Content

- Cost Of Goods Sold Equation

- Types Of Transactions

- What Is The Extended Accounting Equation?

- Financial Statement

- Accounting Basics For Small Businesses

- Example Balance Sheet

- Extended Accounting Equation

- Financial Accounting

- Accounting Types For Accounts Receivable

Thus, the accounting equation is an essential step in determining company profitability. Financial statements are prepared to know and evaluate the financial position of a business at a certain time.Therefore, the people who use the statements must be confident in its accuracy. The rule that total debits equal total credits applies when all accounts are totaled. The cash basis of accounting records revenue when cash is received and expenses when they are paid in cash. The accounting equation is fundamental to the double-entry bookkeeping practice.Its applications in accountancy and economics are thus diverse. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes.You only enter the transactions once rather than show the impact of the transactions on two or more accounts. But, that does not mean you have to be an accountant to understand the basics. Part of the basics is looking at how you pay for your assets—financed with debt or paid for with capital. In this form, it is easier to highlight the relationship between shareholder’s equity and debt . As you can see, shareholder’s equity is the remainder after liabilities have been subtracted from assets.Total all liabilities, which should be a separate listing on the balance sheet. Think of retained earnings as savings, since it represents the total profits that have been saved and put aside (or “retained”) for future use. This number is the sum of total earnings that were not paid to shareholders as dividends. Assets include cash and cash equivalentsor liquid assets, which may include Treasury bills and certificates of deposit. Financing through debt shows as a liability, while financing through issuing equity shares appears in shareholders’ equity. Cost of purchasing new inventory is the amount of money your company has to spend to secure the necessary products or materials to manufacture your products. The break-even point tells you how much you need to sell to cover all of your costs and generate a profit of $0.

Cost Of Goods Sold Equation

The accounting equation is considered to be the foundation of the double-entry accounting system. Billie Nordmeyer works as a consultant advising small businesses and Fortune 500 companies on performance improvement initiatives, as well as SAP software selection and implementation.Expenses reduce revenue, therefore they are just the opposite, increasedwith a debit, and have a normal debit balance. Equity is the residual claim or interest of the most junior class of investors in assets after all liabilities are paid. The accrual method records income items when they are earned and records deductions when expenses are incurred, regardless of the flow of cash. Revenue is what your business earns through regular operations. Expenses are the costs to provide your products or services. Accounting equation explanation with examples, accountingcoach.com. Locate total shareholder’s equity and add the number to total liabilities.However, he has a $9,000 loan which is now recorded as a liability. In addition, John contributed $1,000 towards the vehicle, creating an equity in John’s books.

- For example, assume a company purchases office supplies on credit for $6 thousand and a credit is entered to the vendor payable account.

- Both liabilities and shareholders’ equity represent how the assets of a company are financed.

- Current assets include inventory, while fixed assets include such items as buildings and equipment.

- Receipts refer to a business getting paid by another business for delivering goods or services.

Add the $10,000 startup equity from the first example to the $500 sales equity in example three. Add the total equity to the $2,000 liabilities from example two. The accounting equation shows on a company’s balance that a company’s total assets are equal to the sum of the company’s liabilities and shareholders’ equity. Below are some of the most common accounting equations businesses should know. On your balance sheet, these three components will show how your business is financially operating. Your assets include your valuable resources, while your liabilities include any debts or obligations you owe. If your assets are financed by debt, it’ll be listed as a liability on your balance sheet.

