Content

- Publication 509 , Tax Calendars

- Calculating Your Estimated Tax Payments

- Dor Tax Calendar 2021

- When Are 2021 Estimated Tax Payments Due?

- Due Dates For 2021 Estimated Tax Payments

- Save Your Tax Return

Provide each partner with a copy of their Schedule K-1 or substitute Schedule K-1 by the 15th day of the 3rd month after the end of the partnership’s tax year. Form 7004 is used to request an automatic 6-month extension of time to file Form 1065.You should also recalculate if your own personal situation changes or if there are tax law changes that can affect your tax liability for the year. So, if you file on the first day, you might still be waiting until February 15 for your refund. The IRS does not release a calendar, but continues to issue guidance that most filers should receive their refund within 21 days. They also remind filers that many tax software programs allow you to submit your taxes before the start of tax season. However, these software programs don’t eFile until the IRS opens the system . Go to IRS.gov/IdentityTheft, the IRS Identity Theft Central webpage, for information on identity theft and data security protection for taxpayers, tax professionals, and businesses. If your SSN has been lost or stolen or you suspect you’re a victim of tax-related identity theft, you can learn what steps you should take.

Publication 509 , Tax Calendars

Visit this page on your Smartphone or tablet, so you can view the Online Tax Calendar on your mobile device. Please note that not all dues dates for every tax type are included on this calendar. When both state and local taxes are considered, you’ll pay more sales tax when shopping in these states. Once you enter all your information, it will tell you what is going on with your refund.

Calculating Your Estimated Tax Payments

You don’t have to make the payment due January 18, 2022, if you file your 2021 tax return by January 31, 2022, and pay the entire balance due with your return. If you have additional questions, you can connect live to a TurboTax Live tax expert for unlimited tax advice or even have a tax expert or CPA file for you from start to finish. IRS Form 1040X is a two-page form used to amend a previously filed tax return.

- This 2007 date change was not discovered until after many forms went to print.

- Once you enter all your information, it will tell you what is going on with your refund.

- Likewise, if your estimate is too low, go to the Form 1040-ES worksheet again to readjust your next estimated tax payment.

- The calendars provided in this publication make the adjustment for Saturdays, Sundays, and legal holidays.

- This form is due on the 15th day of the 3rd month after the end of the corporation’s tax year.

Use it to report income tax withheld on all nonpayroll items. A list of nonpayroll items is available in the Instructions for Form 945. This tax calendar covers various due dates of interest to employers. Form 7004 is used to request an automatic 6-month extension of time to file Form 1120. Some taxes can be paid with the return on which they are reported.

Dor Tax Calendar 2021

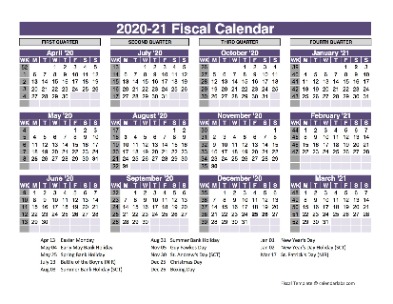

Go to IRS.gov/Account to securely access information about your federal tax account. The IRS Video portal (IRSVideos.gov) contains video and audio presentations for individuals, small businesses, and tax professionals. You may also be able to access tax law information in your electronic filing software.Always protect your identity when using any social networking site. Tips and links to help you determine if you qualify for tax credits and deductions. Armed Forces and qualified veterans may use MilTax, a free tax service offered by the Department of Defense through Military OneSource. If the due date falls on a Sunday, the deposit is due on the following Monday. For more information on filing these forms, go to IRS.gov/Form5500. Payments are due on the 15th day of the 4th, 6th, 9th, and 12th months of the corporation’s tax year.

When Are 2021 Estimated Tax Payments Due?

Personal information may include your IP address, digital identifiers, and your interactions with digital properties. TAS works to resolve large-scale problems that affect many taxpayers.

How much of my Social Security is taxable in 2021?

For the 2021 tax year, single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.If you fail to timely, properly, and fully make your federal tax deposit, you may be subject to a failure-to-deposit penalty. For an EFTPS deposit to be on time, you must submit the deposit by 8 p.m. Eastern time the day before the date the deposit is due..

Due Dates For 2021 Estimated Tax Payments

Form 1040-SR is available to you if you were born before January 2, 1956. While we diligently research and update our holiday dates, some of the information in the table above may be preliminary. The 2020 tax filing date has been moved from April 15 to July 15 in light of the COVID-19 novel coronavirus crisis. He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future.Services are offered for free or a small fee for eligible taxpayers. To find a clinic near you, visit TaxpayerAdvocate.IRS.gov/about/LITC or see IRS Pub. The IRS uses the latest encryption technology to ensure your electronic payments are safe and secure. You can make electronic payments online, by phone, and from a mobile device using the IRS2Go app. Paying electronically is quick, easy, and faster than mailing in a check or money order. Go to IRS.gov/Payments for information on how to make a payment using any of the following options. Tax-related identity theft happens when someone steals your personal information to commit tax fraud.

Save Your Tax Return

The IRS starts charging penalties and interest on the day the return is due, no matter when you file. You can minimize the failure-to-file penalties by filing as soon as possible, paying as much as you can when you file and setting up an installment plan for the balance.

When Is Tax Day 2021?

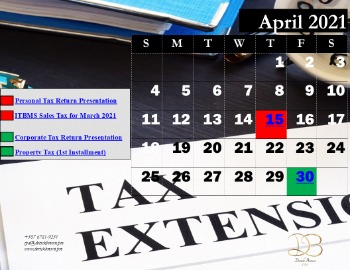

Make sure your calendar is up-to-date with these important deadlines, dates, possible extensions and other factors in play for both individuals and businesses in 2021. When you login first time using a Social Login button, we collect your account public profile information shared by Social Login provider, based on your privacy settings. We also get your email address to automatically create an account for you in our website. Once your account is created, you’ll be logged-in to this account. First, it starts with your tax software, tax preparer, or your paper refund. To confirm the IRS receives it, you’ll see the “accepted” message in your tracking software. But we do have to make money to pay our team and keep this website running!Social security and Medicare taxes you withhold from your employees’ wages and the social security and Medicare taxes you must pay as an employer. This form is due on the 15th day of the 4th month after the end of the corporation’s tax year.