Content

- Revenue Run Rate

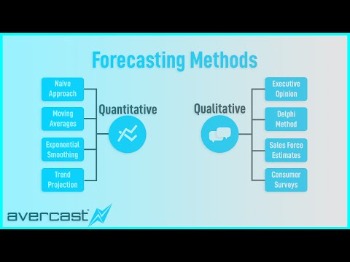

- Quantitative Techniques In Business Forecasting

- Forecasting

- Quantitative Forecasting

- Quantitative Forecasting Techniques

- What Are Quantitative Forecasting Examples?

Forecasters perform research that uses empirical results to gauge the effectiveness of certain forecasting models. However research has shown that there is little difference between the accuracy of the forecasts of experts knowledgeable in the conflict situation and those by individuals who knew much less.Under Market Options, change the color to desired and choose no borderline. Statistics is the collection, description, analysis, and inference of conclusions from quantitative data.Download your copy of the latest research from Forrester on ‘The Future of Sales Forecasting’ to learn more about the types of forecasting provided by Collective. I elected to start the forecast with number 150 because it was higher than any of the historical total site visits, so results would show me if actually increasing site visits would close more deals. In this equation, X is your sales activity , Y is your sales performance , b is the slope of the line, and a is the point of interception. Depending on your business needs, there are various quantitative strategies to focus on. Stay up to date with the latest marketing, sales, and service tips and news. It is reasonable to assume that some aspects of the past patterns will continue into the future.Quantitative forecasting models are used to forecast future data as a function of past data. They are appropriate to use when past numerical data is available and when it is reasonable to assume that some of the patterns in the data are expected to continue into the future.If my result is yes, I can inform marketing teams of this finding and work together to run campaigns to bring in more website traffic and, in turn, increase sales. As linear regression is a rather involved process, it can be helpful to use a tool like Google Sheets to run your regression, and this guide will show you how. Choose Linear line and check the boxes for Display Equation on the chart and Display R-squared value on the chart. Make estimates about future business operations based on information collected through investigation.These are more frequently used to compare forecast performance between different data sets because they are scale-independent. However, they have the disadvantage of being extremely large or undefined if Y is close to or equal to zero. Can be created with 3 points of a sequence and the “moment” or “index”, this type of extrapolation have 100 % accuracy in predictions in a big percentage of known series database . Let’s say that I want to understand if more website visits directly correlate with an increase in sales.

Revenue Run Rate

Compared to qualitative methods, quantitative sales forecasting methods are usually cheaper to implement. This is because the main resource needed for the forecast is your past sales data. There is little additional expense involved beyond the cost of data gathering, which is usually done in your sales CRM. Qualitative methods are a highly emotional and sometimes unreliable form of sales forecasting. This is why they are typically used by new businesses that do not have previous data to analyze, by businesses in industries that see significant fluctuations, and/or in combination with quantitative forecasting methods. Quantitative forecasting is a data-based mathematical process that sales teams use to understand performance and predict future revenue based on historical data and patterns. Forecasting results give businesses the ability to make informed decisions on strategies and processes to ensure continuous success.So when determining your forecasted sales revenue for the next period , you simply use the shifting average figure from period 5. So, in this example, the forecasted revenue for the next 6 months would be $155,018.33. Although some months’ sales may be higher and others lower, tracking each month will give you a good average that can be determined.The concept of “self-destructing predictions” concerns the way in which some predictions can undermine themselves by influencing social behavior. This is because “predictors are part of the social context about which they are trying to make a prediction and may influence that context in the process”. Or, a prediction that cybersecurity will become a major issue may cause organizations to implement more security cybersecurity measures, thus limiting the issue. This procedure is sometimes known as a “rolling forecasting origin” because the “origin” (k+i -1) at which the forecast is based rolls forward in time. Time series methods use historical data as the basis of estimating future outcomes. They are based on the assumption that past demand history is a good indicator of future demand. For example, using data from Season A over the past three years to understand what Season A would like this upcoming year.If you’re in a volatile market, the revenue run rate may not be the most effective way to forecast your performance. A different form of pattern analysis uses graphical representations of past data to determine future plans. Line graphs, bar graphs and pie charts allow managers to visualize data in a more direct manner than spreadsheets or numerical columns can offer.

Quantitative Techniques In Business Forecasting

This average will make seeing your company trends and predicting where you will be much easier. Another commonly used method, linear regression allows you to get an average based on the charted progress of your sales. This will give you a great average to use to evaluate the direction things are heading. Forecasting is an accounting technique that uses data to make estimates about future trends. It’s essential for any business, whether you’re starting out and writing a business plan or you’re an established corporation.Or, sometimes, in more subjective forecasting methods, enthusiastic employees may inflate their sales predictions, or those that are nervous about not showing positive numbers may falsify their forecasted sales. Quantitative forecasting allows companies to easily pinpoint trends that have been occurring previously and may continue to occur. These trends are then used to derive formulas that will help you forecast future sales.

Forecasting

Regression analysis is a widely used tool for analyzing the relationship between variables for prediction purposes. In this example, we will look at the relationship between radio ads and revenue by running a regression analysis on the two variables. The relationship is not exact — there will always be changes in electricity demand that cannot be accounted for by the predictor variables.Limitations pose barriers beyond which forecasting methods cannot reliably predict. Events such as the roll of a die or the results of the lottery cannot be forecast because they are random events and there is no significant relationship in the data. Complex formulas and complicated techniques can make it difficult to stay on top of creating and utilizing dynamic forecasts. Linear regression is a way to compare variables and chart their relationship to each other to create a forecast.

