Content

- Using The Income Statement

- Where Are Selling & Administrative Expenses Found On The Multi

- Financial Statements, Taxes, And Cash Flow

- Types Of Operating Expenses

- Significance Of Profit Before Tax

- Earnings Per Share

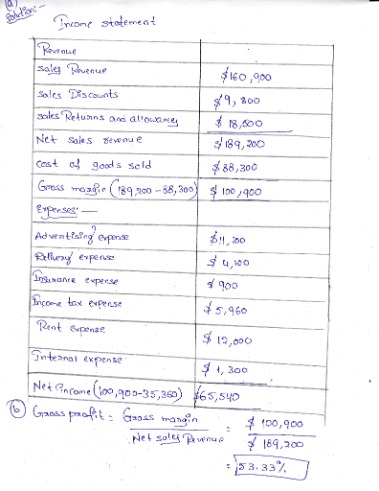

To calculate your business’s net income, subtract your Expenses and Losses from your Revenues and Gains. If the net income is a positive number, then your business is reporting a profit for that reporting period. If the net income is a negative number, then your business is reporting a loss. All non-owner changes in equity (i.e., comprehensive income) shall be presented either in the statement of comprehensive income or in a separate income statement and a statement of comprehensive income. Components of comprehensive income may not be presented in the statement of changes in equity. After revision to IAS 1 in 2003, the Standard is now using profit or loss for the year rather than net profit or loss or net income as the descriptive term for the bottom line of the income statement. Regardless of which line item we choose to forecast, the method is simple.

What does PE ratio indicate?

In short, the P/E ratio shows what the market is willing to pay today for a stock based on its past or future earnings. A high P/E could mean that a stock’s price is high relative to earnings and possibly overvalued. Conversely, a low P/E might indicate that the current stock price is low relative to earnings.Although most of the information on a company’s income tax return comes from the income statement, there often is a difference between pretax income and taxable income. These differences are due to the recording requirements of GAAP for financial accounting and the requirements of the IRS’s tax regulations for tax accounting . Certain items must be disclosed separately in the notes if it is material . This could include items such as restructurings, discontinued operations, and disposals of investments or of property, plant and equipment. Irregular items are reported separately so that users can better predict future cash flows. The operating section of an income statement includes revenue and expenses. Revenue consists of cash inflows or other enhancements of assets of an entity, and expenses consist of cash outflows or other using-up of assets or incurring of liabilities.

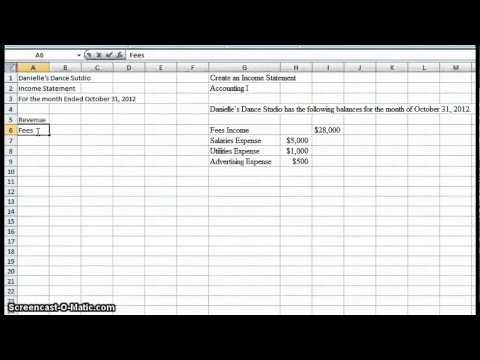

Using The Income Statement

They are required by law to release their financial statements quarterly and annually. Operating Income Before Depreciation and Amortization shows a company’s profitability in its core business operations. The Selling, General, and Administrative Expense (SG&A) category includes all of the administrative and overhead costs of doing business. The most commonly used are “statement of income,” “statement of earnings,” “statement of operations,” and “statement of operating results.” Tax expense affects a company’s net earnings given that it is a liability that must be paid to a federal or state government.When a long-term asset is purchased, it should be capitalized instead of being expensed in the accounting period it is purchased in. The earnings can come from different sources such as rental income, discounts received, and total sales, among others. Other unique income sources include service income, interest earned on bank accounts, and bonuses. The first part of the formula, revenue minus cost of goods sold, is also the formula for gross income. Revenues are exposed to a number of expense types, and understanding the relationship between costs and revenues is the primary function of the income sheet. Broadly speaking, depreciation is a way of accounting for the decreasing value of long-term assets over time.

Where Are Selling & Administrative Expenses Found On The Multi

A machine bought in 2012, for example, will not be worth the same amount in 2022 because of things like wear-and-tear and obsolescence. Depreciation refers to the decrease in value of assets and the allocation of the cost of assets to periods in which the assets are used–for tangible assets, such as machinery. In essence, if an activity is not a part of making or selling the products or services, but still affects the income of the business, it is a non-operating revenue or expense. For instance, a company has to pay one kind of tax on the salaries it pays to its employees, then another tax on the purchase of any assets. Furthermore, there are taxes levied at the state or the national level as well.

What is taxable income formula?

Taxable Income Formula = Gross Sales – Cost of Goods Sold – Operating Expense – Interest Expense – Tax Deduction/ Credit.However, a tax expense is only recognized when a company has taxable income. In the event that a loss is recognized, the business can carry its losses forward to future years to offset or reduce future tax expenses. They are reported separately because this way users can better predict future cash flows – irregular items most likely will not recur. Depreciation / Amortization – the charge with respect to fixed assets / intangible assets that have been capitalised on the balance sheet for a specific period. It is a systematic and rational allocation of cost rather than the recognition of market value decrement. Revenue – Cash inflows or other enhancements of assets of an entity during a period from delivering or producing goods, rendering services, or other activities that constitute the entity’s ongoing major operations. It is usually presented as sales minus sales discounts, returns, and allowances.

