Someone who is paid a salary is paid a fixed amount in each pay period, with the total of these fixed payments over a full year summing to the amount of the salary. There is no linkage between the amount paid and the number of hours worked. Someone receiving a salary is usually in a management or professional position. A salary is a set amount an employee is paid for work, usually based on a yearly time frame.

Employee compensation fluctuates with the amount of work they do, so you can adjust your costs based on revenue. Hourly employees can also be employed part-time, which may mean they don’t expect benefits, such as health insurance and retirement plans. Norms exist in many industries to dictate whether a role is salaried or hourly. They don’t include other types of compensation or benefits that might be available for the employee such as health insurance or retirement. There is also a difference between salary and wages in regard to the speed of payment.

Employee pay is typically one of the more significant expenses of any business. Depending on your industry, your total payroll may account for 18 to 52 percent of your operating budget. Let’s take a deep dive into the pros and cons of each wage type to help you make your decision. Let’s consider a full-time employee who works as a marketing manager for a small business.

If they only come in for 20 hours in a week, they’ll only receive $300 for that pay period. The waged person are said to be doing “blue collar labour job” which implies that an individual is engaged in the unskilled or semi-skilled job and is drawing wages on a daily basis. There are also exemptions to overtime pay for certain industries, including amusement parks, airlines, movie theaters, restaurants, and some agricultural businesses. That said, some types of employees are known as “exempt,” which means some of the overtime or FLSA rules don’t apply to them.

By contrast, in many roles classified as knowledge work, the employee’s contribution isn’t about time but about outcomes or deliverables. The outcomes are often scalable, so revenue doesn’t correlate with hours worked, and workers may be more likely to seek full-time roles with steady paychecks and benefits. Each structure has pros and cons, so consider both before deciding on a plan for each role. Like salary, average hourly rates vary widely based on industry, job role, and location. Let’s say their company has a busy month and they average 45 hours per week. Since they earn a salary, they’ll still get $2,300 on each paycheck despite the extra hours.

Payroll Mistake? Send This Payroll Error Letter to Employees

Whether you compensate a role with an hourly wage vs. a salary depends on a lot of factors in your business and the job market. Consider the norms for the type of role you’re hiring and the industry you’re in. Think about which structure makes fiscal sense based on your business’s cash flow and revenue. Salary pay is usually a good fit for full-time employees that work a typical 9-5, whereas paying people on an hourly basis may be more appropriate for part-time workers or employees whose schedules vary more from week to week. A salary is when you pay employees the same amount each pay period regardless of how much they work. In contrast, a wage is an hourly rate you pay employees based on how much time they put in during a pay period.

- Hourly wage employees must be paid the federal or state minimum wage rate, whichever is higher.

- Accounting for these fluctuations can be time-consuming, but you can streamline your payroll process using software like Hourly that automatically tracks time and calculates payroll for hourly workers.

- The expression of a person’s pay rate varies depending on whether that person receives a salary or wages.

If you have multiple hourly rate employees, your payroll will fluctuate based on the number of hours each person works. Say they pick up extra shifts during the holidays when the store gets busy and work 44 hours in one week. Their employer needs to pay them $600 (at the pay rate of $15 per hour) for the first 40 hours and at least $90 (at the pay rate of $22.50 per hour) for their four overtime hours, giving them a total of $690 for the week.

Paying Wages: Pros and Cons

Salaried persons are generally said to be doing “white collar office jobs” which implies that an individual is well educated, skilled and is employed with some firm and holds a good position in the society.

Both hourly and salaried employees are eligible for overtime at a rate of time and a half if they are non-exempt workers, which includes people who earn less than $684 per week (or $35,568 per year). You can hire a mix of employees with some paid hourly and some paid salary. Decide which compensation type makes the most sense for each role based on the responsibilities and experience required. It doesn’t include other types of compensation that might be included in an employee’s paycheck, such as commissions, bonuses, stipends, reimbursements or benefits, such as retirement contributions and health insurance plans. Since they don’t fall under any FLSA exemptions, they’re considered a covered non-exempt employee, meaning they’re entitled to earn minimum wage and overtime pay. Since they have a professional role and earn a salary higher than $35,568 per year, they’re exempt from the FLSA rules and are not entitled to overtime pay when they work more than 40 hours a week.

