Content

- Get Your Clients Ready For Tax Season

- What Is Lifo?

- Fifo

- How Lifo Inventory Costing Works

- Lifo Periodic

- Does Lifo Or Fifo Defer Tax Payments In Times Of Rising Prices?

- What Is Lifo Method? Definition And Example

- Impact Of Lifo Inventory Valuation

- Definition Of Lifo Method

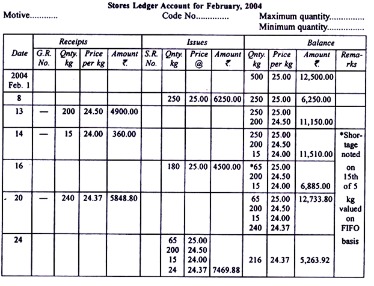

During inflation environment, cost of goods is higher whereas remaining inventory balance in lower. Through LIFO, the main advantage lies in reporting lower profits, getting around financial analysis. Furthermore, electing to use the LIFO method can be relatively complex. If you’re using FIFO, you’ll need to file Form 970 with the IRS to make the switch. You’ll be required to specify which goods LIFO will apply to, identify the inventory methods you’ve previously used for these goods, and explain what the LIFO method won’t be used for. Once you’ve started using LIFO accounting, you’re not allowed to go back to another inventory-costing method unless you get approval from the IRS. Milagro buys 80 additional units on March 25, and sells 120 units between March 25 and the end of the month.

Get Your Clients Ready For Tax Season

Upon its enactment in March, the American Rescue Plan Act introduced many new tax changes, some of which retroactively affected 2020 returns. Making the right moves now can help you mitigate any surprises heading into 2022. Following is the Tabular representation of the Calculation of Cost of goods sold and Closing inventory as of March 31st. Finally, 500 of Batch 3 items are counted at $4.53 each, total $2,265. Then, 1,500 of Batch 2 items are counted at $4.67 each, total $7,000. All 2,000 of Batch 1 items are counted at $4.00 each, total $8,000. Although there are many differences between the two sets of standards, the IFRS is considered to be more ‘principles-based’, while GAAP is thought to be more ‘rules-based’.

Why was LIFO banned?

IFRS prohibits LIFO due to potential distortions it may have on a company’s profitability and financial statements. For example, LIFO can understate a company’s earnings for the purposes of keeping taxable income low. It can also result in inventory valuations that are outdated and obsolete.Based off of this information, one can assume that if a company uses LIFO, the recorded amount of inventory is not an accurate reflection of cost of the current period. This low valuation affects the computation and evaluation of current assets and any financial ratios that include inventory, resulting in reduced comparability between companies using LIFO and others using FIFO. It makes fundamental analysis of higher cost items difficult in the recent inventory turnover.

What Is Lifo?

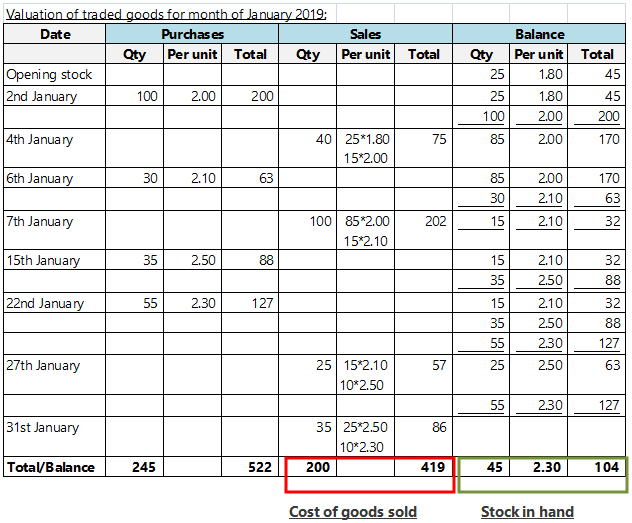

Let us use the same example that we used in FIFO method to illustrate the use of last-in, first-out method. LIFO method is more complex when the prices of the products keep fluctuating. More often than not, the LIFO method is used theoretically because, in the long run, its inventory may become very inaccurate and outdated. Most companies use this method but not completely to calculate its inventory evaluation.

Fifo

Some attributes of a LIFO method can be freely combined, while others may only be used in certain combinations. The future value or worth of any investment is the amount to which a sum of money invested today grows during a stated period of time at a specified interest rate. Managers apply the concepts of interest, future value, and present value in making business decisions.

Why is LIFO allowed?

Many companies use LIFO primarily because it allows lower income reporting for tax purposes. The conformity rule of IRC § 472(c) requires those companies to also use it for financial accounting purposes.Therefore, accountants need to understand these concepts to properly record certain business transactions. After the removal of all assets which are subject to retention of title arrangements, fixed security, or are otherwise subject to proprietary claims of others, the liquidator will pay the claims against the company’s assets. The disclosure of the LIFO reserve is better for comparing the profits and ratios of a company using LIFO with the profits and ratios of a company using FIFO. LIFO is simple to understand, easy to operate among these inventory management systems. Use LIFO on the following information to calculate the value of ending inventory and the cost of goods sold of March.These non-recurring items are adjusted so that the financial statements will better reflect the management ‘s expectations of future performance. If a company uses LIFO, recorded inventory is not an accurate reflection of cost of the current period. This low valuation affects the computation and evaluation of current assets and any financial ratios that include inventory, reducing comparability between companies using different methods. The change in the balance in the LIFO reserve will also increase the current year’s cost of goods sold. This in turn reduces the company’s profits and therefore, taxable income.