Financial Statements, Taxes, And Cash Flow

An income statement under accrual accounting reflects revenues “earned”, where an exchange in value among the parties has taken place, regardless of whether cash was received. Expenses on the statement have been “incurred”, where the business has received a benefit and has paid for it or has recorded a liability to pay it at a future date. As with revenues, the exchange of cash does not dictate the amount reported for the expense.

- Accountants must always be cognizant of the capacity of financial statement users to review and absorb reports.

- Some people refer to net income as net earnings, net profit, or simply your “bottom line” .

- The final step is to deduct taxes, which finally produces the net income for the period measured.

- Finance costs – costs of borrowing from various creditors (e.g., interest expenses, bank charges).

- Every time a business sells a product or performs a service, it obtains revenue.

We must also take note of the items contained in each of the categories and make sure they are all always recorded accurately. And makes record keeping easier for investors who read them and the accountants who prepare them. This is even more disadvantageous to shareholders of C corporations who must pay taxes again on the dividend received.In the single-step presentation, the gross and operating income figures are not stated. In this method, sales minus materials and production equal gross income. By subtracting marketing and administrative and research and development (R&D) expenses from gross income, we get the operating income figure. In the context of corporate financial reporting, the income statement summarizes a company’s revenues and expenses, quarterly and annually, for the fiscal year. The final net figure and other numbers in the statement are of major interest to investors and analysts.

Types Of Operating Expenses

This can be a great indicator of how scalable an operation is, and the relative return an organization will see as they achieve growth. As we’ve earleir discussed, income tax involves an outflow of cash and is hence considered a liability for the organization. Conversely, though the single-step income statement lacks detail, it is easy to prepare and easy to analyze. As a result, the bottom line—net income—for the company increased from $605,000 in 2019 to $885,000 in 2020.

Significance Of Profit Before Tax

With Bench, you can see what your money is up to in easy-to-read reports. Your income statement, balance sheet, and visual reports provide the data you need to grow your business. So spend less time wondering how your business is doing and more time making decisions based on crystal-clear financial insights. For a more readable format, try the multi-step format, which is the format of choice for larger and multi-department organizations. Smaller businesses may start reporting their financial results with a single-step income statement and then switch to the multi-step format once their operations become larger and more complex.The income statement is a financial statement that is used to help determine the past financial performance of the enterprise, predict future performance, and assess the capability of generating future cash flows. It is also known as the profit and loss statement (P&L), statement of operations, or statement of earnings. The income statement is one of three financial statements that stock investors rely on.The header states the name of the company, identifies the report as an income statement and includes the time period covered in the document. Sole proprietorships, simple partnerships and other small, service-based businesses can use single-step income statements to report their profits. For example, valuation of inventories using LIFO instead of weighted average method. The changes should be applied retrospectively and shown as adjustments to the beginning balance of affected components in Equity.Finance costs – costs of borrowing from various creditors (e.g., interest expenses, bank charges). Some numbers depend on accounting methods used (e.g., using FIFO or LIFO accounting to measure inventory level). Interest expense is found by multiplying the opening balance in each period with the interest rate. This interest expense is then added back to the opening balance, and is then reduced by any principal repayments, to find the closing balance. This schedule outlines each individual piece of debt on their own schedule, and sometimes makes a summary schedule that totals all balances and interest expense. By including all of the above , you can arrive at net income, or the bottom line of the income statement.

How Does A Tax

However, they provide slightly different perspectives on financial results. The difference is what is referred to as the earnings/profit before tax. If Wyatt wants to calculate his operating net income for the first quarter of 2021, he could simply add back the interest expense to his net income. Another useful metric is the gross margin, which underlines the variable costs attached to adding new units of sales. While it is relatively easy for an auditor to detect error, part of the difficulty in determining whether an error was intentional or accidental lies in the accepted recognition that calculations are estimates. It is therefore possible for legitimate business practices to develop into unacceptable financial reporting.Income statements include judgments and estimates, which mean that items that might be relevant but cannot be reliably measured are not reported and that some reported figures have a subjective component. Thus, organizations have to be careful and minimize their taxable incomes if not, they would end up spending from their profits. And this would, in turn, reduce the profits supposed to be used for other purposes. One of the reasons this may be happening is that according to the tax code, companies are supposed to use the accelerated depreciation method to determine their taxable profit. Also, general operating expenses have been kept under strict control, increasing by a modest $25,000. In 2019, the company’s operating expenses represented 15.7% of sales, while in 2020, they amounted to only 13%. No items may be presented in the statement of comprehensive income or in the notes as extraordinary items.

Tax Expense

That gain might make it appear that the company is doing well, when in fact, they’re struggling to stay afloat. Operating net income takes the gain out of consideration, so users of the financial statements get a clearer picture of the company’s profitability and valuation.Items that might be relevant but cannot be reliably measured are not reported (e.g., brand recognition and loyalty). Our Accounting guides and resources are self-study guides to learn accounting and finance at your own pace. Gain the confidence you need to move up the ladder in a high powered corporate finance career path. They can be categorized as equity multiples and enterprise value multiples.Profit before tax is one of the most important metrics of a company’s performance. For one, it provides internal and external management with financial data on how the company is performing. Since it does not include tax, PBT reduces one variable, which could come with different indicators that influence the final financial data results. It is important to know which expenses qualify as selling expenses and which qualify as administrative expenses.