Content

- Accounting For Managers

- Calculation Of Predetermined Overhead And Total Cost Under Traditional Allocation

- Allocating The Hr Departments Cost

- What Do You Mean By Overheads?

- How To Determine The Amount Of Overhead To Be Allocated To Finished Goods Inventory

- What Are The Issues Associated With Cost Tracing & Cost Allocation?

The department also pays wages and benefits to a production supervisor. This supervisor’s work cannot be directly traced to production. The total overhead for the department is $16,000 for the month. Divide overhead costs out into spreadsheet columns, based whether the overhead expense should be applied to all product or selected products.The overhead rate has limitations when applying it to companies that have few overhead costs or when their costs are mostly tied to production. Also, it’s important to compare the overhead rate to companies within the same industry.

Accounting For Managers

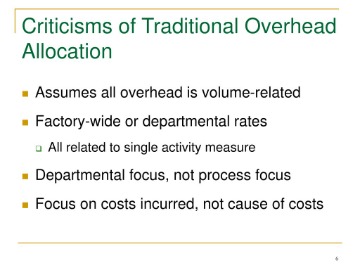

This assumption of a causal relationship is increasingly less realistic as production processes become more complex. The predetermined overhead rate is set at the beginning of the year and is calculated as the estimated overhead costs for the year divided by the estimated level of activity for the year. This activity base is often direct labor hours, direct labor costs, or machine hours. Allocating direct costs to production is pretty straightforward — you know what the materials and direct labor costs.

- In contrast, a G&A cost might be one that applies to the general running of the business.

- Allocation of the overhead is important for budgeting as well as determining how much a business should charge for its services.

- The reason is that all of the manufacturing costs will be reported as the cost of goods sold.

- The equation for the overhead rate is overhead costs divided by direct costs or whatever you’re measuring.

- While all indirect costs are overheads, you need to be careful while categorizing these costs.

- The overhead rate can also be expressed in terms of the number of hours.

Record the overhead allocation by the means of a journal entry that increases the expense of the finished goods inventory. If you use the Organization Reporting application, you can allocate overhead by organization instead of on a firmwide basis. For a variety of reasons, such as establishing project fees, your firm may want to estimate its actual overhead rate. If you are Prorating overhead, the provisional rate for a particular project is the rate that was in effect the last time you allocated overhead. You can choose to allocate overhead on a firmwide basis or by organization . You can now find out the overhead percentage as a percentage of sales.

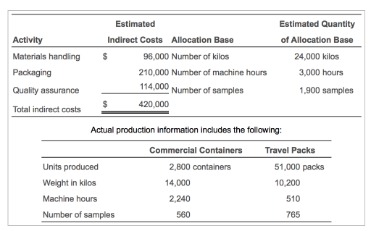

Calculation Of Predetermined Overhead And Total Cost Under Traditional Allocation

Because these costs cannot be traced directly to the product like direct costs are, they have to be allocated among all of the products produced and added, or applied, to the production and product cost. Is the work used in manufacturing that can be directly traced to the product. Job order costing traces the costs directly to the product, and process costing traces the costs to the manufacturing department. The drawback to using the predetermined overhead rate to allocate overhead is that it assumes the cost to produce each item is stagnant. Determine the most stable cost driver in the production of your goods.Overhead costs are allocated to products to provide information for internal decision making, to promote the efficient use of resources, and to comply with U.S. Overhead amounts appear on all of the major project-related reports . You can also print an Overhead Allocation report that provides detailed information about current period, year-to-date, and job-to-date overhead allocation. Because the Overhead Allocation utility calculates overhead on a year-to-date basis, you can run the utility whenever you want .This overhead percentage is applied to each project, based on either direct labor or revenue,to determine the total amount of overhead allocated to each project. Apply the overhead by multiplying the overhead allocation rate by the number of direct labor hours needed to make each product. Let’s assume a company has overhead expenses that total $20 million for the period. The company wants to know how much overhead relates to direct labor costs.

Allocating The Hr Departments Cost

A large company with a corporate office, a benefits department, and a human resources division will have a higher overhead rate than a company that’s far smaller and with less indirect costs. Direct costsare costs directly tied to a product or service that a company produces. Cost objects can include goods, services, departments, or projects. Direct costs include direct labor, direct materials, manufacturing supplies, and wages tied to production. For example, contractors can choose to estimate their overhead for each job using an established rate.

What Do You Mean By Overheads?

To calculate the overhead rate, divide the total overhead costs of the business in a month by its monthly sales. For example, most businesses categorize legal expenses as overhead costs. However, if you own a law firm, these expenses directly contribute to production and hence are part of your direct costs. Overhead rate is a cost allocated to the production of a product or service.It is important to include indirect costs that are based on this overhead rate in order to price a product or service appropriately. If a company prices its products so low that revenues do not cover its overhead costs, the business will be unprofitable.