Having mostly or exclusively salaried workers also stabilizes your payroll, so costs will remain the same regardless of how much or how little business you do. In this guide, we’ll explain the difference between hourly wage versus salary pay, the pros and cons of each and how to determine which is best for your business. An employee is supposed to work for certain fixed hours daily but if Sometimes the work is not finished in time the employee has to devote his extra time without any additional pay. An employee is entitled to leaves, perks, and benefits, i.e. salary will be given if an employee has availed a leave and didn’t turn up for the work. When comparing hourly pay to salaries, there’s no option that’s always better. Salaries offer more consistent employee payments and can make running payroll easier.

It doesn’t mandate overtime pay for holidays or other off-shifts as long as those are included in the 40-hour work week, but many employers offer additional pay for these shifts. Instead, an employer pays an employee based on how many hours they work each pay period, which might be a week, two weeks, half a month or a month. Hourly wage employees must be paid the federal or state minimum wage rate, whichever is higher. The expression of a person’s pay rate varies depending on whether that person receives a salary or wages. Thus, a person may receive a salary of $52,000, or wages of $25.00 per hour.

The difference between salary and wages

Employers pay on a weekly, biweekly or semimonthly schedule and base paychecks on a fraction of the annual salary. Employees must be paid a minimum of $684 per week to qualify as salaried, which also excludes them from being eligible for overtime pay. The term salary and wages is often confused by people and is used interchangeably.

An employer can’t dock pay for a salaried employee for any week in which the employee worked or was available and willing to work, regardless of how many hours they put in. Salaried employees tend to also be entitled to paid time off, such as vacation and sick leave. They’ll get paid normally for that time off, even if they don’t work at all within a workweek. If there’s a slower month and they average 35 hours per week, they’ll still get their set amount of $2,300 on each paycheck. The greatest benefit of paying employees a salary is attracting more senior workers, who tend to expect a stable paycheck and benefits.

Salaried Employee Example

How you pay an employee―in addition to how much―could determine whom you can attract to the role and how the employee impacts your business’s finances long-term. As of 2022, the average annual pay for salaried jobs in the U.S. is $54,132. But this can vary widely based on factors like your company’s location or industry and an employee’s education level. Employers often use wages to pay part-time employees, seasonal staff, restaurant employees, or gig workers (such as in construction). From the perspective of the employee, another difference is that a salary provides a guaranteed fixed income, while a wage provides a variable income that may be higher or lower than the annual rate of pay provided by a salary. Wage is termed as a compensation that is given on the basis of the amount of work done and the hours spent in doing that.

- The term salary is the agreed upon amount of money between the employer and the employee that is extended at regular intervals on the basis of an individual’s performance.

- If you want to figure out what competitive pay means for your business, look at the average salaries for your city, state, and industry.

- This article presents you the important differences between salary and wages in tabular form.

- Someone receiving a salary is usually in a management or professional position.

- A salary is a set amount an employee is paid for work, usually based on a yearly time frame.

When divided by a number of months the amount to be disbursed monthly is ascertained. Accounting for these fluctuations can be time-consuming, but you can streamline your payroll process using software like Hourly that automatically tracks time and calculates payroll for hourly workers. On the flip side, their pay will be lower when they work fewer hours in a week.

If a person is paid a salary, he is paid through and including the pay date, because it is very simple for the payroll staff to calculate his salary, which is a fixed rate of pay. However, if a person is paid wages, he is usually paid through a date that is several days prior to the pay date; this is because his hours may vary, and the payroll staff needs several days to calculate his pay. The essential difference between a salary and wages is that a salaried person is paid a fixed amount per pay period and a wage earner is paid by the hour.

Business

Wages are variable and do vary with day to day functioning of an individual. Wages are given to labours who are engaged in manufacturing processes and get the compensation on a daily basis. The term salary is the agreed upon amount of money between the employer and the employee that is extended at regular intervals on the basis of an individual’s performance. Salary is generally a fixed amount of package calculated on an annual basis.

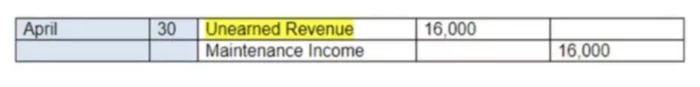

If a person is paid wages and there is a gap between the last day worked for which he is paid and his pay date, that gap is paid in his next paycheck. This gap does not exist for a salaried worker, since he is paid through the pay date. Thus, pay is much more likely to be accrued in a company’s financial statements for a person being paid wages than for someone being paid a salary.

If you want to figure out what competitive pay means for your business, look at the average salaries for your city, state, and industry. You can also offer perks, such as employee benefit packages, on top of a salary to attract top talent. When you begin to hire people for your business, you have to make some choices, like what roles to hire for and how much to pay people. For instance, construction workers make an average of $35.04 per hour, while the typical retail worker earns $23.04 per hour.