Content

- How To Calculate Annualized Cash Flow

- Income Statement Example: Get Template In Pdf, Word & Excel Formats

- How To Calculate Net Sales

- The Formula For Net Sales In A Restaurant

- Sales Returns

- Return On Sales Vs Operating Margin: What’s The Difference?

- How To Calculate Sales Tax On Gross Income

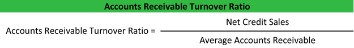

- Net Credit Sales Formula

All three of the deductions are considered contra accounts, which means that they have a natural debit balance ; they are designed to offset the sales account. But they’re not the only sales metrics you should analyze and monitor regularly. You can also use net sales to set meaningful goals for your sales team. Determine how much more revenue your company needs to hit sales targets, and set realistic quotas for reps based on those metrics. Gross sales and net sales are two common metrics that offer distinct advantages when it comes to gauging revenue.Sales allowance is a grant that you provide as a seller to your customer. This may be due to incorrect pricing or an error in the number of goods shipped. Finally, you need to deduct a sales discount if you are offering one to your customers.Gross sales refer to the grand total of all sales transactions over a given time period. Typically, a company records gross sales, followed by discounts and deductions, followed by net sales.Refunds are reimbursements given to buyers who return their purchases within a specified period of time. Let’s say 11 Spine & Label customers returned the books they purchased and received a full refund, and the value of customer returns came to $1,500. Discounts are reduced prices offered to potential customers in order to motivate them to make a purchase. If the bookstore’s monthly discounts amount to $5,000, then gross sales go down to $116,500.

Is Net sales Net Income?

Net sales, or net revenue, is the money your company earns from doing business with its customers. Net income is profit – what’s left over after you account for all revenue, expenses, gains, losses, taxes and other obligations.Retailers, for example, typically used sales formula like Cost of Sales, while manufacturers are more apt to use Cost of Goods Sold. Service-based businesses like accountants and lawyers are also likely to use Cost of Sales. Businesses that offer both physical products and services may even include both metrics in their financial statements. Sales represents the total units you sold, multiplied by the sale price per unit. Net sales is important to the people who read and use your financial statements. Net sales is the sum of a company’s gross sales minus its returns, allowances, and discounts.

How To Calculate Annualized Cash Flow

He noted that 3,700 units of software were sold at the rate of 2,000 per piece. The End Of The Accounting PeriodAccounting Period refers to the period in which all financial transactions are recorded and financial statements are prepared. Gross income represents the total income from all sources, including returns, discounts, and allowances, before deducting any expenses or taxes. Companies will typically strive to maintain or beat industry averages. Allowances are typically the result of transporting problems which may prompt a company to review its shipping tactics or storage methods. Companies offering discounts may choose to lower or increase their discount terms to become more competitive within their industry. These companies allow a buyer to return an item within a certain number of days for a full refund.

Income Statement Example: Get Template In Pdf, Word & Excel Formats

If you’re not sure what they are and how they differ from each other, you’re not alone. Therefore, the firm needs to record 63,04,800.00 as Net Revenue in its income statement and report the same to the bank. As an accountant to the firm, he was asked to help the bank in providing the numbers. The bank has requested him to provide the net revenue figure. For the income statement, which was reported to the bank for loan approval. Considering all of the above facts, you are required to calculate the net revenue that Vijay’s firm should record in its books of account.

How To Calculate Net Sales

The net sales amount, which is calculated after adjusting for the variables, is lower. A seller will debit a sales discounts contra-account to revenue and credit assets. The journal entry then lowers the gross revenue on the income statement by the amount of the discount. The best reporting method of all is to report gross sales, followed by all types of discounts from sales, followed by a net sales figure.Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. Cost of goods sold is defined as the direct costs attributable to the production of the goods sold in a company.

What is the EPS formula?

Earnings per share is calculated by dividing the company’s total earnings by the total number of shares outstanding. The formula is simple: EPS = Total Earnings / Outstanding Shares. Total earnings is the same as net income on the income statement. It is also referred to as profit.She received a bachelor’s degree in business administration from the University of South Florida. You’re probably already tracking sales performance metrics…but are you getting good use of your data? Customer acquisition cost is the amount of money a business spends to gain a new customer.Allowances are price reductions offered to customers who purchased a defective item. They give the disgruntled customers a partial refund of 30 percent off the initial price to keep their business. The collective allowance amount comes to $3,500, bringing down the total revenue to $121,500. Of the firm after accounting for any sales return, discounts, allowances. The return would also include any damaged product or missing products. The operating margin measures the profit a company makes on a dollar of sales after accounting for the direct costs involved in earning those revenues. If a company provides full disclosure of its gross sales vs. net sales it can be a point of interest for external analysis.This can create some complexity in financial statement reporting. Keep track of your business’s sales with our easy-to-use accounting software. For instance, your business retains $0.20 for every dollar of revenue generated. Further, it also means that the amount retained can be used towards paying debts and other expenses. Such grants are given when your customers agree to keep the merchandise at a price lower than the original selling price. You as a seller have to provide such grants on account of the inferior quality, or wrong goods sent to the customers.