How To Determine The Amount Of Overhead To Be Allocated To Finished Goods Inventory

Calculating overhead costs is not just important for budgeting but also determining how much the business should charge for a service or product to make a profit. For example, if you have a service-based business, then apart from the direct costs of providing the service, you will also incur overhead costs such as rent, utilities and insurance. Most accounting software packages allow you to set up overhead allocations. As you put in the time to do this work, keep the ultimate goal in mind. Allocating overhead helps you to assign all of your company costs to a product or service. Overhead allocation will help you make better business decisions. Say that the cutting department incurs overhead costs to repair and service their machinery.For example, say your business had $10,000 in overhead costs in a month and $50,000 in sales. After reviewing the product cost and consulting with the marketing department, the sales prices were set. The sales price, cost of each product, and resulting gross profit are shown in Figure 6.6.U.S. GAAP requires that all manufacturing costs—direct materials, direct labor, and overhead—be assigned to products for inventory costing purposes. A method of allocating costs that uses one cost pool, and therefore one predetermined overhead rate, to allocate overhead costs.

What Are The Issues Associated With Cost Tracing & Cost Allocation?

On the one hand, there’s excellent general-purpose accounting software that can work very well for small contractors. But if it isn’t designed to allocate overhead to distinct jobs, you can be stuck doing work outside of the system. That increases the risk of entry error and calculation mistakes. Plus, it means your financial data is stored in more than one place. Indirect costs by definition mean they are not directly traceable to a product and will require an allocation. The concept of overhead can be expanded to entire departments within a company.The goods not sold must be reported at their cost in the company’s asset entitled Inventory. The proper accounting and monitoring of the costs are critical for the best-in-class contractors. The Overhead Allocation report shows, project by project, how overhead was distributed as of the last time Overhead Allocation was run. Some of the goods manufactured are not sold in the same period in which they were produced. The service requires full cookie support in order to view this website. When you first implement Vision, you may want to enter historical overhead for prior years and/or months in the current year. Janet Berry-Johnson is a CPA with 10 years of experience in public accounting and writes about income taxes and small business accounting.

What’s The Difference Between Prime Costs And Conversion Costs?

ACA & W-2 Services Our ACA reporting & e-filing services include official 1094-C and 1095-C IRS reporting, optional e-filing , mailing to your employees and experienced support to help you. Not every accounting system is going to be a fit for everyone. Finding one that you can implement well with accounting processes that help your success is the most important thing.The department allocation approach allows cost pools to be formed for each department and provides for flexibility in the selection of an allocation base. Although Figure 3.3 “Using Department Rates to Allocate SailRite Company’s Overhead” shows just two rates, many companies have more than two departments and therefore more than two rates. Organizations that use this approach tend to have simple operations within each department but different activities across departments. One department may use machinery, while another department may use labor, as is the case with SailRite’s two departments.Alternatively, contractors can track each overhead cost in their G/L and distribute them proportionally across all jobs. A simple example could assign 25% of your total overhead to a job representing 25% of your company’s direct job costs. However, you can add finer-grain complexity by allocating only a set portion from each overhead G/L account or by allocating a greater or lesser proportion to certain G/L accounts. Let’s assume that the cost to operate your human resources department is $200,000 a year. Since this is an overhead cost, you need an activity level to allocate the cost to other departments.It makes sense to apply repair and maintenance costs to production using machine hours. These costs cannot be directly tied to a pair of blue jeans you produce. However, every cost you incur in your business must be tied to a product that you sell. To accomplish this, overhead costs are applied to a product using an overhead rate. Multiply the cost driver by the total overhead to allocate a portion of the overhead to each product. For example, if 1,000 man-hours goes into the production of 100,000 items, then 1 percent of the man-hours goes into each product. The 1 percent is the cost driver, so multiply it by the total overhead to derive a reasonable overhead allocation to each item.The department allocation approach uses several cost pools and therefore uses several predetermined overhead rates. Is calculated at the start of the accounting period by dividing the estimated manufacturing overhead by the estimated activity base.The hard part is determining the amount of overhead to allocate to finished goods inventory. The key to allocating overhead costs is in deciding on the appropriate allocation method for your business. Instead, they will be broken out into various department cost pools. This approach allows for the use of different allocation bases for different departments depending on what drives overhead costs for each department. The Assembly department may find that overhead costs are driven more by labor activity than by machine use and therefore decides to use labor hours or labor costs as the allocation base. It is often difficult to assess precisely the amount of overhead costs that should be attributed to each production process. Costs must thus be estimated based on an overhead rate for each cost driver or activity.