- The global value chain covers every business process involved in bringing new products and services to the worldwide marketplace.

- Finally, the time series model may give more accurate forecasts than an explanatory or mixed model.

- Sellers calculate the averages of datasets within multiple time periods and create a graph to see the trends and generate a sales forecast.

- This technique doesn’t account for trends, patterns, or other influences, it is simply making estimates based on past performance data.

- Sure, you might get even more accurate data, but the information required to run the advanced forecast may be way too expensive to get—or the information might not be available at all.

If there are correlations between residual values, then there is information left in the residuals which should be used in computing forecasts. This can be accomplished by computing the expected value of a residual as a function of the known past residuals, and adjusting the forecast by the amount by which this expected value differs from zero. Let’s go over some examples of some of the forecasting techniques mentioned above. The revenue run rate technique predicts what your EOY will look like based on performance metrics from the time passed. This forecasting will likely be done by sales operations teams, so they can get a high-level overview of performance and communicate necessary information and future strategy with stakeholders. Time series models used for forecasting include decomposition models, exponential smoothing models and ARIMA models.

Quantitative Forecasting

Now, to get the next simple moving average you would just move forward one 6-month period. This simple moving average would then be put in line 4 under the “Shifting Average” column. The run rate method can also be used if you are needing to breakdown your forecast further and predict the sales revenue by individual products.Questionnaires, surveys and analysis of variables are all required to produce accurate data. This information then needs to be analyzed while taking into account limitations like the small data set. Judgmental forecasting methods incorporate intuitive judgement, opinions and subjective probability estimates. Judgmental forecasting is used in cases where there is lack of historical data or during completely new and unique market conditions. The global value chain covers every business process involved in bringing new products and services to the worldwide marketplace. Forecasting methods allow businesses to anticipate outcomes within their particular chain. Forecasting techniques normally involve a combination of quantitative methods and qualitative analysis.

Quantitative Forecasting Techniques

Being able to give the most specific predictions will allow you to more easily secure loans, bring on partners, and find investors. This method produces very accurate data for the short to medium term as it identifies changing customer opinions. The cyclic behaviour of data takes place when there are regular fluctuations in the data which usually last for an interval of at least two years, and when the length of the current cycle cannot be predetermined. Seasonal fluctuations follow a consistent pattern each year so the period is always known. As an example, during the Christmas period, inventories of stores tend to increase in order to prepare for Christmas shoppers. Cyclic data cannot be accounted for using ordinary seasonal adjustment since it is not of fixed period. If the residuals have a mean other than zero, then the forecasts are biased and can be improved by adjusting the forecasting technique by an additive constant that equals the mean of the unadjusted residuals.Such analysis is provided by both non-profit groups as well as by for-profit private institutions. Risk and uncertainty are central to forecasting and prediction; it is generally considered good practice to indicate the degree of uncertainty attaching to forecasts. In any case, the data must be up to date in order for the forecast to be as accurate as possible. In some cases the data used to predict the variable of interest is itself forecast. It’s not all bad news for modern sales teams looking to make the most of their data, however. Quantitative forecasting techniques can be bolstered by modern tools enabled by artificial intelligence that reduce manual work in collecting and analyzing data. In the example provided below, we will look at how straight-line forecasting is done by a retail business that assumes a constant sales growth rate of 4% for the next five years.

Top Four Types Of Forecasting Methods

However, there are several reasons a forecaster might select a time series model rather than an explanatory or mixed model. First, the system may not be understood, and even if it was understood it may be extremely difficult to measure the relationships that are assumed to govern its behaviour. Second, it is necessary to know or forecast the future values of the various predictors in order to be able to forecast the variable of interest, and this may be too difficult.

Business Forecasting

In this book we are concerned with forecasting future data, and we concentrate on the time series domain. Stock analysts use forecasting to extrapolate how trends, such as GDP or unemployment, will change in the coming quarter or year. The further out the forecast, the higher the chance that the estimate will be inaccurate. Finally, statisticians can utilize forecasting to analyze the potential impact of a change in business operations.. For instance, data may be collected regarding the impact of customer satisfaction by changing business hours or the productivity of employees upon changing certain work conditions.OmniSci provides an always-on dashboard for monitoring the health of forecasting models. The ability to visualize predictions alongside actual outcomes with OmniSci Immerse makes it easier to identify when and how predictions diverge from real life. A quality business forecast system should provide clear, real-time visualization of business performance, which facilitates fast analysis and streamlined business planning. With this simple moving average method, you can factor in and account for steady increases in revenue to help make your forecast for the next period even more accurate.Some methods are more easily understood with visual graphs, such as the moving and weighted average methods. Sellers calculate the averages of datasets within multiple time periods and create a graph to see the trends and generate a sales forecast. Because these quantitative forecasting methods focus solely on data, it is paramount that the data they analyze is accurate. Producing accurate data has long been a major challenge for sales teams using quantitative forecasting; it can take a lot of time to enter data into a CRM to keep it in good shape.