Content

- Who Files Schedule C: Profit Or Loss From Business?

- Tax Deductions And Benefits For The Self

- Taking Deductions

- What Is A Sole Proprietorship?

- Get Help With Your Schedule C Form

- Freelancetaxation Com

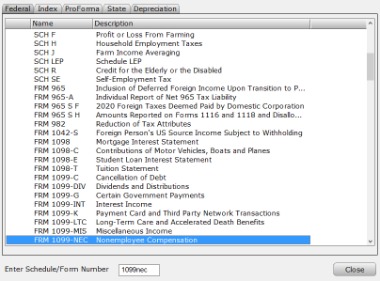

If you file electronically with a tax software program, it will automatically direct you to Schedule C based on your answers to certain questions. Beginning with the 2020 tax year, the 1099-MISC is no longer used for reporting non-employee compensation. Instead, the 1099-NEC form is used to report these payments. The form is sent to workers and reported to the IRS by the end of January of the following year. 1099-NEC forms for the 2020 tax year must be sent by January 31, 2021. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

- Making the right moves now can help you mitigate any surprises heading into 2022.

- Farm income refers to profits and losses incurred through the operation of a farm.

- Contractors don’t have an employer, so they’re responsible for paying taxes and reporting their income.

- You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

- Businesses that operate as a sole proprietorship or a single-member limited liability company must fill out Schedule C on Form 1040.

- Most companies like Upwork, Uber, and Airbnb will only issue a 1099-K if you reach 20K in revenue and have over 200 transactions.

- It is a calculation worksheet known as the “Profit or Loss From Business” statement.

Will not deduct home office expenses or depreciation for business assets, like a cell phone or printer. Had only one business as either a sole proprietor, qualified joint venture, or statutory employee. It may seem a little confusing to fill out a Schedule C, but most of the difficulty revolves around staying organized. If you accurately track all income, expenses, and supporting documents during the year, you simply need to follow the Schedule C instructions and fill in the blanks. In addition, you should also consider a mileage tracker if you are planning on claiming the standard mileage deduction.

Who Files Schedule C: Profit Or Loss From Business?

You don’t have to register your small business as a sole proprietor with your state, as you would have to do if you have an LLC or corporation business type. And you there’s no way to register as an independent contractor; you just receive income from a 1099-MISC and report it on your business tax return. A sole proprietorship or sole trader is an unincorporated business with a single owner who pays personal income tax on profits earned from the business. If you have no income and no deductible business expenses to report in a given tax year, you do not need to file a Schedule C for your business. The instructions for Schedule C explain the rules for each type of expense. You’ll add up all the expenses and subtract them from your gross profit to arrive at your net profit, which is taxable income for your personal tax return. If you have a net loss, it may be deductible on your personal tax return.If you report a loss on Line 31, no self-employment tax is due. Many sole proprietors receive 1099-NEC forms from their customers or clients showing exactly how much they were paid by that entity. This information goes in sections I and J on Schedule C. Prior to 2020, form 1099-MISC was used instead. How do you divide expenses between your W-2 income and your freelance income? Business expenses are supposed to be for specific business purposes. If you had to travel to Seattle for a freelance job, then those expenses should be handled on your Schedule C. If the job was for a W-2, then the expenses are no longer deductible. Social security taxes are handled differently for W-2 work than for self-employment work which is what you do as a freelancer.

Tax Deductions And Benefits For The Self

You may have to file a Schedule C even if you have a regular day job where you’re someone’s employee. So if you’re freelancing on the side, your self-employment means you’ll probably need to add the Schedule C to your to-do list. If you only earn income or wages from employment that is reported on Form W-2, you don’t need to fill out Schedule C on Form 1040. Remember I said that this allocation is only for something you can’t directly trace. If you had to get a SIM card for a tour you did in Europe playing drums for a group on tour and for which you got paid as a freelancer, that expense can be directly attributed to your 1099 work and put on your Schedule C.In the following article, we’ll provide an overview of IRS Schedule C instructions for independent contractors. As a sole proprietor, you report your business taxes on Schedule C of your tax return (Form 1040 or 1040-SR). The net income from your Schedule C goes into your personal tax return, along with other income. Any income from a 1099-MISC will go into the Schedule C, along with other business income. One thing you’ll notice on your 1099-NEC forms is that your clients don’t withhold income tax from your payments like they do for their employees.

What qualifies as a Schedule C?

IRS Schedule C is a tax form for reporting profit or loss from a business. You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040. Schedule C is typically for people who operate sole proprietorships or single-member LLCs.The goal of the Schedule C is to determine your business profit. The business profit comes from taking your business income, and then subtracting your business expenses. This number is the income that is subject to taxation, and is reported on Line 12 of your 1040. Schedule C is a part of your individual tax return where your business shows its income and expenses. A separate business return exists when you have a partnership or when you file your business as an S-Corporation.

