or quick assets to pay off its current liabilities. Besides, the current ratio may not give you an accurate picture of your business’s liquidity if you’re a seasonal business, as assets/liabilities are likely to vary wildly depending on the period selected. As such, you should look at the current ratio over a more extended period to get a more accurate sense of your accounting liquidity and the proportion of your current assets to liabilities. The acid test ratio or the quick ratio calculates the ability to pay off current liabilities with quick assets.It is often used by lenders and potential creditors to measure business liquidity and how easily it can service debt. A good current ratio is between 1.2 to 2, which means that the business has 2 times more current assets than liabilities to covers its debts. Liquidity ratios are a class of financial metrics used to determine a debtor’s ability to pay off current debt obligations without raising external capital. For example, in one industry, it may be more typical to extend credit to clients for 90 days or longer, while in another industry, short-term collections are more critical.

Current Ratio Formula

If a company’s cash ratio is greater than 1, the business has the ability to cover all short-term debt and still have cash remaining. However, a higher ratio may also indicate that the cash resources are not being used appropriately since it could be invested in profitable investments instead of earning the risk-free rate of interest. If the cash ratio is equal to 1, the business has the exact amount of cash and cash equivalents to pay off the debts. If the cash ratio is less than 1, there’s not enough cash on hand to pay off short-term debt. There are several ratios available for analysis, all of which compare the liquid assets to the short-term liabilities. In this example, although both companies seem similar, Company B is likely in a more liquid and solvent position. An investor can dig deeper into the details of a current ratio comparison by evaluating other liquidity ratios that are more narrowly focused than the current ratio.If you’re worried about covering debt in the next 90 days, the quick ratio is the better ratio to use. If you’re looking for a longer view of liquidity, the current ratio, which includes inventory, is better. A current ratio of less than 2 may indicate financial issues and an inability to pay off current debts, while a current ratio over 4 may indicate that your business is not using its assets efficiently. Both are considered liquidity ratios, and both let you know if you have enough current or liquid assets to pay off all of your bills, should they come due.For example, to accrue a provision for product warranty costs, assume that minor repairs cost 5% of the total product sales and an estimated 5% of products may require minor repairs within 1 year of sale. Major repairs cost 20% and 1% of products may require major repairs in 3 years. A loss contingency is not reported if it can not be recognized due to improbability (not more than 50% likely to occur) and/or the amount of the loss can not be reliably measured or estimated. Gain contingencies are reported on the income statement when they are realized .