Content

- Filing A 1099 Form Without An Ein Number

- Form W

- How To Generate 1099 Forms From Quickbooks

- Do I Need To Get A W9 From My Vendors?

- Besides A Client, Who Might Ask Me To Fill Out Form W

- When Does Your Business Need A W

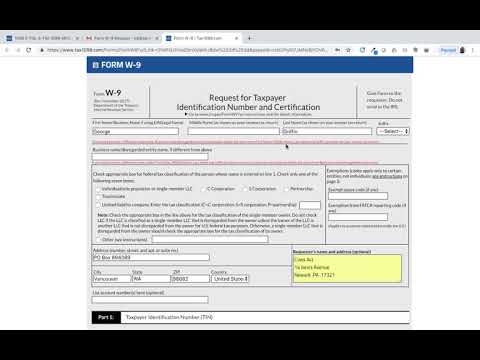

Some vendors will fill out a form like one of the Form W-8 or similar forms for foreign persons. Form W9 is an Internal Revenue Service form for vendors to fill out and provide to the trades or businesses that pay them. With regards to business payments, the EIN, ITIN or SSN can only be used by the vendor for US business tax obligations and cannot be used for US personal tax obligations.Comparisons Trying to decide between two popular software options? Case Studies & Interviews Learn how real businesses are staying relevant and profitable in a world that faces new challenges every day. Best Of We’ve tested, evaluated and curated the best software solutions for your specific business needs. It’s jam-packed with advice, guides, and informational blog posts like this one. Everything inside is designed to help business leaders as you succeed. Your account is fully activated, you now have access to all content.Payables automation software seamlessly integrates with the payer’s ERP system or accounting software. IRS W-9 Form is known as Request For Taxpayers Identification Number and Certification Form. Less “B” notices to work – As you increase the number of 1099s that are issued, you will also increase the likelihood of receiving “B” notices from the IRS. When submitting a 1099 form to the IRS without a TIN number or with a TIN that doesn’t match the legal name on the W-9, you will likely receive a CP2100 or CP2100A notice. This is an error notice from the IRS saying the 1099 form you submitted was not correct.

Who is required to fill out a W9?

The W-9 form must be filled out by self-employed workers such as independent contractors, vendors, freelancers and consultants. This form allows businesses to keep track of their external workforce. As a contractor or freelancer, you may have completed jobs for multiple businesses.So back to W-9 forms and what you need to know about the 1099-MISC. If you are U.S. person and fill out a W-9 for a client , you will most likely receive a 1099-MISC form.

Filing A 1099 Form Without An Ein Number

Hold onto Forms W-9 for active contractors and inactive contractors for whom you’ve filed a 1099 in the past three years. If they’re paper forms, make sure to keep them in a locked filing cabinet. Form W-9 is an Internal Revenue Service form used to verify and certify that you are working with a legitimate business that is paying its taxes.

- Vendors accurately enter their W9 information online through the supplier portal, reducing the accounts payable team’s workload.

- If the EIN begins with any other numbers, the company must use a W-9 .

- You can stop backup withholding when you receive a completed W-9.

- It collects the vendor’s name, address, business type, and taxpayer identification number , and it certifies an individual’s or entity’s legal eligibility to work.

- IRS Forms 940 and 941 must be filled out to ensure you’re paying employment taxes.

- Unless you’re told otherwise through a W-9 or an IRS letter, non-employee workers are fully responsible for paying their taxes.

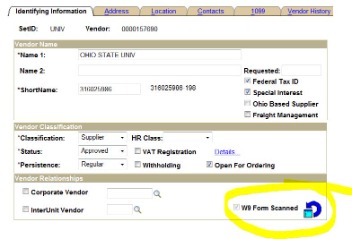

Construction Management This guide will help you find some of the best construction software platforms out there, and provide everything you need to know about which solutions are best suited for your business. Vendors accurately enter their W9 information online through the supplier portal, reducing the accounts payable team’s workload. Members of the accounts payable team don’t need to manually enter paper W9 forms from vendors or constantly follow-up to get completed forms. Each University department is responsible for requesting the initial substitute form W9 from new vendors. Has the IRS sent you a letter telling you that you are subject to mandatory backup withholding?

Form W

For context that would be a $2.4 million dollar penalty on $10 million dollars paid to a vendor. The risk here is massive and really not understood by many companies. The ITO will provide the forms after receiving a completed Business Visitor Questionnaire. The W-8BEN is used to confirm that a vendor is a foreign person and must be provided even if the vendor is not claiming a tax treaty reduction or exemption from withholding. Therefore, all foreign vendors must provide a W-8BEN even if no ITIN or SSN exists, unless another W-8 series form is provided. A valid W-8BEN must be provided before payment is issued by Vanderbilt. Form W9 is an IRS form a vendor submits with a taxpayer identification number and contact information to businesses that pay them.