How Lifo Inventory Costing Works

The LIFO method assumes that the most recent products added to a company’s inventory have been sold first. The costs paid for those recent products are the ones used in the calculation. Let’s assume you own a retail store and use thefirst in, first out methodof accounting.

Lifo Periodic

This increases the recorded cost of goods, reduces the recorded profit, and therefore lowers income taxes as well. The only reason for using LIFO is when companies assume that inventory costing methods and the higher inventory cost themselves will increase over time providing a higher value, which means prices will inflate. While implementing LIFO system, cost of inventories at the end of inventory face price increases, as compared to inventories, purchased earlier. Due to the rising prices of already present inventory items this becomes a little complex. Voluntary changes in inventory costing methods generally are applied retrospectively for financial reporting purposes.The first timepoint is indicated by the last LIFO valuation performed. The total of the existing layer quantities or values represents the corresponding stock. In law, liquidation is the process by which a company is brought to an end, and the assets and property of the company are redistributed. Liquidation is sometimes referred to as ‘winding-up’ or ‘dissolution’, although dissolution technically refers to the last stage of liquidation. Under FIFO technique, cost of inventory is related to the cost of latest purchases, that is Rs.70.

- However, the Code and regulations require the cumulative effects of inventory method changes to be treated prospectively.

- Due to inflation and general price increases, the amount of money companies pay for inventory will usually increase over time.

- Now he wants to calculate the cost of goods sold while taking the inventory using the LIFO method.

- In prior budgets, the Obama Administration has proposed to repeal LIFO altogether in an attempt to generate greater tax revenues.

- Congress has threatened to outlaw the method as the Internal Revenue Service introduces laws and requirements that make using the LIFO method inconvenient at best.

- The IFRS provides a framework for globally accepted accounting standards.

- GAAP loom larger than accounting for inventories, particularly the disallowance of the last-in, first-out method in IFRS.

Due to LIFO’s potential to skew inventory value, UK GAAP and IAS have effectively banned LIFO inventory accounting. By moving high-cost inventories to cost of goods sold, businesses can lower their reported profit levels and defer income tax recognition for the total purchases. As a result, the ending inventory balance is valued at previous costs whereas the most recent costs appear in the cost of goods sold. Larger ending inventory unit cost value causes complications in goods calculation, which affects the current financial health and net profit of the company. Imagine that your business purchased 100 faucets one year ago at a per-unit price of around $10.Such considerations could come to the fore with the proposed adoption by U.S. public entities of IFRS, which does not permit last in, first out for financial accounting. Many companies use LIFO primarily because it allows lower income reporting for tax purposes.This is a common problem with the LIFO method once a business starts using it, in that the older inventory never gets onto shelves and sold. Depending on the business, the older products may eventually become outdated or obsolete. Brad prides himself on always making sure his store carries the latest hardcover releases, because traditionally sales of them have been reported as very good. However, the book industry has been going through a hard time recently with an increase in customers switching to digital readers, meaning less demand. In other words, more expensive inventory is expensed before less expensive inventory effectively lowering profits and taxable income.

Impact Of Lifo Inventory Valuation

However, indirect effects—for example, bonuses—are reflected prospectively . LIFO stands for last-in, first-out, meaning that the most recently produced items are recorded as sold first. Due to inflation, the amount of money companies pay for inventory will usually increase over time. If a company decides to undergo LIFO liquidation, the old costs of inventory will be matched with the current, higher sales prices resulting in a higher tax liability. Income tax deferral is the most common answer for using LIFO while evaluating current assets.The conformity rule of IRC § 472 requires those companies to also use it for financial accounting purposes. Therefore, CPAs may be called upon to help manage inventory method changes. Companies using LIFO would have to switch to FIFO or average cost. The change would place companies in violation of the conformity requirement. Absent relief from the Treasury Department, it would require them to change their tax method of inventory reporting.LIFO is used only in the United States, which is governed by the generally accepted accounting principles . Section 472 of the Internal Revenue Code directs how LIFO may be used. Last-In, First-Out method is used differently under periodic inventory system and perpetual inventory system.Another option is the weighted average method, which calculates the average cost for all items currently in stock. GAAP sets accounting standards so that financial statements can be easily compared from company to company. GAPP sets standards for a wide array of topics, from assets and liabilities to foreign currency and financial statement presentation. Under LIFO, using the most recent costs first will reduce the company’s profit but decrease Brad’s Books’ income taxes. It is a method used for cost flow assumption purposes in the cost of goods sold calculation.Depending on the unit cost and timing of inventory transactions, the LIFO method can generate a number of tax benefits due to profitability impacts on the income statement. Dollar value LIFO uses this approach with all figures in dollar amounts, rather than inventory units. As a result, companies have a different view of their balance sheets than under other methods, such as FIFO (first-in, first-out). The subject company’s financial statements may be affected by events that are not expected to recur, such as the purchase or sale of assets, a lawsuit, or an unusually large revenue or expense.With FIFO, the cost of inventory reported on the balance sheet represents the cost of the inventory most recently purchased. FIFO most closely mimics the flow of inventory, as businesses are far more likely to sell the oldest inventory first. The LIFO method is an acronym used in accounting and many computational concepts for Last-In, First-Out. In accounting, this is used to compute the number of goods sold over a duration of time when taking inventory.