Content

See Peace of Mind® Terms for details. Enrolled Agents do not provide legal representation; signed Power of Attorney required. Audit services constitute tax advice only. Consult an attorney for legal advice. H&R Block prices are ultimately determined at the time of print or e-file. This also impacts whether you’ll need to use Form 8814 or Form 8615.State e-file not available in NH. E-file fees do not apply to NY state returns. There are a lot of things to consider about kiddie tax when deciding if your child’s income should go on their return or yours. The SECURE Act changes to the kiddie tax rate are retroactive. For 2020, the child’s standard deduction is limited to the greater of $1,100 or earned income plus $350, but not to exceed $12,500. Adult children who turn 19—or 25 in the case of dependent full-time students—by the end of the tax year are not subject to the kiddie tax.

Tax Fee Wizard

And if you made more than $11,000 in unearned income, you’ll be required to do file a separate return. How long do you keep my filed tax information on file? If you’ve already e-filed or mailed your return to the IRS or state taxing authority, you’ll need to complete an amended return. You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office. How do I update or delete my online account?

Featured Tax Reviews

First, you might want to check if you even can include your child’s income on your return. You can’t claim deductions on your return that your child would be eligible for if they had filed a separate return. No estimated tax payments were made for the child and the child’s income was not subject to backup withholding. Students who receive nontuition scholarships. Unfavorable press coverage of these consequences motivated Congress to change the kiddie tax once again. Rules for computing the kiddie tax.

- Offer valid for tax preparation fees for new clients only.

- Additional fees and restrictions may apply.

- Under the Kiddie Tax rules, a portion of a child’s (or young adult’s) net unearned income can be taxed at the federal income tax rates paid by the child’s parent.

- State e-file available within the program.

- And our partners can never pay us to guarantee favorable reviews .

- MetaBank® does not charge a fee for this service; please see your bank for details on its fees.

Intuit may, but has no obligation to, monitor comments. Comments that include profanity or abusive language will not be posted. Income from a W-2 job, freelancing, or running a business is earned income. Normal income tax rules apply to that type of income. Because of the Kiddie Tax, some college investors may want to consider filing their own separate tax returns — even if they don’t work a standard job. Even if you don’t think of yourself a “kid,” here’s what you need to know about the Kiddie Tax rate. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment.

Understanding The Kiddie Tax

Member SIPC. Unauthorized access is prohibited. This site is designed for U.S. residents.

Credit Resources

The tax law originally only covered children under 14 years of age. Children under the age of 14 cannot legally work, which means that any income they received usually came from dividends or interest from bonds. However, the tax authorities realized that some guardians would take advantage of the situation and then give stock gifts to their older, 16-to-18-year-old children. The child was a full-time student at least age 19 and under age 24 at the end of the tax year and the child didn’t have earned income that was more than half of your support. You can learn more about him on the About Page, or on his personal site RobertFarrington.com. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers.

How is kiddie 2020 calculated?

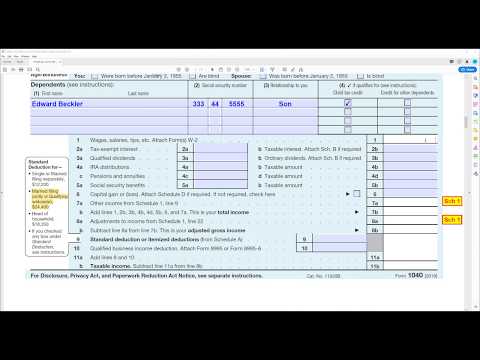

Calculating the Kiddie Tax The amount of your child’s taxable income is equal to total net income (earned and unearned) less the standard deduction. For 2020, the child’s standard deduction is limited to the greater of $1,100 or earned income plus $350, but not to exceed $12,500.Under the kiddie tax, a child is taxed at normal tax rates on earned income plus unearned income up to the threshold amount. Thus, for 2020, the normal tax rates apply to a child’s earned income plus $2,200 of unearned income. A child’s net unearned income (above the amount taxed at the child’s rate) is taxed to the child at his or her parents’ tax rate (assuming that rate is higher than the child’s rate). The 2019 legislation returns the kiddie tax to its roots of taxing children’s unearned income at their parents’ marginal tax rates for tax years 2020 and beyond.

Refunds

This is a friendly notice to tell you that you are now leaving the H&R Block website and will go to a website that is not controlled by or affiliated with H&R Block. This link is to make the transition more convenient for you. You should know that we do not endorse or guarantee any products or services you may view on other sites. For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block.

Intuit Accountants Team

H&R Block’s tax pros explain everything you need to know about investment income. But let’s now quickly review the updated Kiddie tax rules for 2018 and beyond, assuming you want to follow the favorable Secure Act change for 2018 and 2019. The child’s income is only from interest and dividends . You’re the parent qualified to make the election or you file a joint return with your child’s other parent. At the end of the tax year your child was under age 19 (or under age 24 if a full-time student).