Taking Deductions

Using the entries on Schedule C, the taxpayer calculates the business’s net profit or loss for income tax purposes. This figure then is transferred to Form 1040 and is used in calculating the taxpayer’s overall tax liability for the year. Taxpayers who operate more than one sole proprietorship must file a separate Schedule C for each business. For independent contractors, filing taxes is a little more complicated. Contractors don’t have an employer, so they’re responsible for paying taxes and reporting their income. However, Form 1040 includes additional requirements for 1099 contractors. Specifically, you must report your business income and related expenses on Schedule C, Profit or Loss from Business .So if you’re not sure whether or not you qualify, you might as well use the regular Schedule C just to be safe. Schedule C instructions may seem intimidating, but, for most small business owners, they prove fairly straightforward. Once you list your expenses and income, you’ve essentially completed the form. An independent contractor is someone who is working for someone else and who provides services, but who is not an employee. An independent contractor is typically a creative professional or technical person, like a designer, web expert, or IT professional. If you have a single member LLC and have not elected to be treated as a corporation for tax purposes, you will file a Schedule C. It is essentially the same as a sole proprietor.As a self-employed individual, you must pay Social Security and Medicare taxes. However, since your 1099-NEC income is not subject to employment-tax withholding, you’re required to pay these taxes yourself. For example, the cost of sophisticated computer software is an ordinary and necessary expense for a freelance graphic designer. On the other hand, the cost of hiring a limousine to travel to clients may be helpful, but is not ordinary by tax standards. Schedule C is typically for people who operate sole proprietorships or single-member LLCs. Many or all of the products featured here are from our partners who compensate us.

What Is A Sole Proprietorship?

The Paycheck Protection Program is a loan program to help businesses pay for emergency needs, including paying employees. The terms “sole proprietor” and “independent contractor” are both used to discuss self-employed people. The two terms are confusing, so let’s straighten out the differences.This is a must for Uber and other car-sharing services drivers. Trip Log and Mile IQ are great apps that also integrate nicely with Quickbooks. For your 2020 tax return, the IRS has extended the deadline from April 15, 2021, to May 17, 2021. Schedule C also includes Part III for calculating “Cost of Goods Sold.” This is for use if your business manufactures items for sale or purchases items for resale. The cost is also deductible from your total business revenues. “Ordinary” essentially means that just about everyone else in your line of business also spends on this same expense. “Necessary” means that the expense was helpful or appropriate to allow you to make money.It is a calculation worksheet known as the “Profit or Loss From Business” statement. This is where self-employed income from the year is entered and tallied, and any allowable business expenses are deducted. On the specific subject of taking home office expenses, be careful because home office rules can trip you up if you try to allocate them . Besides that home office expenses are no longer allowed for W-2 work, any home office be it for W-2 or 1099 work has to be exclusive. That means no other work can be done in the same space than for the purpose you deduct it for. That means you cannot have the same office if you used it both for your W-2 work and for your 1099 work. Thus because your equipment is in your home office, you also cannot use the same computer for both.

Get Help With Your Schedule C Form

Simply snap a picture of the receipt and you can automatically categorize it. You can file Form 1040 and Schedule C the same way you file the rest of your tax forms, whether you prefer to do so by mail or electronically. If you file by mail, be sure to include any necessary payments with your form. Send it to your state’s IRS processing office, postmarked on or before the deadline, which is usually April 15. If you e-file your taxes, you can pay online, but be sure to submit before the deadline.The process of filing your taxes with Form 1099-NEC is a little different than if you only had income reported on a W-2. Is a place to list other business expenses that didn’t fit into the categories in Part II. If you’re filing your taxes with a tax filing software, the Schedule C-EZ will automatically be generated if you meet all of the necessary requirements. If you take a look at Part II of your Schedule C , you’ll see a lengthy list of deductible expenses. Any of those expenses that you paid in order to run your businessmay be deductible. If you use a tax filing software, this form will be automatically generated when you report that you are self-employed, or that you received a 1099-NEC or 1099-K.

Freelancetaxation Com

It is important to keep track of all of your income as an independent contractor, as it all needs to get reported. Keep in mind, you may or may not receive a 1099-K from sites like Upwork and Airbnb. Most companies like Upwork, Uber, and Airbnb will only issue a 1099-K if you reach 20K in revenue and have over 200 transactions. In the event you do receive a 1099-K, you must report your income accurately as the IRS also receives a copy of the 1099-K. Even if you do not receive a 1099-K, the IRS can still request income information based on your taxpayer ID , as all platforms request this information. If you use Sharing Economy apps like Airbnb, Uber, or Upwork, you can view an annual revenue report on your profile. Be sure to include gross earnings as you will deduct any commissions in the ‘expenses’ portion of your Schedule C.Since you don’t have a paycheck (you aren’t an employee), you don’t have withholding. The amount is based on your business net income for the year and it’s added to your other tax liability on your 1040. If you are selling products, or in some other specific cases, you would not receive a 1099-MISC form, but you would get your business income from the sale of those products. Many sole proprietors are able to use a simpler version called Schedule C-EZ. This form omits a lot of the detail in the full Schedule C and just asks for your total business receipts and expenses. However, you still need to complete a separate section if you claim expenses for a vehicle.