Types Of Transactions

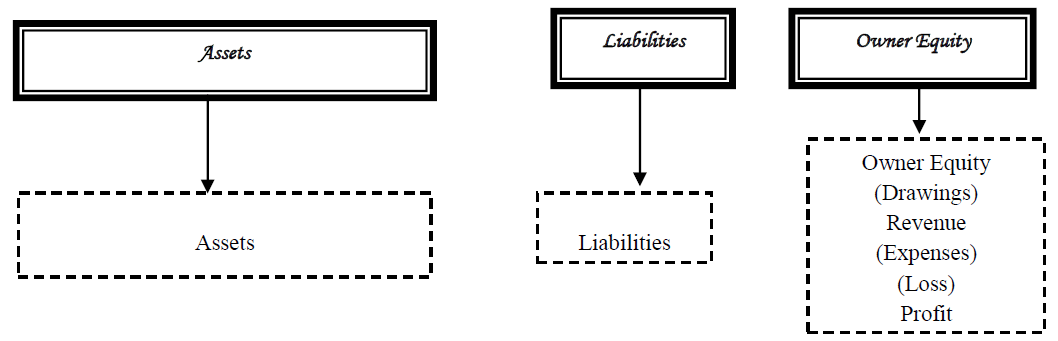

All of the basic accounting equations discussed throughout this post stress the importance of double-entry bookkeeping. The resources owned by a business are its assets; for example, assets can consist of cash, inventory, land, and buildings. The rights, claims or obligations to creditors are the liabilities. The rights of the owners are called the owner’s equity; the rights of the owners is the residual amount after deducting liabilities from assets. Preparing financial statements requires preparing an adjusted trial balance, translating that into financial reports, and having those reports audited.

What are the four basic accounting equations?

There are four main financial statements. They are: (1) balance sheets; (2) income statements; (3) cash flow statements; and (4) statements of shareholders’ equity.Single-entry accounting does not require a balance on both sides of the general ledger. If you use single-entry accounting, you track your assets and liabilities separately.

What Is The Extended Accounting Equation?

Each transaction (let’s say $100) is recorded by a debit entry of $100 in one account, and a credit entry of $100 in another account. When people say that “debits must equal credits” they do not mean that the two columns of any ledger account must be equal. If that were the case, every account would have a zero balance , which is often not the case. The rule that total debits equal the total credits applies when all accounts are totaled. Each example shows how different transactions affect the accounting equations.

Financial Statement

The accounting equation explains the relationship between assets, liabilities, and owner’s equity to maintain balance between the three main categories of accounts in a company. Learn about the definition and components of the accounting equation. For example, assume a company purchases 100 units of raw material that it expects to use up during the current accounting period. As a result, it immediately expenses the cost of the material. However, at the end of the year the company discovers it only used 50 units. The company must then make an adjusting entry to reflect that, and decrease the amount of the expense and increase the amount of inventory accordingly. An adjusting entry is a journal entry made at the end of an accounting period that allocates income and expenditure to the appropriate years.In double-entry bookkeeping, a sale of merchandise is recorded in the general journal as a debit to cash or accounts receivable and a credit to the sales account. The amount recorded is the actual monetary value of the transaction, not the list price of the merchandise. A discount from list price might be noted if it applies to the sale. Fees for services are recorded separately from sales of merchandise, but the bookkeeping transactions for recording sales of services are similar to those for recording sales of tangible goods. The process of preparing the financial statements begins with the adjusted trial balance.Learn how to record a purchase using the system of double-entry accounting. Internal controls in accounting are procedures that ensure the business is ran in the most effective, orderly, and accurate fashion. Explore definition, purpose, examples, and types of internal controls in this lesson. He borrows $500 from his best friend and pays for the rest using cash in his bank account. To record this transaction in his personal ledger, the person would make the following journal entry. Revenue and owner contributions are the two primary sources that create equity.

Accounting Basics For Small Businesses

This is because creditors – parties that lend money – have the first claim to a company’s assets. For a company keeping accurate accounts, every business transaction will be represented in at least two of its accounts. For instance, if a business takes a loan from a bank, the borrowed money will be reflected in its balance sheet as both an increase in the company’s assets and an increase in its loan liability. Knowing how to calculate retained earnings allows owners to perform a more in-depth financial analysis.

Accounting Types For Accounts Receivable

A month later the company receives the vendor’s invoice and immediately pays the invoice amount in full. The payment leads to a $6,000 credit entry to the cash account and a $6,000 debit entry to the vendor payable account. As a result, only the assets and liabilities elements of the basic accounting equation are affected by the transaction. In this instance, both the assets and liabilities are decreased, while the owner’s equity remains unchanged.