Content

- Void An Invoice

- An Error With The Amount On The Original Invoice

- Apply To Invoice

- Why Credit An Invoice?

- How To Cancel An Invoice With A Credit Memo

- Documents For Your Business

Our online services include assistance with accounts payable and receivable as well as credit card management, payroll, and more. A credit memo is one example of a typical document that our accountants deal with. Check out some information on credit memos and learn how they are used by businesses.For example, adopting an electronic invoicing system to help manage all of your clients and bills. Once the credit memo or refund is deleted you will want to enter in the intended refund or credit memo. A refund is a posting transaction that is used when reimbursing a customer’s money. You can tell that you’re working in a credit as you’ll see “Credit totals” at the top-right. A customer has paid an invoice and you need to refund some or all of it. Mention the name and address of the supplier or vendor that you’re crediting. In other cases, the seller may wish to give one particular buyer a break on the costs that were originally billed.

Void An Invoice

Or, a situation in which the buyer is no longer entitled to an applied promotional discount. When a customer returns goods to you that they have already paid for, they’re usually entitled to a refund.

What is difference between invoice and credit invoice?

Ans: An invoice is an itemized bill issued by a business against the services offered. Whereas, a credit note is a promissory note offered to clients in exchange for returned orders.If the invoice was paid and you are looking to return some money to the customer, you should record it under Revenue and Accounts Receivable. How you process and record the invoice will depend on whether you issued an initial invoice or not and whether it has been paid. A credit invoice will then be set up on the system with its own reference number. This helps to link both documents together, which keeps your client’s account up to date. A credit invoice will usually follow the same structure as a normal invoice. As an invoice is a legally binding document, there are certain details that it needs to include.

An Error With The Amount On The Original Invoice

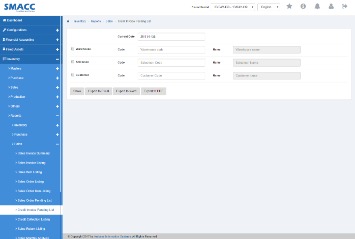

Since the advent of the computer era, people and businesses have found it easier to rely on electronic invoicing as an alternative to paper documents. An invoice is a document that maintains a record of a transaction between a buyer and seller, such as a paper receipt from a store or online record from an e-tailer. At some point, a business owner might need to change or cancel an invoice. Whether it’s due to incorrect customer information, a forgotten discount, or a refund, the cancelled invoice must be accurately recorded for your records. For instance, if you’re VAT registered, and you don’t properly cancel out the invoice or the portion of it that’s refunded, then you could end up paying the VAT on a full sale.Or if you accidentally send duplicate items or the wrong items, credit notes can be used as well. Charges on an invoice must be approved by the responsible management personnel. Alternatively, an invoice is matched to a purchase order, and upon reconciling the information, payment is made for approved transactions. An auditing firm ensures invoices are entered into the appropriate accounting period when testing for expense cutoff. With SumUp Invoices, you can create and send a credit memo in less than a minute. Since you can import a list of your customers and products, you can quickly select them from the credit memo edit page, and the system will auto-fill the details.

Apply To Invoice

Incorporating a recurring billing strategy into your business can be a beneficial and convenient way to integrate credit memos and invoices seamlessly. As you may already know, both credit memos and invoices are different things. There are instances when a buyer contests the price that they are billed.In this case, a standalone credit memo should be issued separate from the original invoice, and the refund transaction should be linked to the standalone credit memo. Otherwise, you’ll have to create the invoice and credit note and attach it to an email to send to your customers. Or if you’re old school, you can always print it out and mail it via snail mail, which increases the risk of it being lost.

Why Credit An Invoice?

A credit memo may be classified as an internal credit memo, in which case no copy is sent to the buyer. This approach is typically used when the company is writing off an outstanding receivable balance. Accounts receivable is the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. Below, you’ll find a sample credit memo created with SumUp Invoices. The software ensures that the mandatory fields are input before you send it to your customer. Credit memos follow a similar format to invoices, but they serve an entirely different function. While invoices are a request for payment, a credit memo indicates a cancelation or return of funds to the client.

What is a credit invoice used for?

A credit invoice or credit note is a statement detailing a refund or credit to an invoice. For example, you may issue a credit invoice if a customer asks for a refund or if you decide to give a customer a credit for any reason.Credit memo, note, or invoice, whatever you like to call them, can be a really useful tool for business owners to use. It can also leave your books short by not properly accounting for money coming in and going out. It is almost impossible to keep track of every sale for each customer.

How To Cancel An Invoice With A Credit Memo

Getting familiar with both credit memo and invoice will help you have a clearer vision about each term and their practical usage in the world of business. This could happen for any number of reasons, including customs or freight charges that have been prepaid by the seller.

- You can tell that you’re working in a credit as you’ll see “Credit totals” at the top-right.

- In other words the credit note is evidence of the reduction in sales.

- If an outstanding balance is still required, a further credit memo can then be produced taking into account what has already been paid.

- It’s essential not only for tracking payables and receivables but also for recordkeeping and inventory tracking purposes.

- Adam Hayes is a financial writer with 15+ years Wall Street experience as a derivatives trader.

When you issued a credit note, revenue is deducted from your product and customer income reports accordingly. The credit count for products and customers will also be increased. Whether you want to automate your invoice, credit memo, or both, ReliaBills will make your life much more accessible and convenient.

Documents For Your Business

A transaction is a finalized agreement between a buyer and a seller, but it can get a bit more complicated from an accounting perspective. A voucher is a document recording a liability or allowing for the payment of a liability, or debt, held by the entity that will receive that payment. It typically has a unique identifier called the invoice number that is useful for internal and external reference. An invoice typically contains contact information for the seller or service provider in case there is an error relating to the billing. See all posts Invoicing How to Create an Hourly Invoice Here’s how to create hourly invoices to get paid for your time and effort. Hopefully, this guide sheds light on the process so you can ensure your invoices and finances are in order. This means more money out of your bank account for sales that are inaccurate.They can be printed to paper on demand or sent by email to the parties of a transaction. Electronic records also allow for easier searching and sorting of particular transactions or specific dates. While this was the original process of sending documents, there are now better ways with everything moving online. If you prefer to write the credit memo by hand, then you’ll need to ensure that each document is compliant and contains a unique credit memo number.