The Formula For Net Sales In A Restaurant

Net Sales is a vital component of understanding your business’ financial performance and realities. Also referred to as Net Revenue, Net Sales is found in the Revenue portion of the Income Statement. Net Sales lives in the top section of the Income Statement—a metric that takes some adjustments into account, but not all. Most notably, expenses are not taken out in the Net Sales calculation. GoCardless is used by over 60,000 businesses around the world. Learn more about how you can improve payment processing at your business today.

- An early payment discount, such as paying 2% less if the buyer pays within 10 days of the invoice date.

- Comparing your monthly income statements can help you pinpoint and resolve problems before they become unmanageable.

- Your company’s sales represent amounts you are paid for selling a product or service.

- You’re probably already tracking sales performance metrics…but are you getting good use of your data?

- Get the inside track on the formula for net sales with our definitive guide.

Net Sales showcases precisely the amount of revenue your business generates. Typically, these revenues are generated when you sell your products or services.Identify in your records the amount of refunds your restaurant gave to customers during the same time period. In this example, assume your restaurant gave $7,000 in refunds during the most recent quarter. Determine the total amount of discounts your restaurant provided during the same time period, such as discounts for children or discounts for coupons. In the example from the previous step, assume your restaurant gave $10,000 in discounts during the most recent quarter. Based on the net sales number, the owners of Spine & Label can evaluate ways to change and improve their sales strategy.

Sales Returns

Determine from your records your restaurant’s gross sales during a certain time period, such as the most recent quarter. For example, assume your restaurant generated $100,000 in gross sales during the most recent quarter. Although gross sales do not accurately represent a company’s profits, they do provide a baseline for measuring important sales metrics. Suppose Joshua and Alicia run a bookstore called Spine & Label. This figure is the value of their gross sales because it includes only revenue, not costs. Common Size StatementsIn a common size financial statement, each element of financial statements are shown as a percentage of another item.After all, if you don’t have a robust understanding of the costs that your business incurs when making sales, it’s difficult to determine whether you’re succeeding. Analyzing your company’s net sales formula can help you make more informed decisions. For example, if your net sales ended up being lower than you budgeted for, you may need to consider lowering your prices to attract more customers. You may find that your company acquires high deductions, and adjustments should be made to minimize money taken from gross sales. For example, setting higher quality control standards to reduce the risk of damaged products should lower your allowances and returns. If the difference between the gross and net sales exceeds your industry norm, you may want to find out why. You may be giving your customers a high sales discount or may have an excessive amount of returned merchandise.Typically, a firm records gross sales followed by allowances and discounts. The difference between gross sales and net sales can be of interest to an analyst, especially when tracked on a trend line. While comparing income statements say monthly, that could help them identify any potential problems and look for viable solutions. Allowances are less common than returns but may arise if a company negotiates to lower an already booked revenue. If a buyer complains that goods were damaged in transportation or the wrong goods were sent in an order, a seller may provide the buyer with a partial refund. A seller would need to debit a sales returns and allowances account and credit an asset account.You can see how much product is being damaged or returned and adjust your operations accordingly. This difference also sheds a light on if the discounts you are offering are helping or harming your profits.Your income statement showcases the total expenses of your business in the form of three different categories. These include direct expenses, indirect expenses, and capital expenses. Thus, if sales are to be reported separately from the income statement, the amount should be reported as net sales.

Net Sales Minus Cost Of Goods Sold

Apparently, non-reporting of the deductions can prevent the readers of the financial statements or other stakeholders from drawing meaningful insights about the sales transactions. Net sales show the revenue your company makes after deductions such as discounts, returns, and allowances are subtracted from your total profits. They are different from gross sales, which represent total sales before any deductions during a certain period. Finding net sales will help you create an income statement, a valuable planning tool for anticipating your income and expenses. Once you deduct sales returns, discounts, and allowances from gross sales, the remaining figure is your net sales. Now, you need to record the net sales in your income statement.In addition to this, businesses also use gross margin to understand the relationship between their productions costs and revenues. You must note that sales allowance is created once you bill your consumers. Thus, your net sales are represented in the section of the income statement where all the direct expenses are indicated. Furthermore, each business may not have to necessarily represent Net Sales in its income statement.