How To Generate 1099 Forms From Quickbooks

Attackers are sophisticated and can make a message look like it came from your bank or even your client. And if you get an email from the IRS, it’s definitely a phishing attempt, and you should forward the email to The IRS doesn’t initiate contact with taxpayers via email. If your Spidey sense starts tingling when someone who hired you calls you an independent contractor, that’s a good sign, and you should investigate the situation further. Start by reviewing theIRS discussion of the difference between the two. If you’re an employee, you should fill out Form W-4, not Form W-9. When a business pays a contractor $600 or more during a tax year, it has to report these payments to the Internal Revenue Service , using an information return called Form 1099-MISC. It’s best practice to start every vendor relationship by asking for a W-9, even if you don’t expect to pay that person or company $600 or more during the year.This review will help you understand what the software does and whether it’s right for you. Business Checking Accounts BlueVine Business Checking The BlueVine Business Checking account is an innovative small business bank account that could be a great choice for today’s small businesses. Appointment Scheduling 10to8 10to8 is a cloud-based appointment scheduling software that simplifies and automates the process of scheduling, managing, and following up with appointments. We give you a realistic view on exactly where you’re at financially so when you retire you know how much money you’ll get each month. One of which was a party and event planning business in Denver. For one event, we worked with a shuttle service to safely drive party guests to and from our big holiday bash.

Do I Need To Get A W9 From My Vendors?

It may simply be the legal name of the person or a more formal business name or trade name . That distinction is dependent on whether or not a business license is in place. The need for a business license will vary from region to region but is likely determined by level of liability and amount of annual earnings. Note that the vendor files a W9 form with the vendor before the total amount paid in a calendar year is known. The supplier may submit Form W9 to the payer and not receive a Form 1099-MISC or 1099-NEC later because the total amount paid by the customer or client in the calendar year is less than $600. Certain payees are exempt from backup withholding and should enter the exempt payee code on Form W9. Hello im a business owner I did not get a w-9 from a vendor but I did get an employment application with ss# can I still file a 1099?

Besides A Client, Who Might Ask Me To Fill Out Form W

1099-NEC is for non-employee compensation, like payments to contractors. Laura Chapman holds a Bachelor of Science in accounting and has worked in accounting, bookkeeping and taxation positions since 2012. She has written content for online publication since 2007, with earlier works focusing more in education, craft/hobby, parenting, pets, and cooking. Now she focuses on careers, personal financial matters, small business concerns, accounting and taxation.

Do I need a W9 from a vendor?

When does my business need a W-9 from a vendor? Businesses are required to provide a 1099-MISC or 1099-NEC (as of 2020) to any vendor who receives payments totaling $600 or more over the course of the year for services whether or not a vendor has been asked for or provided a W-9 form.Routable offers software that supports healthy business-to-business relationships. While obtaining W-9 information is just one step in having a successful vendor management plan, the consequences of not having this W-9 information are far reaching. To help ensure that W-9 forms are collected as soon as possible, Routable software creates the opportunity to collect the information from their W-9 as part of the on-boarding process. Routable’s software gives vendors the freedom to manage their own bank account information and W-9 details through a secure site, providing the privacy that email exchange does not always offer.Your reflex should be to ask for a W-9 from any non-employee whom you’re paying for services. However, you don’t need to collect a W-9 from companies when there’s no chance you’ll need to file a 1099. Form W-9 also reveals a vendor’s run-ins with the IRS that would require you to withhold a portion of the payment for taxes. Unless you’re told otherwise through a W-9 or an IRS letter, non-employee workers are fully responsible for paying their taxes.

When Does Your Business Need A W

If a vendor provides any pushback to the request, or fails to provide complete and accurate information, it can be a red flag. Knowing this early on in the relationship can eliminate penalties down the road. For example, penalties up to $270 may apply for each 1099 form that includes an incorrect TIN. Having that information available ahead of time means that the number and business name can be vetted for accuracy before running into potential delays and further penalties during tax season. FATCA uses reporting of U.S. taxpayer foreign accounts by foreign financial institutions. Using any information from the payee on Form W-9 sent to the business payer isn’t sufficient for FATCA compliance. Easier to get W-9 upfront – It is much easier and more efficient to get a W-9 form from a vendor when they are eager to get paid than at a later point in the year when they have already been paid.If you refuse in response to a legitimate request, your client will withhold taxes from your pay at a rate of 24%. IRS Forms 940 and 941 must be filled out to ensure you’re paying employment taxes. We discuss the difference in each form and how to fill them out accurately. The document is a formal way to request information from a vendor and isn’t meant to be shared with the IRS or other tax authorities.